New Tax Regime 2025 | Income Tax | Zero Tax on 12 Lakh Income | Budget 2025 Income Tax

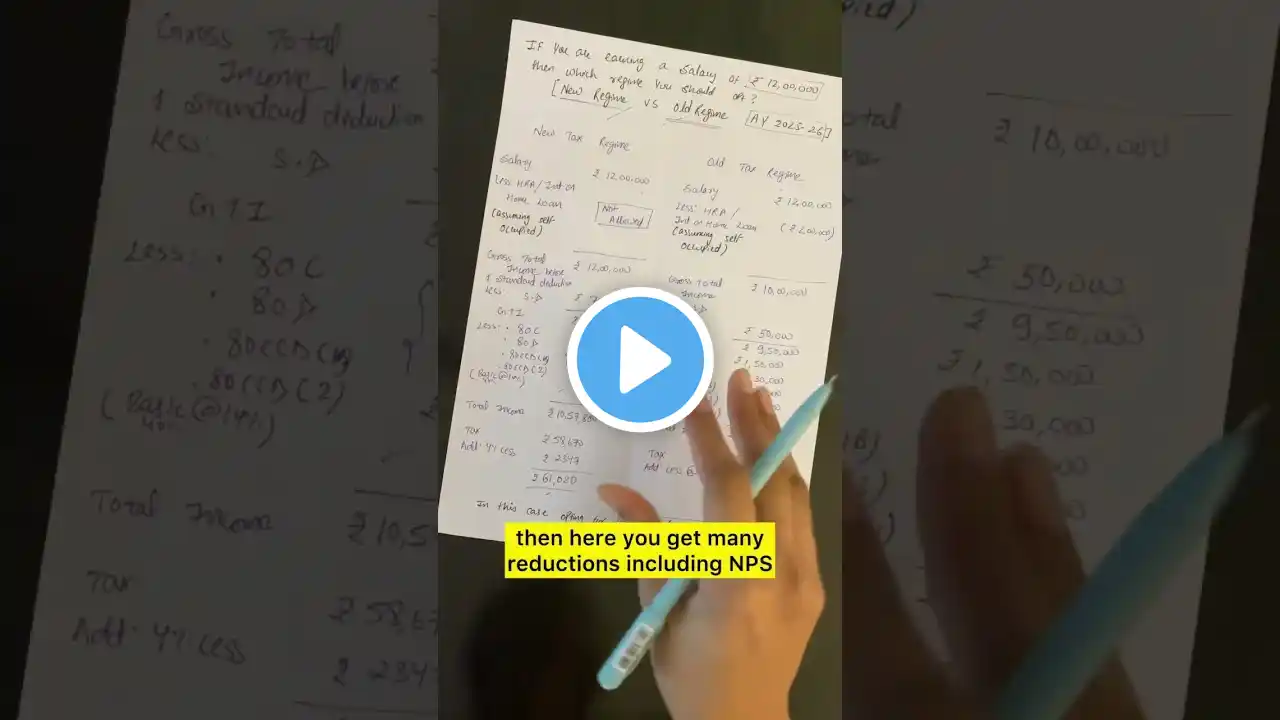

New Tax Regime 2025 | Income Tax | Zero Tax on 12 Lakh Income | Budget 2025 Income Tax Finance Minister Nirmala Sitharaman has announced a ZERO Income Tax slab for annual incomes up to ₹12 lakh under the new tax regime in Union Budget 2025! For salaried taxpayers, this limit goes up to ₹12.75 lakh with a standard deduction of ₹75,000. This move aims to ease the tax burden on the middle class, providing a much-needed boost to disposable incomes. New Income Tax slabs look after Nirmala Sitharaman's announcement: Income up to Rs 4 lakh – Nil Between Rs 4 and 8 lakh – 5 per cent Between Rs 8 and 12 lakh – 10 per cent Between Rs 12 and 16 lakh – 15 per cent Between Rs 16 and 20 lakh – 20 per cent Between Rs 20 and 24 lakh – 25 per cent Above Rs 24 lakh – 30 per cent budget 2025 live income tax new tax regime 2025 live budget 2025 budget highlights 2025 new tax regime slabs new income tax slab income tax slab budget 2025 income tax tax slab income tax budget 2025 income tax slab for ay 2025-26 new tax slab tax slab 2025 live budget groww budget live 2025 new budget 2025 budget live updates new tax slab 2025 budget 2025 tax slab tax budget 2025 live updates budget updates economic times 2025 budget live budget session 2025 today budget news new tax slabs india budget 2025 old tax regime slabs budget 2025 updates income tax calculator budget 2025 live news income tax news budget update tds new tax regime tax slabs 2025 tax slab new budget income tax tax budget capital gains tax budget speech 2025 capex budget income tax slabs capital gain tax budget 2025 income tax slab direct tax budget highlights live income tax slab new regime latest budget news budget 2025 live telecast today's budget direct tax code union budget highlights union budget 2025 pdf bajat 2025 budget 2025-26 budget key highlights income tax department 12 lakh income tax tax 2025 ✦ Disclaimer ✦ These videos are for educational purposes. All images and video footage used is credited within the video but copyright remains with the original owners. Copyright Disclaimer under section 107 of the Copyright Act of 1976, allowance is made for “fair use” for purposes such as criticism, comment, news reporting, teaching, scholarship, education and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. This video is made solely with the purpose of spreading awareness and educating the viewers. The information demonstrated and explained in the video are true to the best of our team’s knowledge and research. Nevertheless, if any error is committed, the same was never intended to be and is absolutely unintentional. In the event of any inadvertent error, kindly email us at contact [email protected] (mail subject : FEEDBACK) for necessary action, to resolve any error/dispute amicably. Viewer’s discretion is advised w.r.t. the products/services of the sponsors advertised on our platforms. We do not claim any responsibility in any manner whatsoever regarding the product/services provided by the sponsors. Thanks for watching this video Aquib Gagroo (An Engineer cum MBA Graduate) from J&K (India) @GagrooAquib @SuperseUparEducation Email id:- [email protected]