How Much Mortgage Can I Afford? How to Calculate

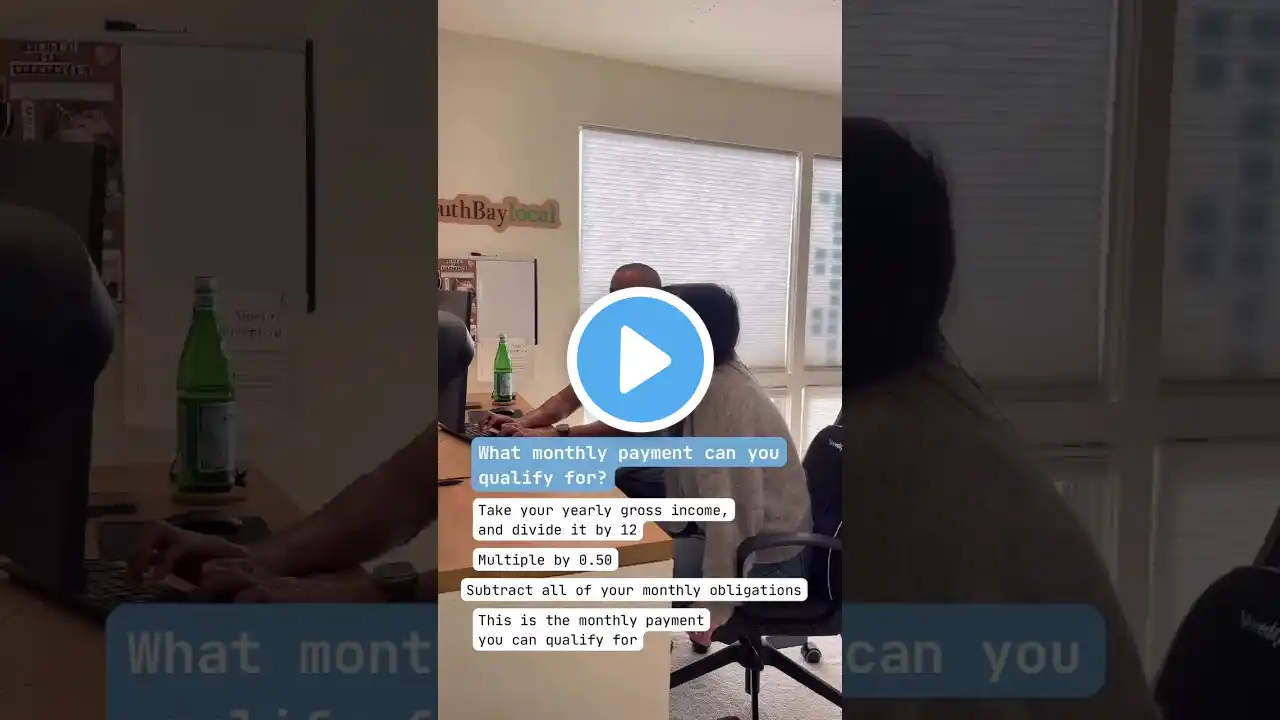

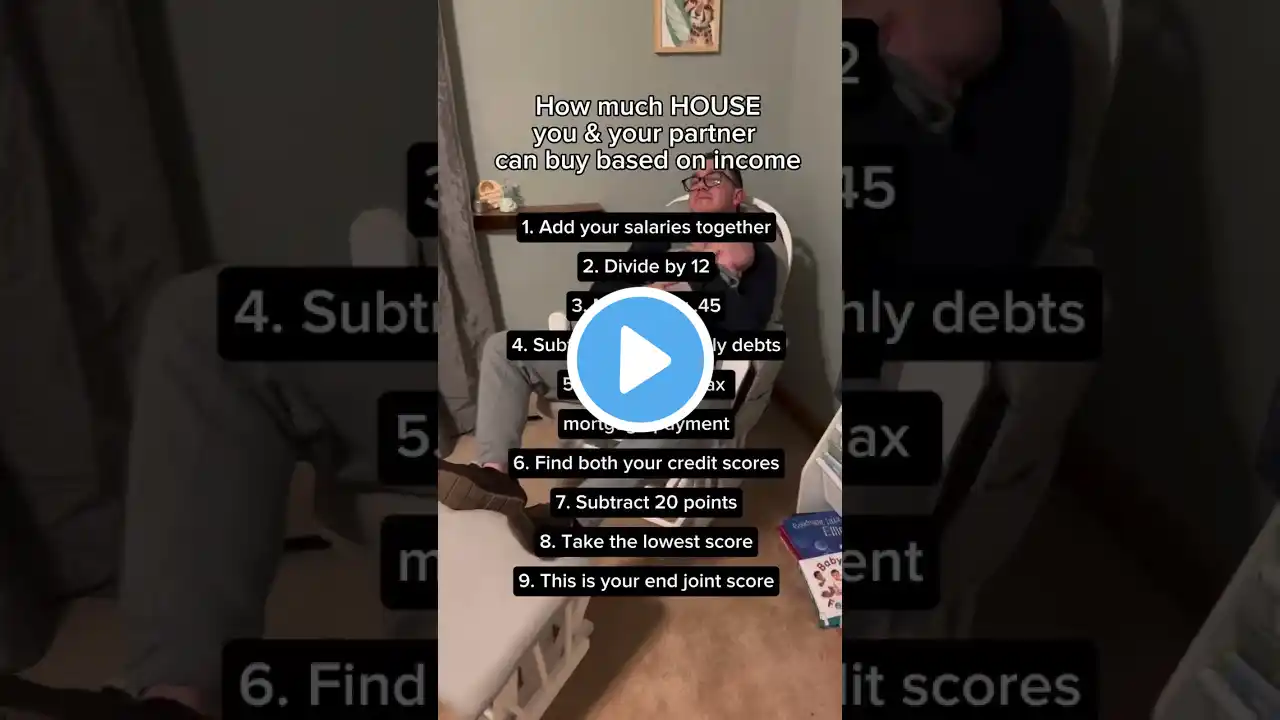

For many people, buying their own home is an exhilarating experience. To be a part of the great Australia dream, to escape the rat race and cease a landlord having it over you. But the problem I’ve encountered is that for many, it’s has never been harder. 00:00 How Much Mortgage Can I Afford? How to Calculate 00:40 1. Who Gets A Home Loan? 00:52 2. What Factors Affect The Banks Decisions In How Much You Can Lend? When I look towards the headlines, news outlets like the Australian Financial Review, seem to be flocking towards blaming uber eats, after pay and Netflix https://www.afr.com/real-estate/uber-... I feel like it’s important try to understand some of the banks guidelines for deciding who gets a home loan, especially when considering that in December 2018, DFA reported a 40% home loan rejection rate. https://www.mortgagebusiness.com.au/b... https://www.abc.net.au/news/2018-08-2... So today I have a simple question, what factors affect the banks decisions in how much you can lend? Unfortunately, the answer to that question is not so simple. Home loan assessment by Banks, Lenders and Building Societies depend on a number of contextual factors including but not limited to income, expenditure and security. Instead of trying to decide which has the biggest impact, we’re going to look at how certain factors change the outcome of a home loan application. In recent times there have been calls to reduce the minimum +7% flaw rate to 2.5% over the lending rate offered, should this take affect we’d expect a steep increase in lending capacity. Westpac recently reduced theirs to 6.5%, which is considered to be under the industries agreed threshold of 7%. Whilst this was short lived and day after brought back to 7.25%. theres increasing pressure by the industry to review this by the regulator. The difference between these two assessment rates would equal an additional $40,000 in lending capacity (from $500,000 with 6.50% flaw rate vs $540,000 on 7.25%), that’s close to a 10% increase. When we look your minimum monthly living expense, we get some surprising numbers, lets take a couple living in Brisbane as an example. Each works a full time job, earning $50,000 p.a. respectively. with this scenario lenders would consider this couples minimum