MCQ 28| Sample Paper Solutions| CBSE 2024| Class 12| Accounts| Solutions| Shorts @learnwithease

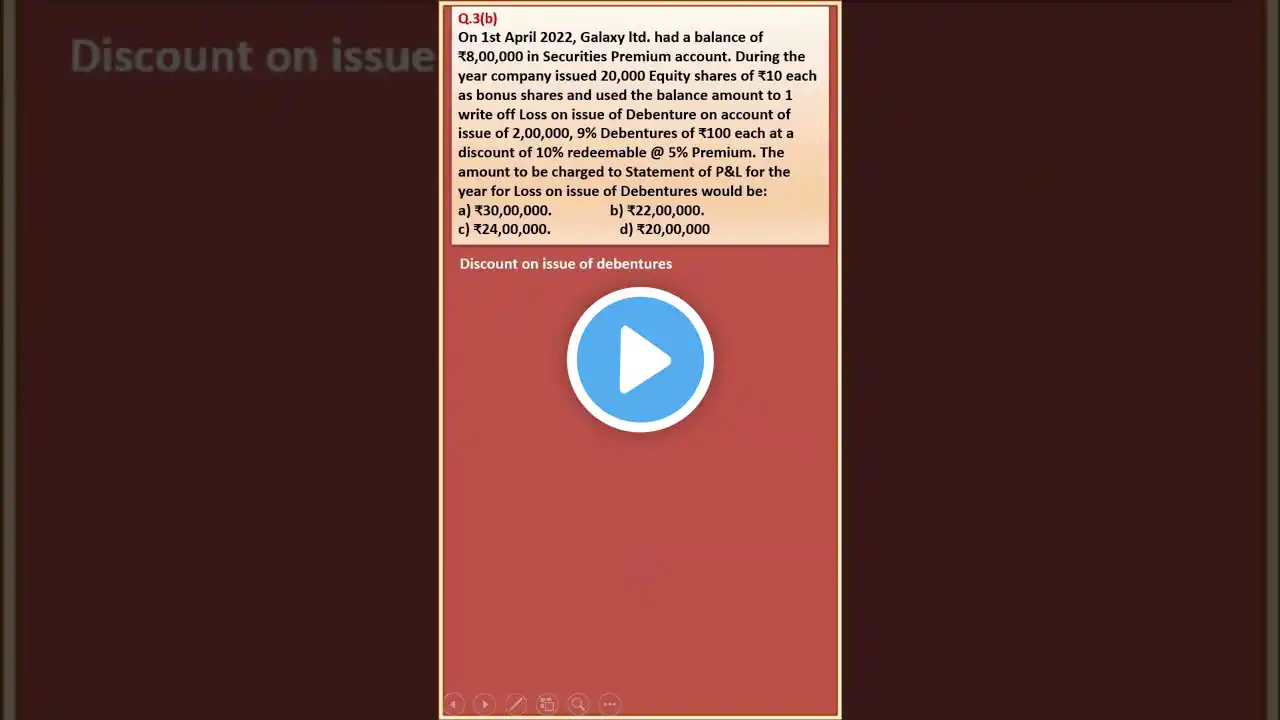

MCQ 28| Sample Paper Solutions| CBSE 2024| Class 12| Accounts| Solutions| Shorts @learnwithease Past Examination and Sample Paper Solutions| CBSE 2023| Class 12| Accounts Solutions@learnwithease CBSE 2024 Class 12 Accounts Solutions| Past Examination and Sample Paper Solutions@learnwithease Partnership Fundamentals| Adjusting and Transfer Entries| Class 12| Accounts| Ch 1@learnwithease Solution of CBSE 2024 Sample Paper Solutions Class 12 Accounts As on 31.02.2024 the following information of Bartan Manufacturing ltd. is available . Net profit ratio 40% Operating profit ratio 50% On 1st April 2024 it was came to notice that the accountant had omitted recording the interest received on investment of Rs. 2,00,000 for the financial year 2023-24. The required rectification was done. What will be the effect of the same on Net Profit and operating profit ratio? Net Profit ratio will increase and Operating Profit ratio will decrease Both Net Profit ratio and Operating Profit ratio will increase Net Profit ratio will increase and Operating Profit ratio will have no change Net Profit ratio will remain same and Operating Profit ratio will increase Adjusting Entries Transfer Entries Minimum Earnings Guaranteed by Partner Minimum Guaranteed Profit to Partner What is the single adjustment entry for Past adjustments How to calculate Commission payable to partners How to calculate interest on partner's loan What provisions will be applicable in absence of agreement to pay interest on loan How to calculate Interest on Drawings What is Drawings out of Profit What is drawings out of capital How to calculate Interest on Partners Capital How to calculate Interest on Partners Fixed capital Journal Entry for Interest on Partners Capital How to calculate Interest on Partners Fluctuating Capital How to prepare Partners Capital Account Two methods of preparing Partners Capital Accounts Fixed Capital Account Method Fluctuating Capital Account Method What is Profit & Loss Appropriation Account What is the Format of Profit & Loss Appropriation A/c Journal Entries of Profit & Loss Appropriation Account Practical Questions Profit & Loss Appropriation Account When to prepare Profit and Loss Appropriation Account In case of Loss whether Profit & Loss Appropriation Account is prepared What is Charge against Profit What is Appropriation Out of Profit What is Partnership Features of Partnership Characteristics of Partnership Definition of Partnership MCQs of Partnership Fundamentals Solutions of D K Goel 2025 Solutions of T S Grewal 2024 Class 12 Accounts #cbsesamplequestionpaper2024class12accounts #cbse2020class12accountssolutionspartnershipfundamentals #cbse2023class12accountssolutionspartnershipfundamentals #cbse2019class12accountssolutions #pastexaminationandsamplepapersolution #cbsepreviousyearquestionswithsolution #cbsesamplepaperclass12accounts #cbse2019class12accountspreviousyearsolutions #issueofdebentures #mcqissueofdebentures #adjustingentries #transferentries #guaranteeofprofit #pastadjustments #rentpaidtopartner #renttopartnerjournalentries #interestonpartnersloan #commissiontopartner #journalentriesinterestonpartnersloan #interestondrawings #interestonpartnerscapital #partnerscapitalaccount #howtopreparecapitalaccountsunderfixedcapitalmethod #howtopreparepartnerscapitalaccountunderfluctuatingcapitalmethod #typesofpartnerscapitalaccount #profitandlossappropriationaccount #journalentries #formatofprofitandlossappropriationaccount #whatispartnership #featuresofpartnership #characteristicsofpartnership #definitionofpartnership #mcqsofpartnershipfundamentals #solutionsofdkgoel2025 #solutionsoftsgrewalclass12accounts #class12accounts #chargeagainstprofit #appropriationoutofprofit #fluctuatingcapitalaccount