Pay ZERO Tax in 2025 with New Regime – Updated Income Tax Saving and Tax Planning Guide

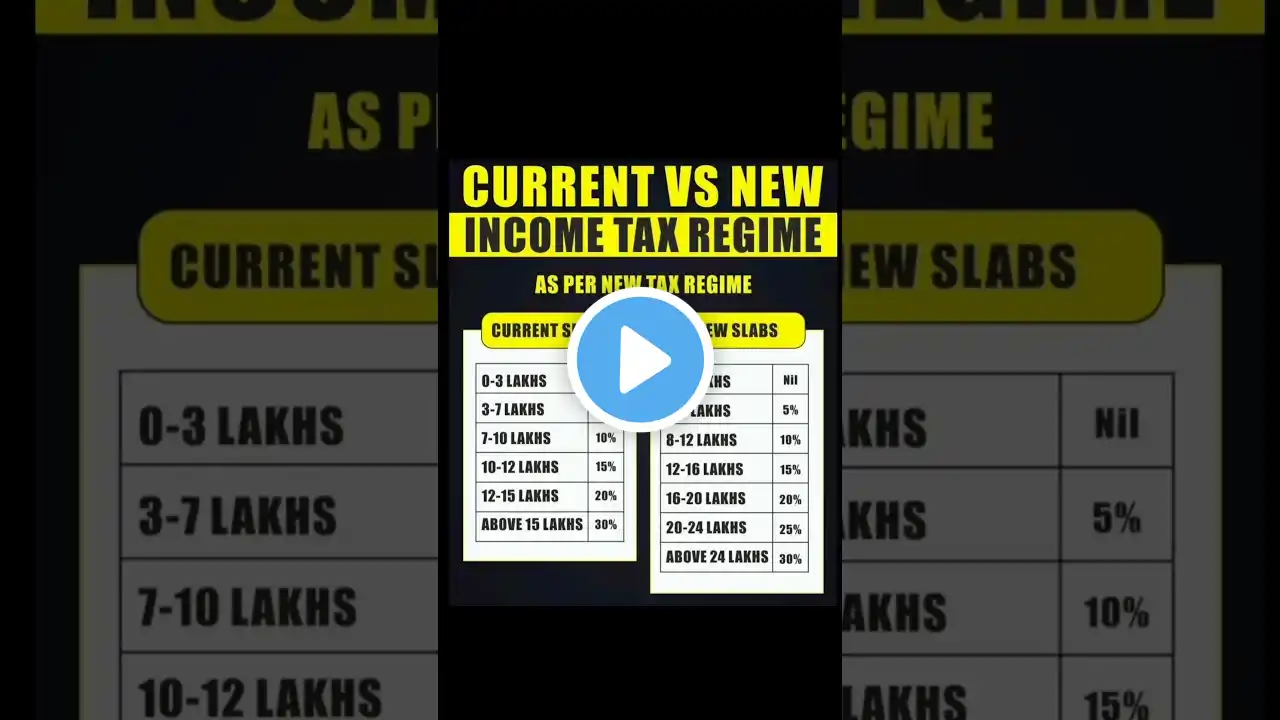

How to Pay ZERO Income Tax in 2025 with New Tax Regime? In this detailed Updated Income Tax Saving and Income Tax Planning Guide , we’ll explore major tax saving options and tax deductions that you can claim under new tax regime in ITR filing for financial year 2024-25. Join All-In-One Video Finance App here: ✔ https://vidfin.com/ Unlimited Access to Stock Recommendations, IPO Analysis, Finance Courses, Sectoral Analysis & In-depth case studies of public companies New Income Tax Slab 2023-24 | New Tax Regime vs Old Tax Regime [with Calculator] • New Income Tax Slab 2023-24 | New Tax... New Tax Regime vs Old Tax Regime Calculator: https://bit.ly/3DMoxST 00:00 Intro 01:05 Excel Calculator 02:25 Employer's Contribution to EPF 03:38 Exemptions under Section 10 04:40 Voluntary Retirement Scheme (VRS) 05:27 Tax Deductions in New Tax Regime 05:40 National Pension System(NPS) 06:39 Income from House Property 10:50 Tax Slabs- New Tax Regime 12:50 Family Pension 13:13 Agniveer Corpus Fund 13:58 Tax Deduction on Gift 14:11 Can we switch Tax Regimes? ------------------------------------------------------------------------------------------- About the Video In this video, we explore how to pay zero tax in 2025 under the new tax regime while ITR filing 2024-25. With more taxpayers opting for new tax regime, we will help you understand tax saving in new tax regime. We break down the key strategies that could help salaried individuals significantly reduce their income tax liability and optimize their income under the new tax slabs. Using a tax regime calculator, we analyze how different deductions and exemptions impact your total income tax calculation 2024-25 and help in tax saving in the new tax regime. We uncover ways to structure your salary efficiently, claim income tax deduction on provident fund (PF), EPF, and NPS, and tax exemptions, including family pension benefits, Agniveer Corpus Fund, which can further enhance tax saving in the new tax regime. Whether it’s maximizing 80C deductions along with Leave Encashment, House Rent Allowance (HRA) and Leave Travel Allowance (LTA) learn how to apply these benefits for income tax return filing (ITR filing 2024-25) We also compare the new tax regime vs old tax regime and specifically examine the old tax regime vs new tax regime 2024-25, helping you determine which option is best for you. In this video, we will cover the following concepts: • How to save Tax in New Tax Regime? • What is New Tax Regime? • New Tax Regime vs Old Tax Regime • What is the Tax Saving in the New Tax Regime? • How to pay zero tax in ITR filing 2024-25? • What are Major Tax Saving options for salaried individual? • Can we switch between different tax regimes? • Tax Deduction under Employee Provident Fund (EPF) • Tax Deduction under National Pension System (NPS) • Tax Deduction under House Rent Allowance (HRA) • Tax Deduction under Leave Travel Allowance (LTA) • How to Claim 80C deductions? • How New Tax slabs impact your financial planning? • Tax Deduction under Agniveer Corpus Fund • Tax Deduction under Voluntary Retirement Scheme • Which tax regime is better? ------------------------------------------------------------------------------------------- Connect with Us INSTAGRAM - / assetyogi TWITTER - / assetyogi FACEBOOK – / assetyogi LINKEDIN - / mukulm ------------------------------------------------------------------------------------------- Website https://assetyogi.com #newtaxregime #itrfiling2025 #taxplanning