MONDAY STOCK MARKET PREDICTIONS #nifty #shorts #banknifty

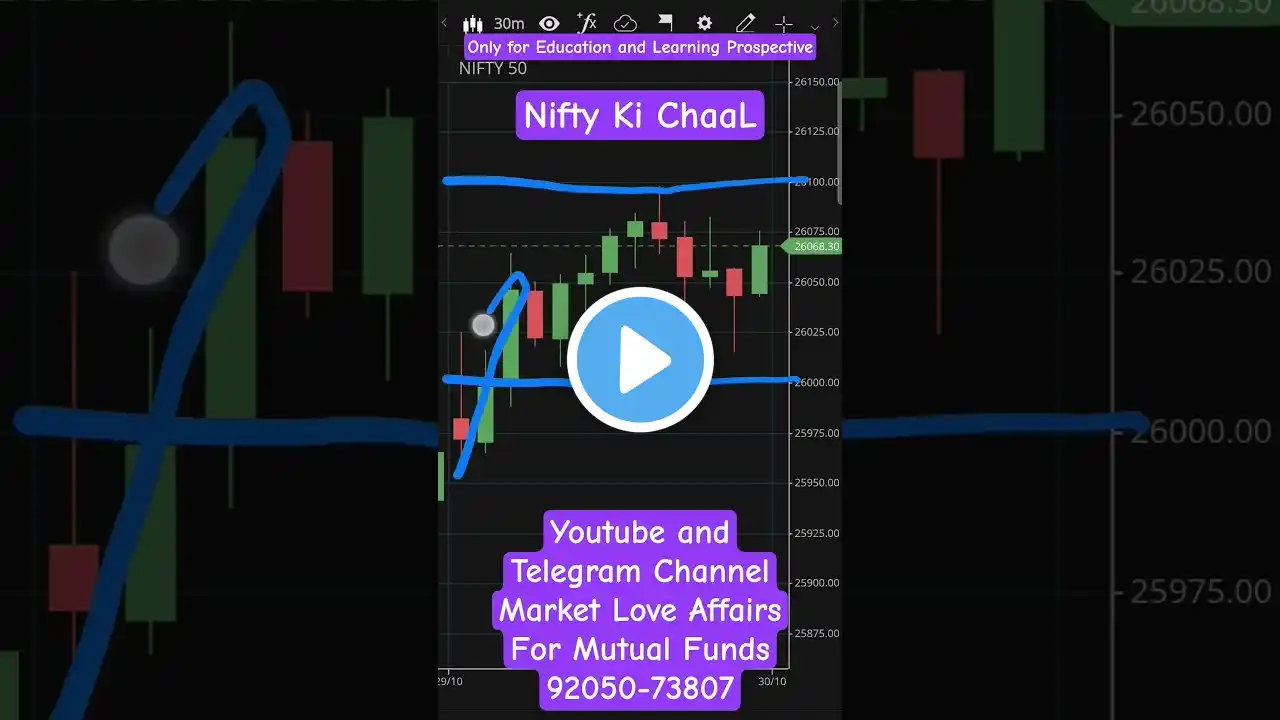

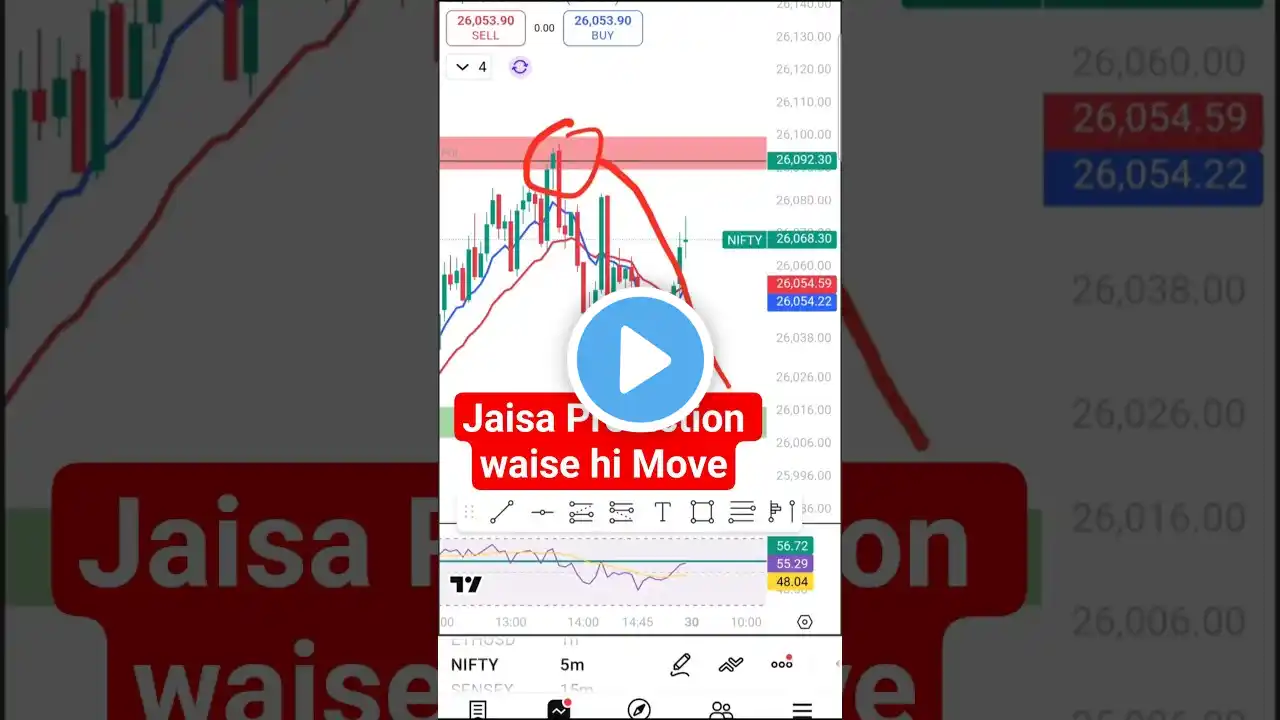

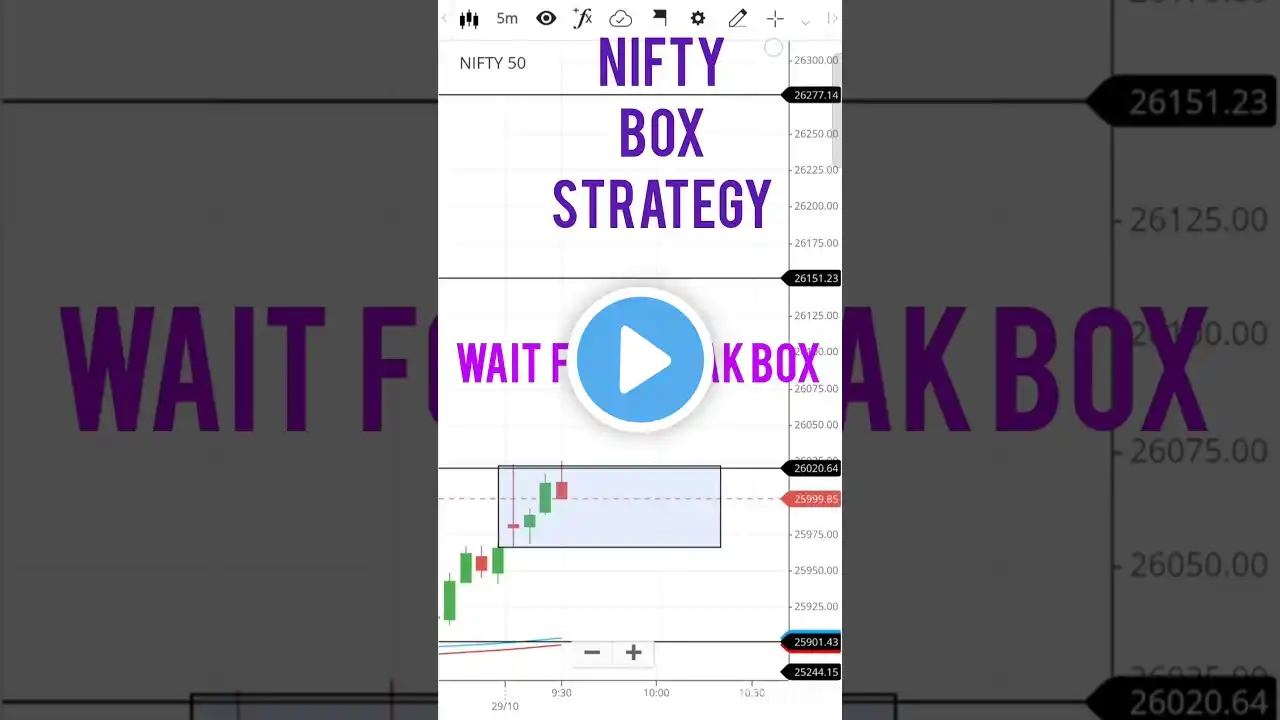

MONDAY STOCK MARKET PREDICTIONS #nifty #shorts #banknifty #TradeDeal, #MarketAnalysis, #Investing, #Sensex, #ProfitBooking, ,#MarketOutlook, #ITStocks, #FII, #BearishPattern, #IntradayTrading, #ShareMarket Nifty prediction, Bank Nifty analysis, October 24 share market, India US trade deal impact, H-1B visa news IT stocks, FII inflow India, bearish meeting line candlestick, Nifty support and resistance, best stocks to buy now, why market fell today, profit booking in Nifty, VIX fear index, technical analysis Nifty, Kotak Securities, HDFC Securities, LKP Securities. JOIN HIMALAYAN STOCKS GURUKUL ON X ( twitter) https://x.com/ajayprashar3?s=21 JOIN HIMALAYAN STOCKS GURUKUL ON FACEBOOK https://www.facebook.com/profile.php?... JOIN HIMALAYAN STOCKS GURUKUL ON INSTAGRAM https://www.instagram.com/himalayan_g... COURTESY-: GOOGLE FINANCE, GOOGLE NOTEBOOK NLM , TRADING VIEW, ANGEL ONE, CANVA, ADOBE PODCAST, GOOGLE GEMINI, DEEP-SEEK,MONEY CONTROL, NSE,BSE, YT CREATOR . NOTE-: All above resources are used for educational purposes only. Disclaimer: The content/video is only for informational and educational purposes. "Himalayan Stocks Gurukul" does not guarantee any returns or