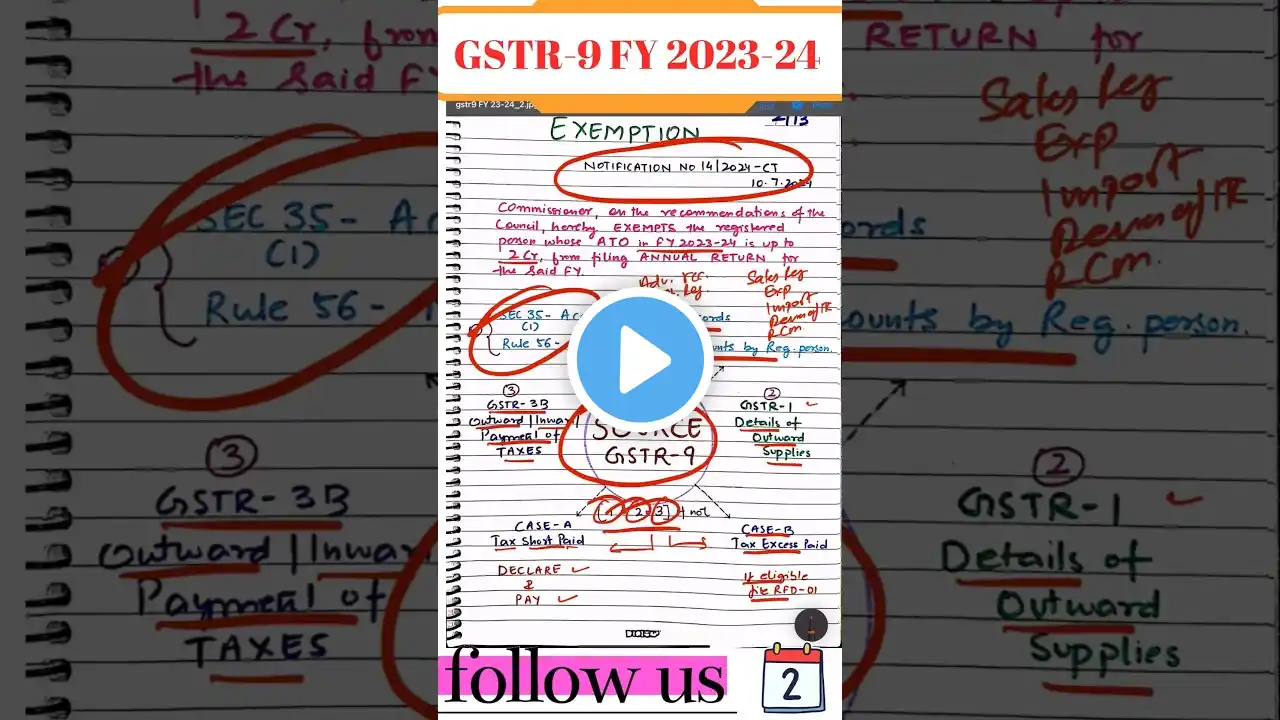

📌GSTR-9 Annual Return | पूरी जानकारी एक ही वीडियो में | How to File GSTR-9| #shorts #youtubeshorts

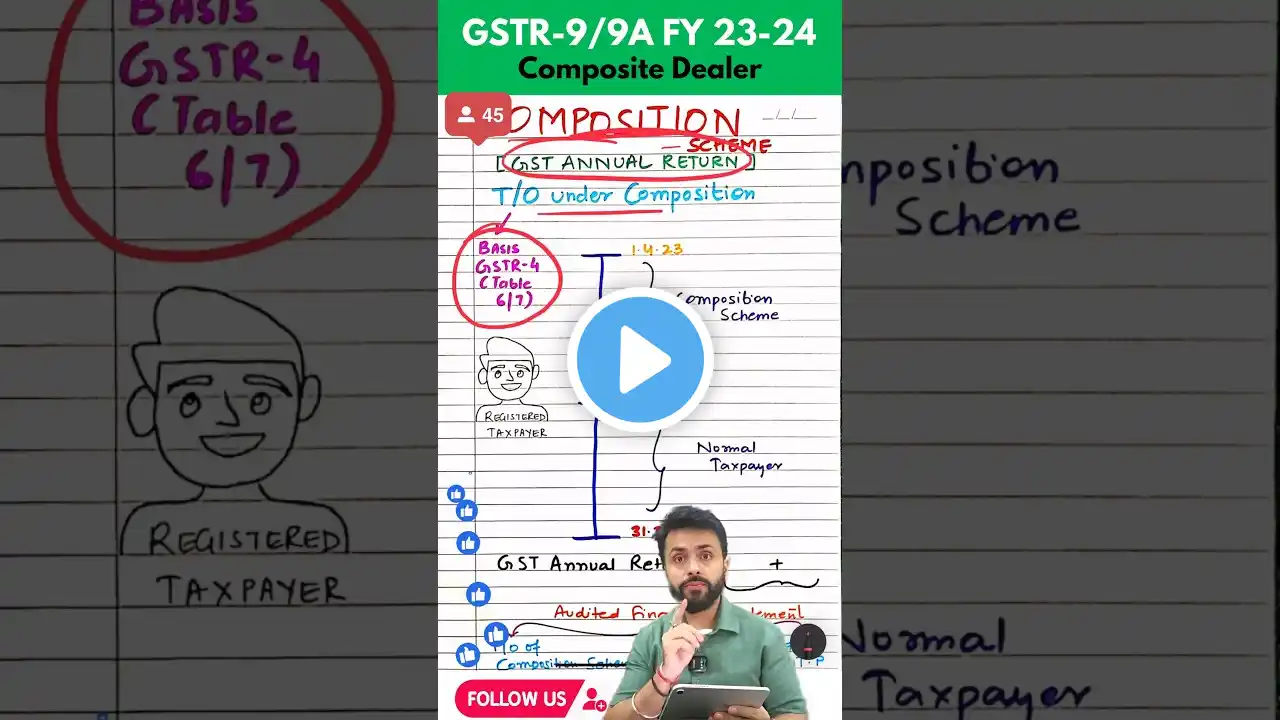

📌Composition Dealers GSTR-9 Annual Return FY 23-24| Day 12 #shorts #short #youtubeshorts #youtube @cadeveshthakur Day 12 of 13 days GSTR-9 Annual Return series For the Financial Year 2023-24, composition dealers are not required to file GSTR-9 (Annual Return). Instead, they need to file GSTR-9A, which is a simplified version of the annual return specifically designed for taxpayers under the Composition Scheme. Key Details About GSTR-9A (FY 2023-24): Who Should File GSTR-9A? Index 00:00 to 00:20 GSTR9/9A 00:21 to 00:40 GSTR9 FY 2023-24 00:41 to 00:50 GSTR9 Annual Return Composite Dealer Taxpayers registered under the Composition Scheme during any part of the financial year. Due Date: The last date to file GSTR-9A for FY 2023-24 is 31st December 2024 unless extended by the government. Details Required in GSTR-9A: Basic Information: GSTIN, legal name, trade name. Outward and Inward Supplies: Taxable turnover, exempted turnover, and other inward supplies (purchases). Tax Paid: Details of tax paid under CGST, SGST, and IGST. TDS/TCS Credits: If applicable. ITC Reversal Details: As per the Composition Scheme rules. Late Fee & Interest: If applicable for delayed payments. Method of Filing: Log in to the GST Portal, navigate to Services - Returns - Annual Return and select GSTR-9A. Fill in the details manually or use third-party software for reconciliation and validation before submission. Penalty for Late Filing: A late fee of ₹200 per day (₹100 CGST + ₹100 SGST), subject to a maximum of 0.5% of turnover. 