How Much House Can I Afford in 2024?

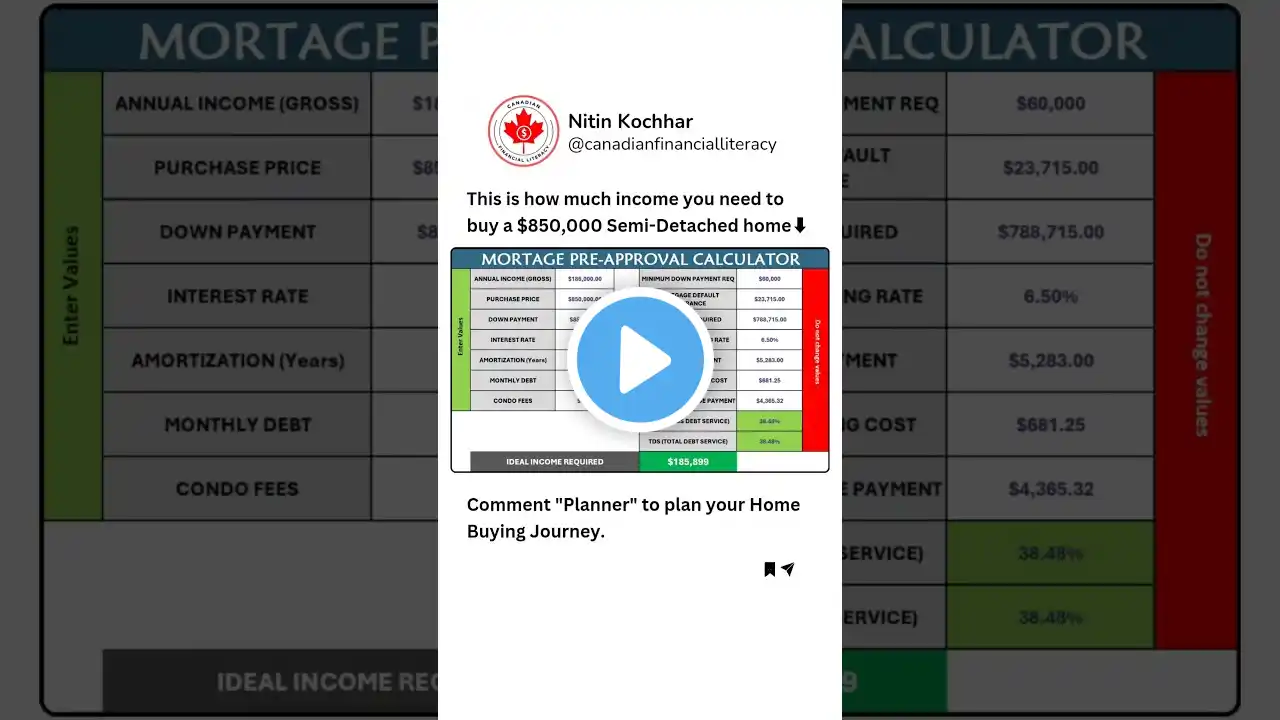

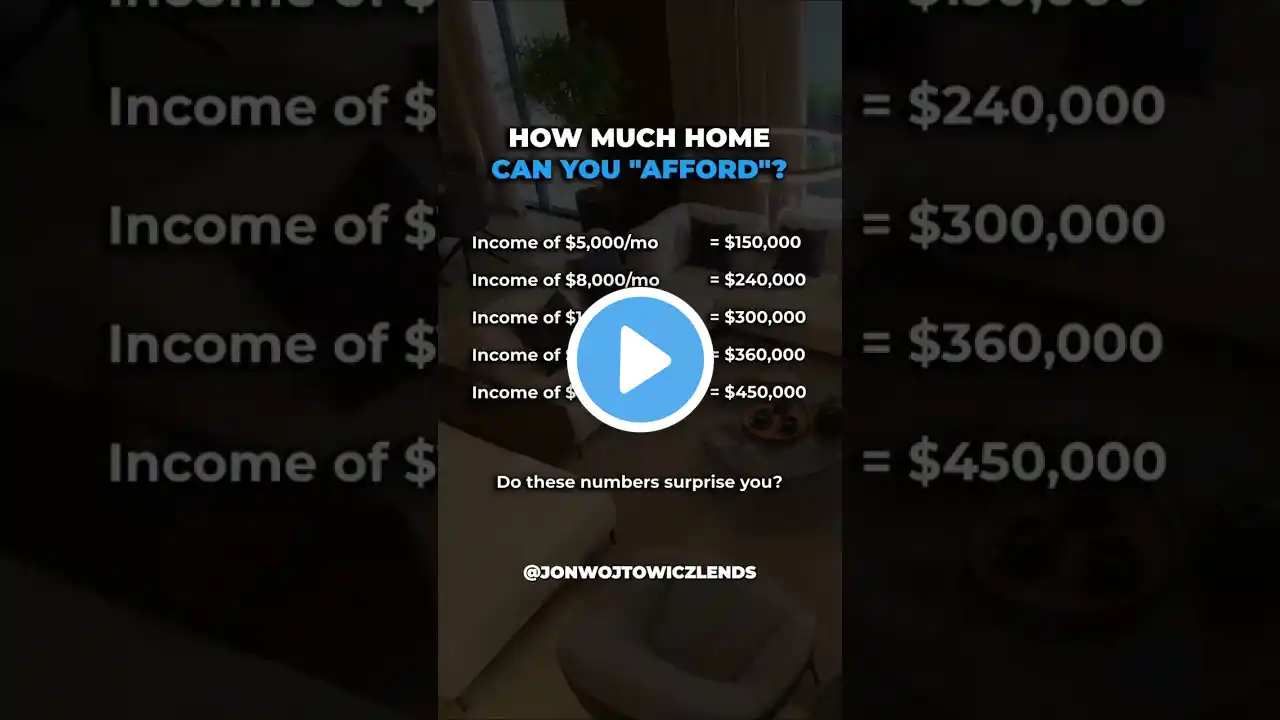

Chapters 00:00 Intro 03:57 personal experience 06:23 3x income method 08:18 25% of income method 12:52 Math Example for 3x income method 16:25 Math example for 25% income method 24:04 hidden costs 29:42 how much to budget yearly for repairs How Much Can I Afford to Spend on a Home Two Options 1. 3x your income 2. 25-30% of your take home Quick qualifiers: How do I figure out 25% of my take-home? Take home is simply the amount after taxes. So you can look at your paycheck or if you know what your salary is, check out Smart Asset’s paycheck calculator. There they will allow you to put your location in and it does the work for you to take out taxes. Once you have that number, you can simply multiply it by .25 for 25% or .3 for 30%. Why do we say 25-30% of your take-home? Because this allows you to have a higher savings rate which is important to achieve financial freedom and independence and retire. For a more in depth audio discussion on this topic, see our Podcast Episode 19 - Financial Independence - What Goes into it? 3x income This option is popular when you discuss buying a house with a real estate agent or a mortgage lender. What this option does is takes your gross salaried amount, and multiplies it by 3. So if you make 80,000, your buying limit would be 240,000 (80,000 x 3). There are problems with this option though which we will discuss below. 25%-30% of take home This option is the better option when looking at how much can I afford to spend on a home. The reason this is better, is twofold: it allows you more room for saving toward retirement and other goals, and allows for more wiggle room incase something unexpected comes up financially. Below is a quick scenario so you can see how these two options compare. With both of these we will assume 80,000 income, 7% interest rate, and 10,000 down. 3x income is 240k. For a 240k house right now at 7% interest the monthly payment would be $2,183 including $1,530 for mortgage, $104 for Home Insurance, $163 for PMI, $368 for Property Taxes. 