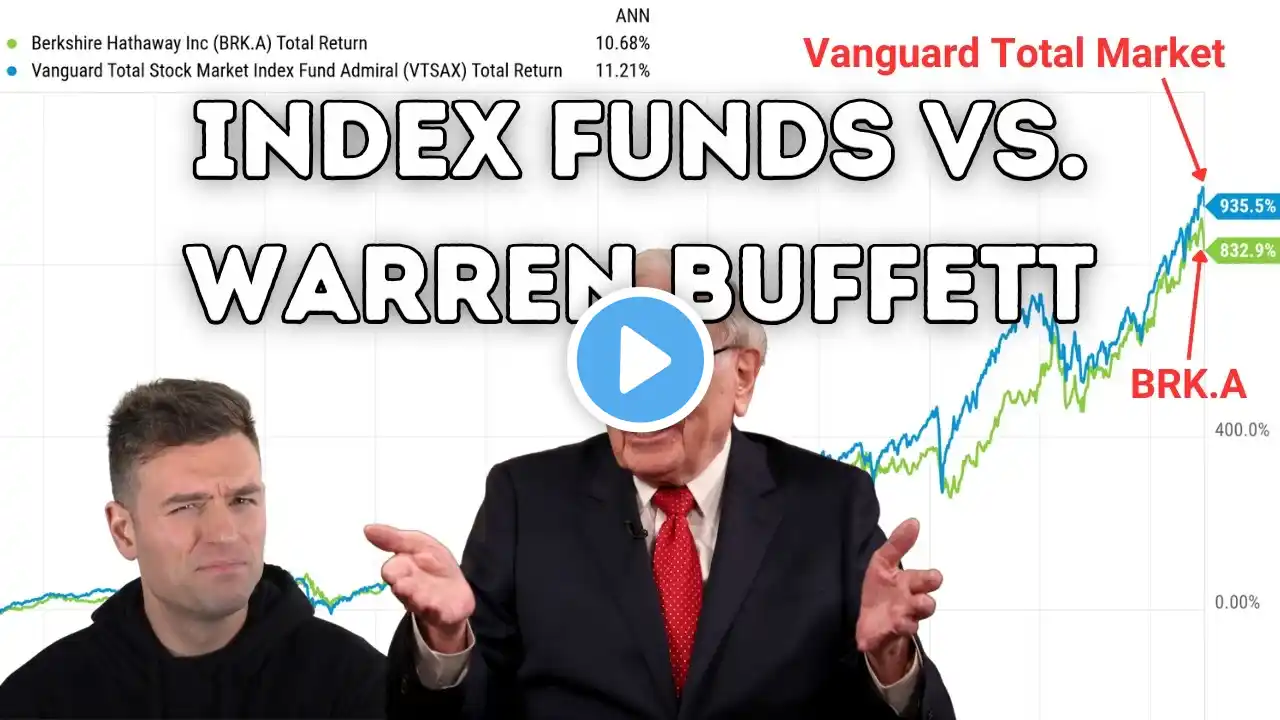

Warren Buffett is beating the market this year

Global investors have been attempting to modify their portfolios in response to significant interest rate increases this year from the Federal Reserve, European Central Bank, Bank of England, and other central banks. Warren Buffett, though, sees no cause for concern. The Oracle of Omaha appears to be going out on top this year. In 2022, Berkshire Hathaway (BRKB) stock has increased by roughly 5.5%. The S&P 500 has fallen by over 15%. Chevron (CVX), the best-performing stock in the Dow this year with a return of over 50%, is owned by Berkshire, which has aided Buffett. Occidental Petroleum (OXY), which has more than doubled, has become the greatest winner in the S&P 500 thanks in large part to Berkshire's ownership of that company. Thanks to higher crude prices, oil stock values have surged. Buffett has also benefited from his preference for staid consumer stocks in 2022. Coca-Cola (KO) and Kraft Heinz (KHC), which have each increased by almost 10% this year, both have significant holdings in Berkshire. In a turbulent year for the economy and markets, Berkshire Hathaway, a sizable conglomerate that owns businesses like Geico and the Burlington Northern Santa Fe railroad as well as consumer brands like Dairy Queen, Fruit of the Loom, and Duracell, has also fared quite well. ------------------------------ All videos on the channel are made and voiced by me. Videos uploaded to the channel is created on the basis of the principle of fair use. All information provided on the channel is taken from public sources. All copyrights belong to their rightful owners. Please be respectful to the interlocutors in the comments, even if your points of view do not coincide. We understand that we publish not the most pleasant news. But you also please be more tolerant to each other, and more respectful to interlocutors.