assume responsibility for financial decisions made by viewers. video is for educational purpose only. Copyright Disclaimer Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use. This video by HIMALAYAN STOCKS GURUKUL covers following points………… 1 The 26,100 Mirage: Nifty's Dream Run Hits a Profit-Booking Wall Nifty opened strong above 26,000 but fell over 200 points from the day's high, closing with only modest gains. 2 Six-Day Rally on Life Support: Can the Bulls Defend Their Fort? The index advanced for the 6th straight session but failed to close above 25,900 for the 3rd day in a row. 3 The "Bearish Meeting Line" Omen: A Chilling Warning for Bulls A key bearish candlestick pattern formed, signaling a potential short-term reversal if weakness continues. 4 The Make-or-Break Zone: Why 25,900-26,100 Holds the Key to Records Experts say a decisive break above this resistance is needed to target the record high of 26,277. 5 Safety Nets in Place: 25,700 & 25,500 Are the Bulls' Last Stand Immediate support levels identified; a break below could trigger a sharper correction. 6 Fear Gauge Creeps Up: VIX Spike Signals Trader Anxiety is Back India VIX surged 3.85%, signaling rising caution, though it's not yet at panic levels. 7 Trade Deal Euphoria Fades: Geopolitics & Delays Spook Investors Early gains fueled by India-US trade deal hopes were erased by US sanctions on Russia and talk of postponed talks. 