25-30% of take home - 80,000 income is $5,228 monthly take home. 30% of the take home is $1,568 including $1,064 for mortgage, $104 for Home Insurance, $83 for PMI, and $273 for Property Taxes. This house is also going to run in the range of $170,000-$180,000. There are a few noticeable differences: The total payment difference is $615 a month. This comes out to $7,380 dollars a year. Percentage wise, the 240k house is 42% of the total take home in comparison to 30%. Maxing a Roth IRA in 2023 is $6,500, or $500 a month. Getting the less expensive home allows you to maximize a retirement account while still owning a home and having money left over each month. The total payment for a home is not simply the mortgage, but includes additional costs such as home insurance, PMI (Private Mortgage Insurance), and Property Taxes. More costs to consider are discussed below. Factors to consider when buying a house There are two main factors to consider when you are looking at how much can I afford to spend on a home. Interest rate: In the illustration above, we used a 7% interest rate. If we were to drop the interest rate down to 4%, the house you could afford on an 80k salary while still paying 25-30% of your take home jumps from 180,000 to 210,000. Looking at the interest rate is vitally important in deciding when you should buy. Perhaps renting for a time being until rates are lower makes the most sense for you in your situation. For an audio discussion on the pros of renting and buying, see our Podcast Episode # 15 - The Pros of Renting or Buying a Home. Invisible Costs: Utilities - cost of heating, AC, water, gas, trash. The age of the home could dramatically impact these. Maintenance and repairs - Again, age could impact this drastically. Older homes require more work typically. Upgrades and additions - Does the house need upgrades so you are more comfortable including kitchen and bathroom. Insurance - home insurance, flood insurance, PMI on mortgage if not 20% down (.5%-1%), closing costs (2-5%).