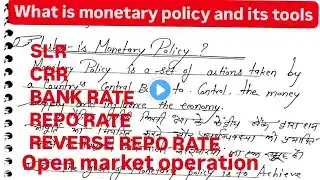

Repo and reverse repo rate

🎯 What is Repo Rate? Repo (Repurchase) Rate is the interest rate at which commercial banks borrow money from the central bank (like the RBI in India) by selling their securities. A higher repo rate makes borrowing expensive, reducing liquidity in the market, while a lower repo rate makes borrowing cheaper, increasing liquidity. Example: If the RBI increases the repo rate, loans and EMIs become expensive, reducing spending and controlling inflation. 🎯 What is Reverse Repo Rate? Reverse Repo Rate is the interest rate at which the central bank borrows money from commercial banks by offering them securities. A higher reverse repo rate encourages banks to park their excess funds with the central bank, reducing money circulation in the economy. Example: If the RBI increases the reverse repo rate, banks prefer depositing money with the RBI instead of giving loans, reducing liquidity and controlling inflation. 🔹 Key Differences: Repo Rate: Central bank lends to banks → Increases money supply Reverse Repo Rate: Banks lend to the central bank → Decreases money supply 📌 Why Are They Important? These rates are tools to control inflation, economic growth, and liquidity in the banking system. Central banks adjust them to maintain economic stability. Let me know if you need a script or a voiceover version! #RepoRate #ReverseRepoRate #RBI #Banking #Finance #Economy #InterestRates #MonetaryPolicy #Inflation #StockMarket #IndianEconomy #FinancialEducation #Investment #UPSC #UPSCPreparation #UPSCExam #IAS #IASPreparation #EconomyForUPSC #MonetaryPolicy #RepoRate #ReverseRepoRate #drishtiiasRBIPolicy #CurrentAffairs #UPSC2025 #Economy #IndianEconomy #CivilServicesExam #Viral #Trending #UPSCTrending #UPSCMotivation #IASDream #CurrentAffairs2025 #EconomyExplained #FinanceFacts #ExamTips #StudySmart #GovernmentExam #CompetitiveExams #UPSCStrategy #RBILatest #StockMarketNews