Term Insurance Ultimate Guide: Best Term Insurance Plans Explained!

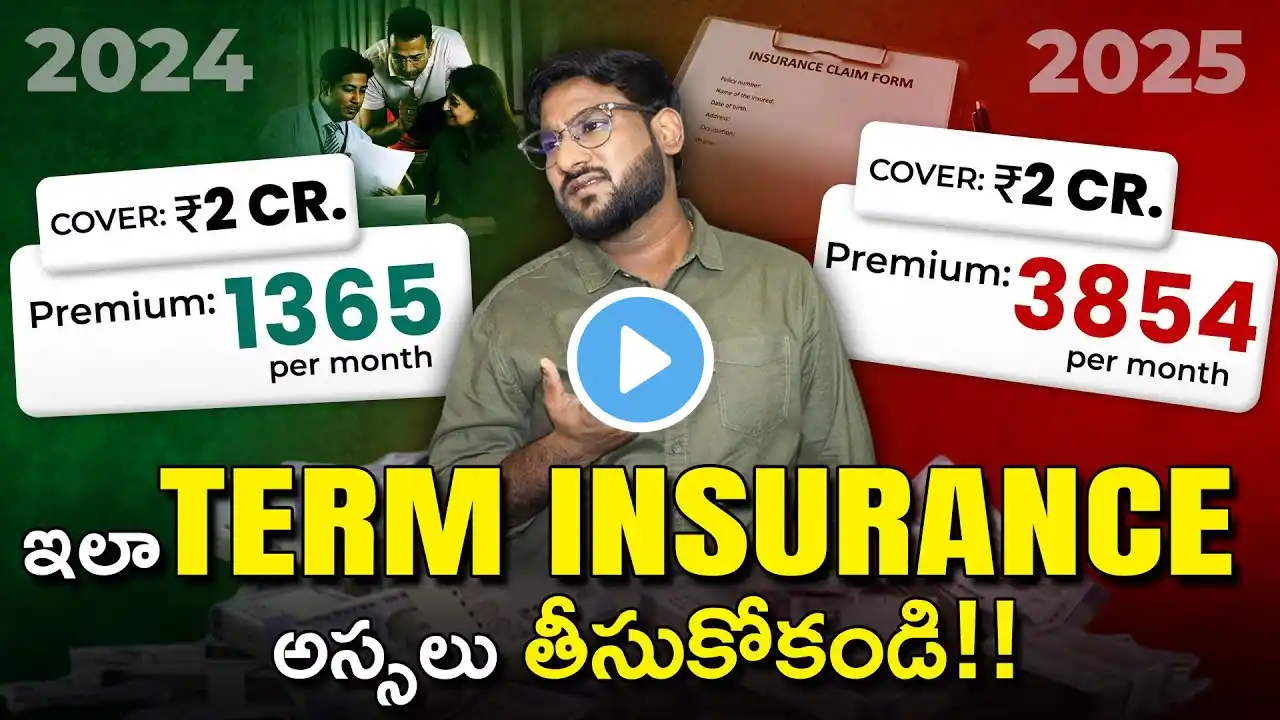

Visit Here To Know More Term Insurance Accident Rider: https://bit.ly/3yblxzO Kya aap samajhna chahte hain 'Term Insurance kya hota hai'? Is video me hum best term insurance plans aur LIC term insurance plan 1 crore (Hindi) par detail me baat karenge. Stay tuned! Term Insurance – aapka financial safety net. In this ultimate guide, we dive into what term insurance is, how it works, and which best term insurance plan suits your needs. Key Benefits of Term Insurance Cost-Effective Protection: Term insurance is generally much cheaper than other types of life insurance because it offers pure protection without an investment or savings component. This affordability allows you to secure a high coverage amount at a lower premium. Financial Security for Dependents: In the event of the policyholder’s demise, term insurance provides a lump sum payout that can help cover living expenses, debts, or educational costs for your family, ensuring their financial stability. Flexibility in Policy Terms: Most term plans offer a variety of policy durations—from 10 to 40 years—allowing you to choose a term that best fits your life stage and financial needs. Tax Benefits: Premiums paid on term insurance policies may be eligible for tax deductions under prevailing income tax laws. Moreover, the death benefit is usually tax-free for your beneficiaries. Brief Overview of Different Term Insurance Plans Pure Term Insurance: This is the most basic form of term insurance, where you only get a death benefit if the insured event occurs during the policy term. It’s ideal for those looking solely for financial protection. Return of Premium (ROP) Term Plans: ROP plans refund the premiums paid if you survive the policy term. Although the premiums are higher, these plans provide a form of savings benefit along with protection. Convertible Term Insurance: These policies allow you to convert your term insurance into a permanent life insurance plan (like whole life or endowment) without undergoing additional medical tests. This flexibility can be beneficial as your needs evolve over time. Group Term Insurance: Offered by employers or associations, these policies cover a group of people at a reduced premium rate, providing an added layer of financial security to employees or members. Guide Coverage: From Basics to Detailed Comparisons What Is Term Insurance? The guide begins by breaking down the fundamentals of term insurance, explaining what it is, how it works, and why it is an essential component of your financial planning. This section is designed for viewers who are new to the concept and need a clear, concise introduction. Detailed Plan Comparisons: After establishing the basics, the guide moves into a comprehensive review of different term insurance plans. Here, you’ll find detailed comparisons that highlight the benefits, drawbacks, and unique features of each plan type, including: Best Term Insurance Plan: Analyzing the top-rated policies based on coverage, premium cost, and additional features. LIC Term Insurance and Other Market Leaders: Providing insights into popular options like LIC term insurance and comparing them with private insurers. Plan-Specific Details: Delving into factors such as policy term, premium amounts, conversion options, and return of premium benefits. By following this structured approach, the guide ensures that you not only understand the basics of term insurance but also gain the confidence to compare different plans and select the one that best suits your financial needs. #TermInsurance #InsuranceGuide #FinancialPlanning #InsuranceHindi