📌GSTR-9 Annual Return FY 2023-24 | पूरी जानकारी एक ही वीडियो में | How to File GSTR-9 Full Video • Annual Return GSTR 9| पूरी जानकारी एक... 👉Welcome to cadeveshthakur ! In this comprehensive video, I explain everything you need to know about filing your GSTR-9 Annual Return for FY 2023-24. Whether you're filing online or offline, this video has got you covered with a step-by-step guide. 📌In this video, I cover: 📍How to file GSTR-9: Detailed procedures for both online and offline modes. 📍Downloading & Filling Offline Utility Form: Complete guidance on downloading the form and filling it correctly. 📍Conditions for Filing GSTR-9: Eligibility requirements and who must file. 📍Due Dates & Consequences: Important deadlines and what happens if GSTR-9 is not filed on time. 📍Important Notifications and Sections: Including Notification No. 14/2014, Section 35, and Rule 56. 📍GST Returns Overview: Understanding GSTR-3B, GSTR-1, and claiming Input Tax Credit (ITC). 📍Documents to Maintain: Outward register, export/import register, reversal of ITC, RCM, advance register, and stock register. 📍Filing GSTR-9 as NIL Return: Who is eligible and the necessary conditions. 📍Implications of a Cancelled GSTIN: Steps and considerations if your GSTIN has been canceled. ✒️💡 Don't miss out on the handwritten notes for GSTR-9! Leave your email ID in the comments, and I'll share them with you. 🔗Make sure to like, subscribe, and hit the bell icon for more insightful GST and accounting content. Feel free to drop any questions or feedback in the comments! How to File GSTR 9 Annual Return 2023-24 | GSTR 9 Annual Return 2023-24 | GST Annual Return Filing GSTR 9 filing FY 2023-24 online & Offline | How to file GSTR 9 | How to file GST Annual