8 FIIs Are BACK! The 5-Day Buying Spree Fueling the Rally Foreign Institutional Investors were net buyers for the fifth consecutive session, providing crucial support. 9 IT Stocks Soar: The H-1B Visa Relief Sparks a Sectoral Frenzy The Nifty IT index jumped 2.4% on clarifications that existing H-1B holders are exempt from new fees. 10 Bank Nifty's Rollercoaster: A 500-Point Plunge from Peak to Close The banking index shed 500 points from its record high, forming a bearish candle and indicating volatility. 11 Options Data Reveals All: The Secret 25,500-26,500 Battlefield Maximum Call and Put open interest points to a tight consolidation range in the near term. 12 Buy-on-Dips Mantra: Experts See Any Fall as a Golden Opportunity The overall uptrend is intact; analysts view any short-term dip as a chance to enter the market. 13 Mid & Small-Caps Bleed: The Hidden Pain in a Flat Market While benchmarks were flat, the broader market (Midcap & Smallcap indices) closed in the red. 14 200 Stocks Hit 52-Week Highs! This Hidden Bull Run is Still On Despite the index struggle, over 200 individual stocks, including major banks, celebrated new highs. 15 Consolidation is the New Rally: Why Sideways Movement is Healthy The market is likely to enter a phase of consolidation, digesting recent gains before its next big move.