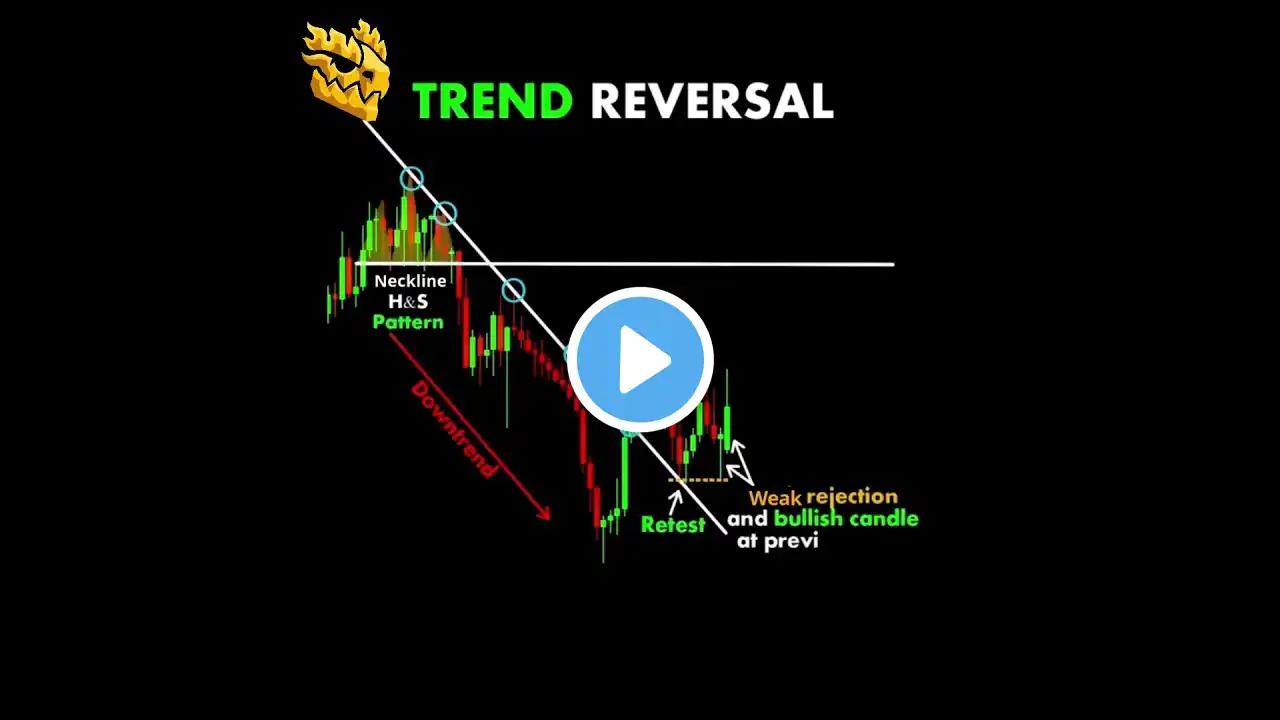

Trend Reversal

What Are Trend Reversals? A trend reversal occurs when the market shifts from an uptrend to a downtrend (bearish reversal) or from a downtrend to an uptrend (bullish reversal). This change is identified when price movements break key support or resistance levels, trendlines, or show reversal candlestick patterns like head and shoulders, double tops/bottoms, or engulfing patterns. Why Are They Used? Traders use trend reversals to identify profitable entry and exit points, helping them capitalize on market shifts. Recognizing reversals early allows traders to adjust strategies, minimize risk, and maximize gains. Confirmation often comes from volume analysis, moving averages, or RSI divergences, increasing accuracy before taking positions.