SBI Credit Card | SBI Credit Card Online Apply | SBI Best Credit Card | SBI Cashback Credit Card

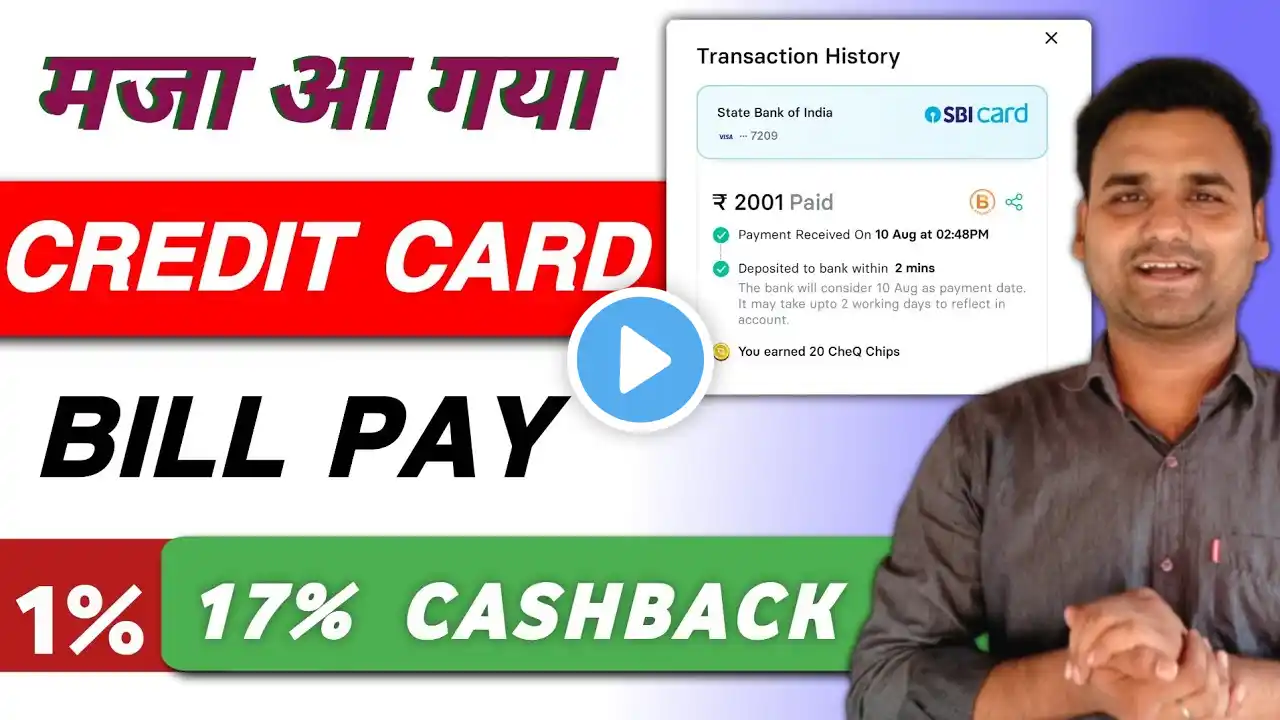

SBI Cashback Credit Card Apply Link https://secure.traqkarr.com/click?pid... —————————— Swiggy HDFC Credit Card Apply https://secure.traqkarr.com/click?pid... -------------------------------------------- About This Video : The SBI Cashback Credit Card is a popular entry-level credit card offered by State Bank of India (SBI). It's designed to provide cashback rewards on everyday expenses, making it ideal for individuals looking for a simple and straightforward way to earn cashback without complicated reward systems. Below are the key features of the SBI Cashback Credit Card: 1. Cashback on Purchases: 1% Cashback on All Purchases: You earn 1% cashback on all eligible purchases made with the card. This includes groceries, fuel, shopping, and more. 5% Cashback on Online Shopping: For online transactions made with select merchants, you earn a higher cashback of 5%, making it beneficial for e-commerce shoppers. 2. Cashback on Utility Bills: You also get cashback on utility bill payments, including electricity, phone bills, and other services. However, you may need to confirm specific partners for this category. 3. Welcome Benefit: Upon card activation, you can enjoy a welcome cashback (generally ₹500) credited to your account after a certain amount of spending within the first few months. 4. Cashback Redemption: The accumulated cashback can be redeemed in the form of statement credit. It's typically credited to your card account, offsetting your outstanding balance. 5. Fuel Surcharge Waiver: Get a fuel surcharge waiver of 1% at all fuel stations in India for transactions between ₹500 and ₹3,000. 6. Milestone Benefits: You can earn additional benefits based on your annual spending milestones, such as extra cashback or vouchers. 7. Annual Fee: The annual fee is relatively low, usually around ₹499 (subject to change), and can often be waived if you meet a specified spending threshold during the year. 8. Reward Points and Redemption: Cashback rewards are credited directly to your statement, and there's no need to convert points into a reward. However, certain categories like online shopping or specific merchant categories might have different reward schemes. 9. Global Acceptance: The SBI Cashback Credit Card is a Visa card, so it’s accepted at millions of locations worldwide, both online and in-store. 10. EMI Facility: The card offers an EMI conversion option for large purchases, allowing you to pay in easy installments over time. 11. Security Features: Fraud Liability Protection: The card offers protection against unauthorized transactions if reported in a timely manner. EMV Chip Technology: Enhanced security for transactions. 12. Low Forex Markup Fee: If you're using the card internationally, the forex markup fee is 2%, which is relatively standard for many entry-level credit cards. 13. Add-On Cards: You can get add-on cards for family members (18 years or older), which helps in accumulating cashback and reward points together. 14. Eligibility: The card is typically available for salaried and self-employed individuals with a good credit score. You may need to meet a minimum income requirement to apply. 15. Customer Support: The cardholder receives support through SBI's 24/7 helpline, mobile app, and net banking for managing the card and addressing queries. Summary of Key Features: 1% Cashback on all purchases. 5% Cashback on online shopping. Fuel surcharge waiver. Low annual fee and easy cashback redemption. Welcome cashback and milestone benefits. EMI facility for large purchases. The SBI Cashback Credit Card is great for those who want simple, transparent cashback rewards and don't want to deal with complicated points systems. It's especially good for frequent online shoppers and people who make regular purchases, as it provides substantial cashback for everyday expenses.