How to Use Super trend Indicator| Easiest trading Strategy| Best Super Trend Strategy

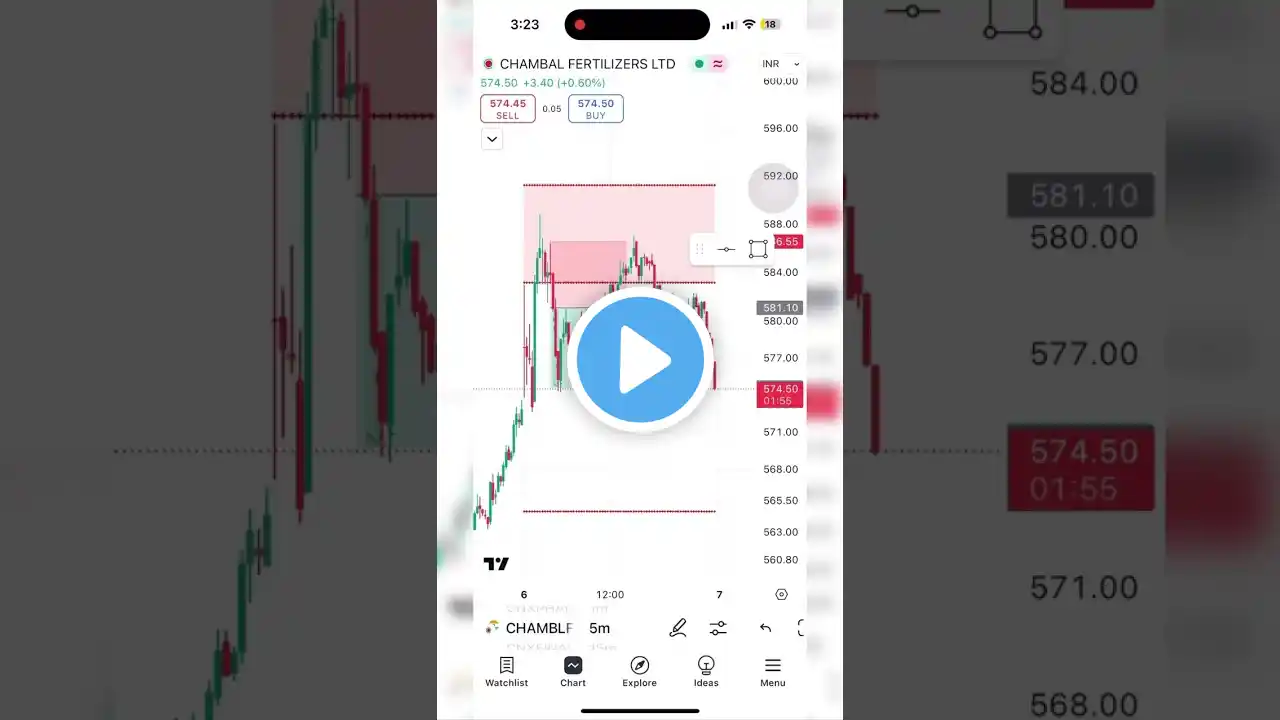

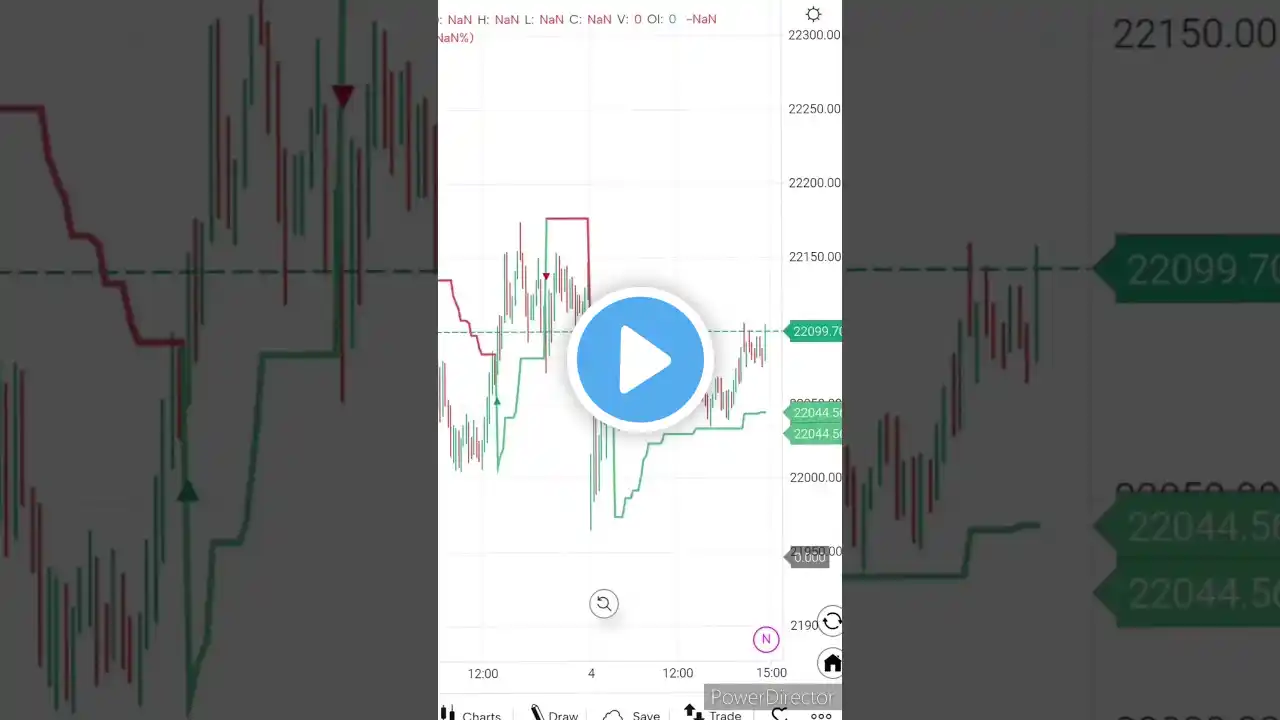

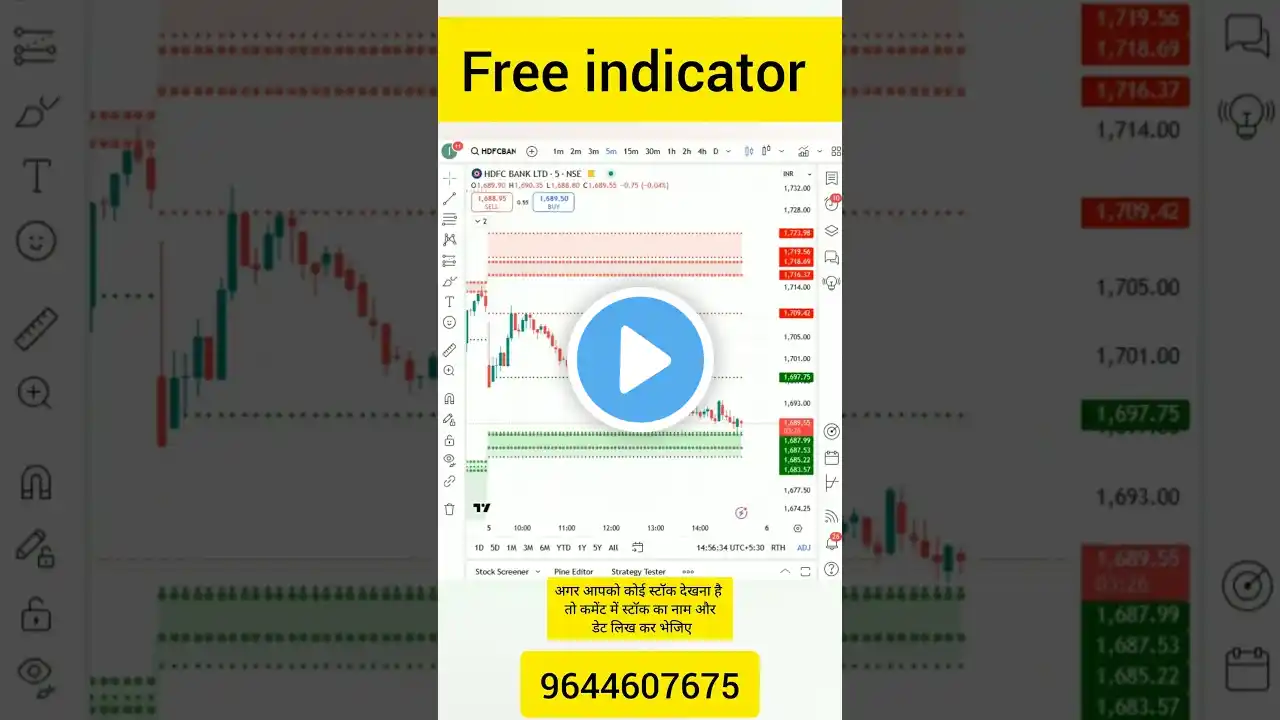

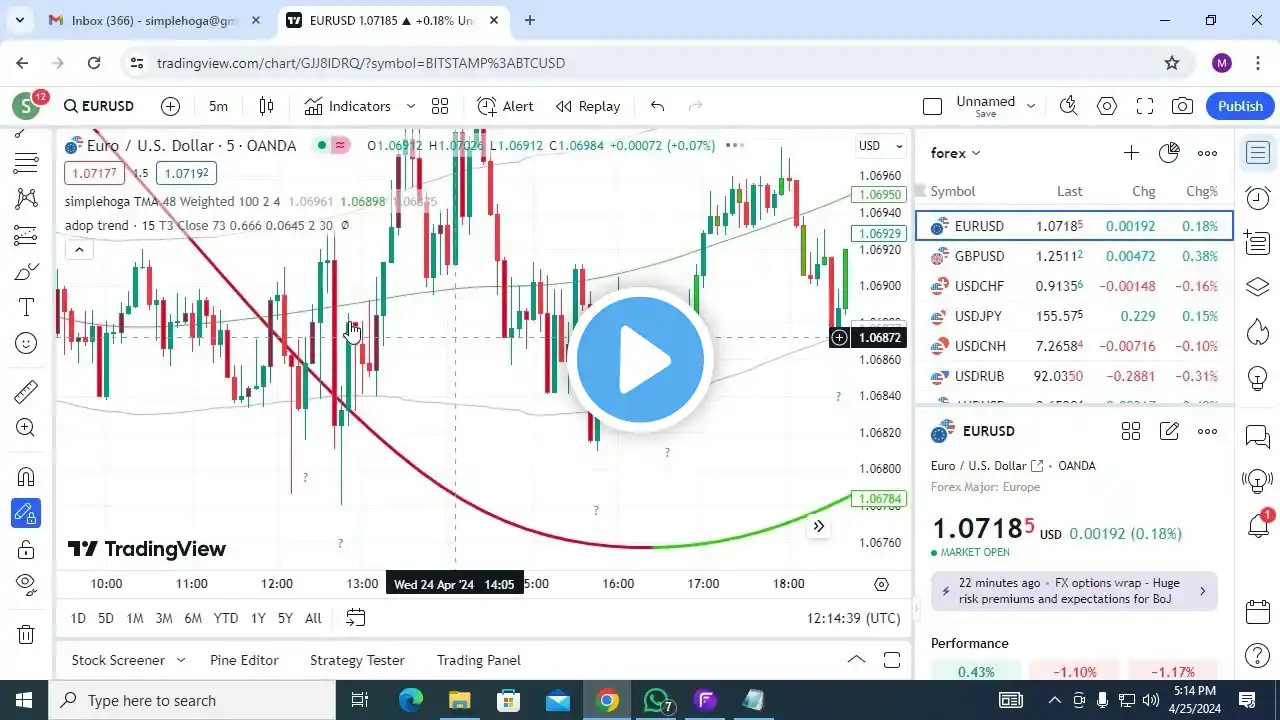

How We Use Super trend Indicator| Easiest trading Strategy| Best Super Trend Strategy #supertrendindicator #binance #earnmoney The Supertrend Indicator is a popular trading tool used to identify trends and generate buy/sell signals. It is based on the Average True Range (ATR) and follows price movements, helping traders make informed decisions. How to Use the Supertrend Indicator Adding the Indicator: Most trading platforms (e.g., TradingView, MetaTrader, or Binance) allow you to add the Supertrend indicator from the indicators list. Adjust the ATR period (commonly set to 10 or 14) and the multiplier (commonly set to 3) based on your preference. Understanding Signals: Buy Signal: When the price moves above the Supertrend line, it turns green, indicating an uptrend. Sell Signal: When the price moves below the Supertrend line, it turns red, indicating a downtrend. Easiest Trading Strategy Using Supertrend 1. Supertrend + Moving Average Strategy Combine Supertrend with a 50-period Exponential Moving Average (EMA). Buy when: The Supertrend turns green. The price is above the 50 EMA. Sell when: The Supertrend turns red. The price is below the 50 EMA. 2. Supertrend + RSI Strategy Use Relative Strength Index (RSI) (14) to confirm signals. Buy when: Supertrend is green. RSI is above 50. Sell when: Supertrend is red. RSI is below 50. Best Supertrend Strategy for Consistency Use Supertrend with other indicators like MACD, Bollinger Bands, or Support & Resistance for confirmation. Avoid trading in sideways/choppy markets where false signals occur. Always use a stop loss below the recent low (for buys) or above the recent high (for sells).