Return GSTR 9 Filing FY 23-24 | GSTR 9/9C Filing in Hindi FY 23-24 | GSTR 9/9C Update in Hindi & filing GSTR-9 FY 2023-24 filing and Optional Vs. Mandatory Tables How to File GSTR-9 & GSTR-9C Annual Return for FY 2023-24 on GST Portal | Step-by-Step Wrong GSTR 2B due to IMS is now solved | Recomputed GSTR 2B before filing GSTR 3B GSTR-9 ki Working kaise kare I How to Prepare GSTR-9 FY 2022-23 I GST Annual return online GST PORTAL पर API Option को Enable कैसे करें l Enable API access in GSTN Portal l Part 12 table 10,11,12 & 13 of GSTR 9 FY 23-24 की GSTR-9 ANNUAL RETURN पूरी बदल गयी How to File GSTR 3B | How to Generate GSTR 2B | All New GST Return System | IMS | GSTR 2B errors Analysis of Table 6 & 8 of GSTR 9 for FY 2023-24 How to File GSTR 9 Annual Return GST New GSTR 9 F.Y 2023-24 पूरी जानकारी एक ही वीडियो में How to File GSTR 9 Annual Return 2023-24 | GSTR 9 Annual Return 2023-24 Clause 6 & 8 iTC Match GSTR 9 Annual Return Filing 2023-24 | Complete Practical gstr 9 annual return 2023-24 gstr 9 annual return 2024-25 gstr9 annual return gstr 9 annual return gstr 9 annual return kisko bharna hai gstr 9 annual return filing process gstr 9 annual return 23-24 gstr 9 annual return working gstr9 and gstr9c 2023-24 gstr9 and gstr9c gstr9 filing gstr9 and gstr9c kya hota hai gstr9 and 9c gstr9 and gstr9c difference gstr9 filing gstr 9 23-24 ca final free lectures, ca inter free course, ca inter free classes on youtube, ca inter free youtube channels, how to go viral on youtube in 1 day, youtube shorts video upload, #viral #shortvideo #viralvideo #shortsvideo #shorts #youtubeshortsvideo #shortsyoutube #viralreels #viralshorts #viralshort #trending #cadeveshthakur #ytshorts #youtubeshorts #youtubeshorts