How Much Car Can You REALLY Afford? #shorts

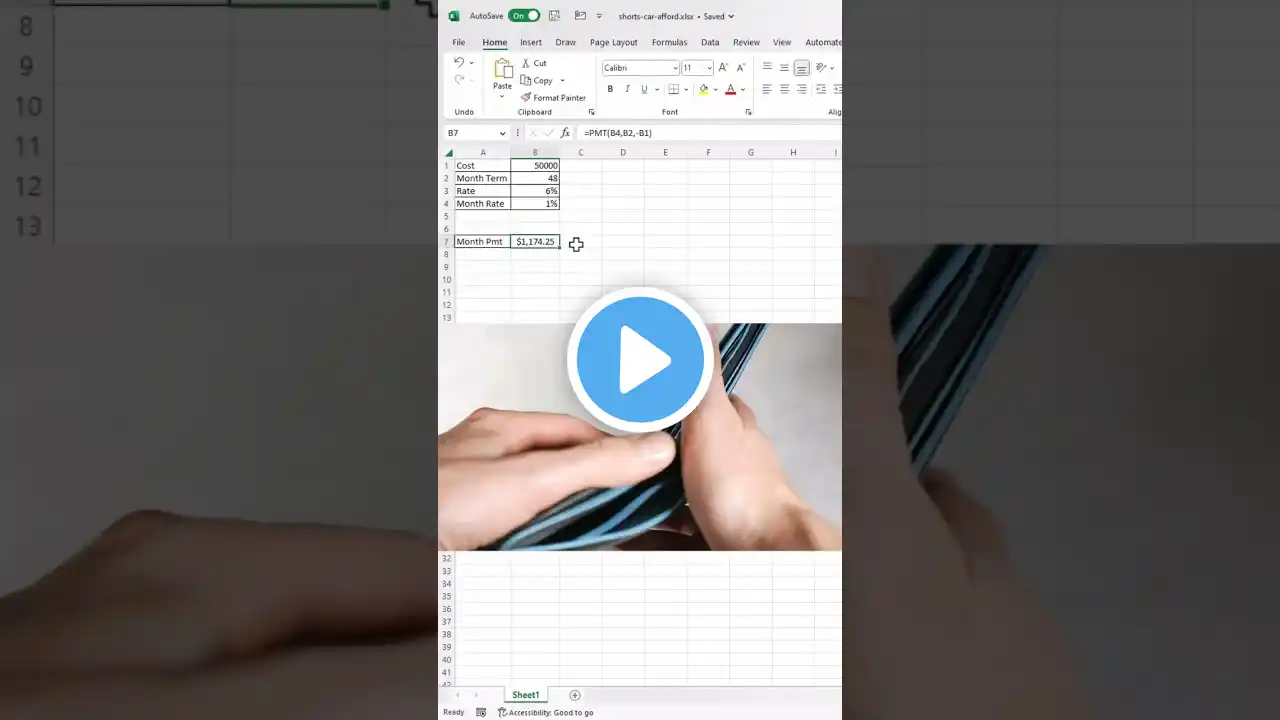

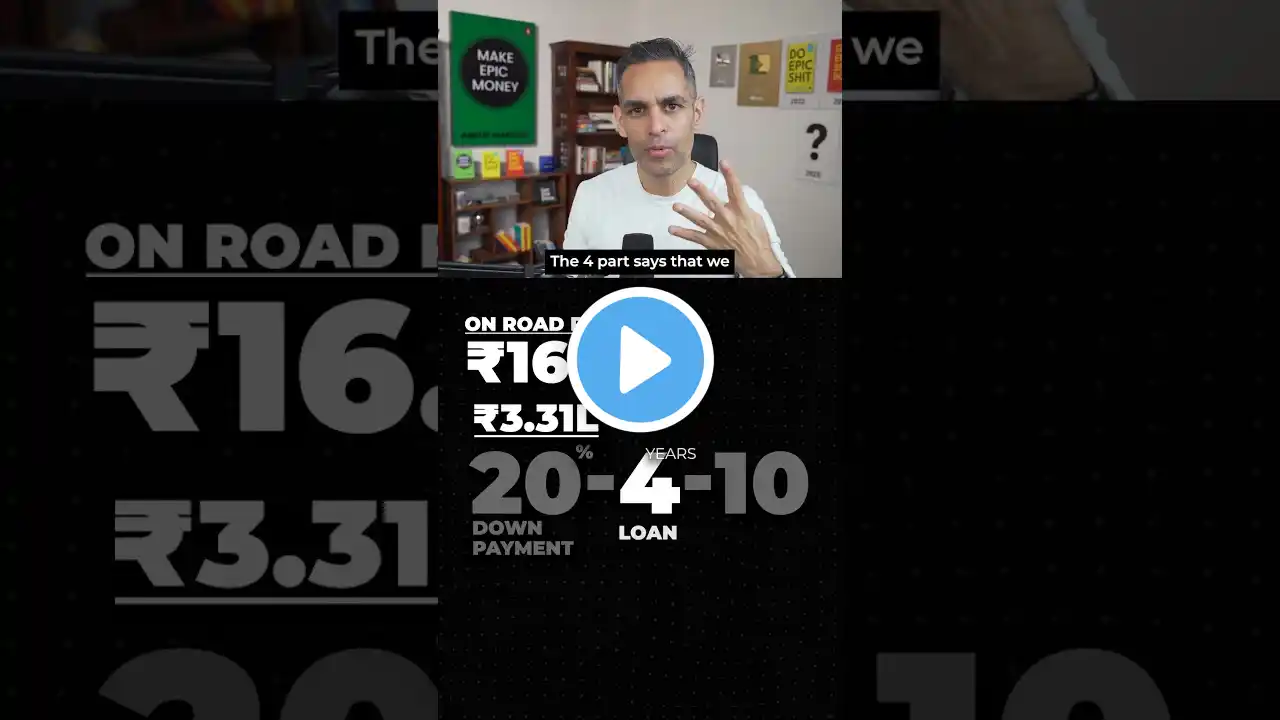

✅CHECK OUT MY COMPREHENSIVE COURSE ON PERSONAL FINANCE: Learn about building credit, establishing savings, effective budgeting, and managing debt! ► https://www.udemy.com/course/keystone... ✅ GET THE KEYSTONE FINANCIAL GUIDE: The ultimate all-inclusive textbook on Money and Investing! ► https://keystonefinancialeducation.com ✅FOLLOW ME ON INSTAGRAM: ► / ejgindis ► @ejgindis CLIENT: So, Mr. Advisor, what are you driving these days? ADVISOR: A sensible and reliable car that I bought used. Did you expect anything different from me? CLIENT: Hmm…I was kinda hoping you’d say a Ferrari. ADVISOR: I sense a car-related question coming on. CLIENT: Yeah, I’d like to know how expensive of a car a person can really afford on their income. ADVISOR: Well, the general advice is that the car’s price should be no more than about 30% to 35% of your gross income. If it’s more than that, you need to increase the down payment. The 20/4/10 rule of car buying says that a down payment should be at least 20%, the car loan shouldn’t exceed 4 years, and all car expenses, including insurance, shouldn’t be more than 10% of your monthly gross income. So, let’s say you make 70 grand per year. Well, divided by 12, that’s $5,800 per month, and 10% of that is $580. That’s your transportation budget. CLIENT: That doesn’t sound like a lot with car prices these days. ADVISOR: A lot of people go way beyond that, purchasing vehicles they can’t afford, and cars are unfortunately a huge source of personal debt. CLIENT: Wow, ok. Thanks! ADVISOR: And of course, learn more about finance and investing by subscribing to my channel, the Keystone Financial Academy on YouTube! DISCLAIMER This video was created for informational and educational purposes only, and should not be construed as a source of specific investing, financial, accounting, or legal advice. This video should never be used as the sole source of information, without consulting with a financial or legal professional to determine what may be best for your individual needs. The creator of this video, Elliot J. Gindis, does not make any guarantee or other promise as to any results that may be obtained from using the information in the video. To the maximum extent permitted by law, the creator of this video disclaims any and all liability in the event that any information, commentary, analysis, opinions, advice, and/or recommendations contained in this video prove to be inaccurate, incomplete, or unreliable, or result in any financial or other losses.