living expenditutre for essential living costs such as groceries & insurance, range from $3,142 to over $4,500. The difference this has a material affect in how much you can borrow with the lower allowing this couple to lead $509,000 and latter $355,000. Over a $150,000 differential. Whilst you may be a perennial saver, sticking to a budget and living under your means, the banks view on the world severely differs, even if you can prove that your everyday expenses are lower their benchmark, the higher of the two is whats adopted, meaning what you can borrow and what you can afford are two different things. And then it gets pretty interesting when we switch our attention to look at income such overtime, a source of whereby you have control. As the saying goes, hard works off, but does it? For the most part banks and lending institutions accept 80 cents in the dollar with the exception of a few adopting 100%. Taking a person with a base salary of $50k and overtime of $20k p.a. the difference in lending capacity is over $31,000, with both stabalising flaw rates and monthly living expenditure. Ultimately how much you can lend is all dependent on context, there is no one thing that impacts your ability to lend, however many different factors which all play apart to dictate just that. If you’re in need of a guide, here’s a tentative rule of thumb that can help you understand your borrowing capacity In general the banks can lend 5 to 6 times your income, so if you earn $100,000, you’ll be able to borrow between $500,000 to $600,000. But that can vary drastically depending on the type of income you earn, if you’re single or in a relationship, what liabilities and what your monthly expenditure is. Ideally a mortgage broker can calculate your borrowing power based on all these factors, and in that way will be able to understand your exact capacity. Essentially the more income you earn and the less you spend the more you’ll ultimately be able to lend. DISCLAIMER: This video offers no Legal, Financial and Taxation advice, and the information contained is general and does not take into account your personal situation. The Listener acknowledges, consents and agrees to the viewing of the content presented on the Channel is subject to the full Disclaimer (below) and agrees to be unconditionally bound by this Disclaimer. Full Disclaimer here – https://www.huntergalloway.com.au/you...