FII DII Data Analysis Today 4 Nov 2025 | FII DII Data Prediction for Tomorrow | NBS Prediction

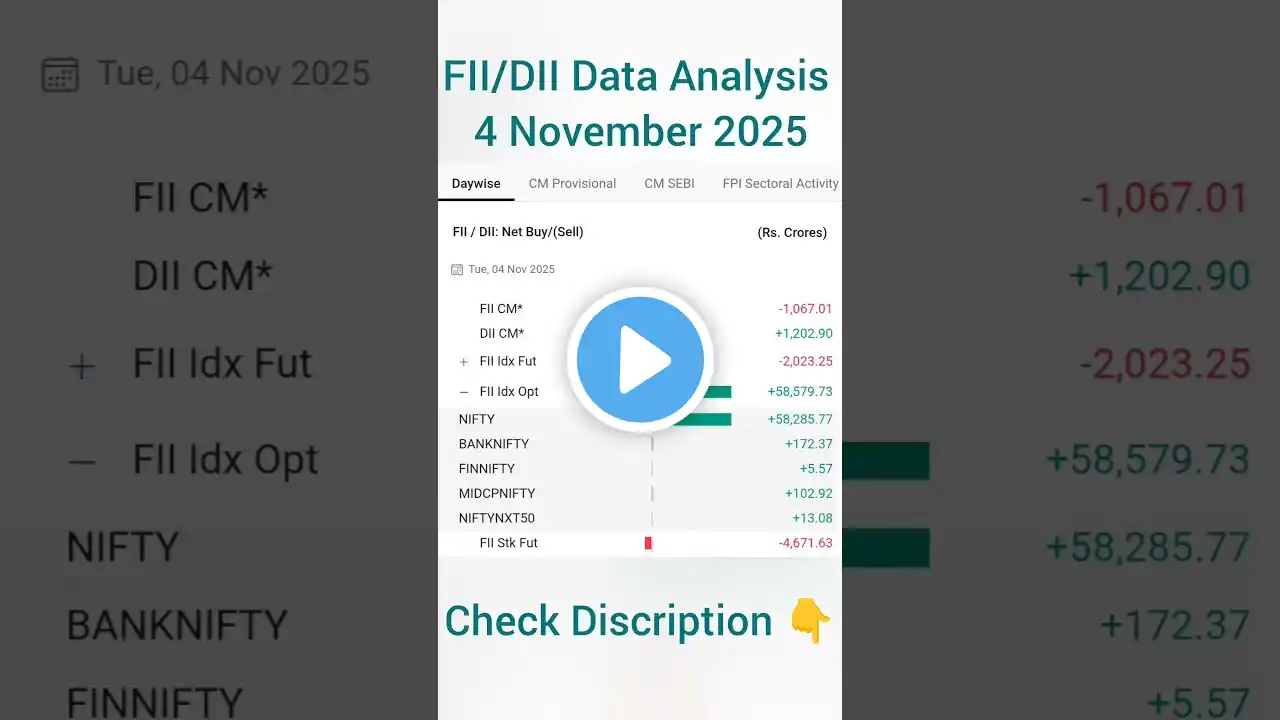

fii dii data analysis today 4 Nov 2025 – This video delivers fiii dii data predection with full fii dii data analysis and fii diii data for tomorrow so you can plan trades in Nifty, Sensex, Bank Nifty and the broader Indian stock market tomorrow. Today’s Institutional Flows (₹ crores) • FII Cash (FII CM): -1,067 • DII Cash (DII CM): +1,203 • FII Index Futures: -2,023 • FII Index Options: +58,580 (aggressive long/short-covering in options) • FII Stock Futures: -4,672 • FII Stock Options: +857 Market Dashboard • Nifty: 25,597.65 (-165.70, -0.6%) • Sensex: 83,459.15 (-519.34, -0.6%) • India VIX: 12.65 (-0.01, -0.1%) 🔔 Subscribe for daily market updates, FII DII data, and stock analysis. 📅 Date: 30 October 2025 #FIIDII #StockMarketIndia #NiftyAnalysis #SensexToday #MarketNews #FIIData #DIIdata #FIIDIIdataanalysis #NiftyPrediction #BankNiftyAnalysis #ShareMarketUpdate What it means (actionable read) Heavy FII buying in index options alongside selling in cash, index futures and stock futures signals hedged positioning: downside pressure intraday, but options flow can fuel sharp rebounds on supportive cues. DII cash buying cushioned declines, keeping structure range-bound. With VIX steady near 12–13, volatility is controlled but spikes are possible around key levels and news. Tomorrow Market Prediction (5 Nov 2025) • Bias: Neutral to cautiously bullish on dips. Expect range trade with rebounds led by options support. • Nifty outlook: 25,420–25,720 primary band. Supports 25,420/25,350; strength above 25,720 can extend to 25,820–25,900 if FII index-option longs persist. • Sensex outlook: 83,000–83,800 band; follow-through above 83,800 can target 84,100. • Bank Nifty view: Watch for relative strength if DII support continues; dips may get bought near recent swing supports. • Trading plan: Respect levels, use staggered entries; fade extreme moves while VIX stays subdued. Track FII index futures—any shift to net buying would upgrade the bullish case. SEBI Disclaimer This content is for education and information only. I am not a SEBI-registered advisor. Markets are risky; do your own research and consult a qualified financial advisor before investing or trading. Any prediction here (including fii dii data analysis and fii diii data for tomorrow) is probabilistic, not a buy/sell recommendation.