Best Swing Trading Strategy || Bollinger Band trading strategy || #stockmarket #swingtrading #shorts

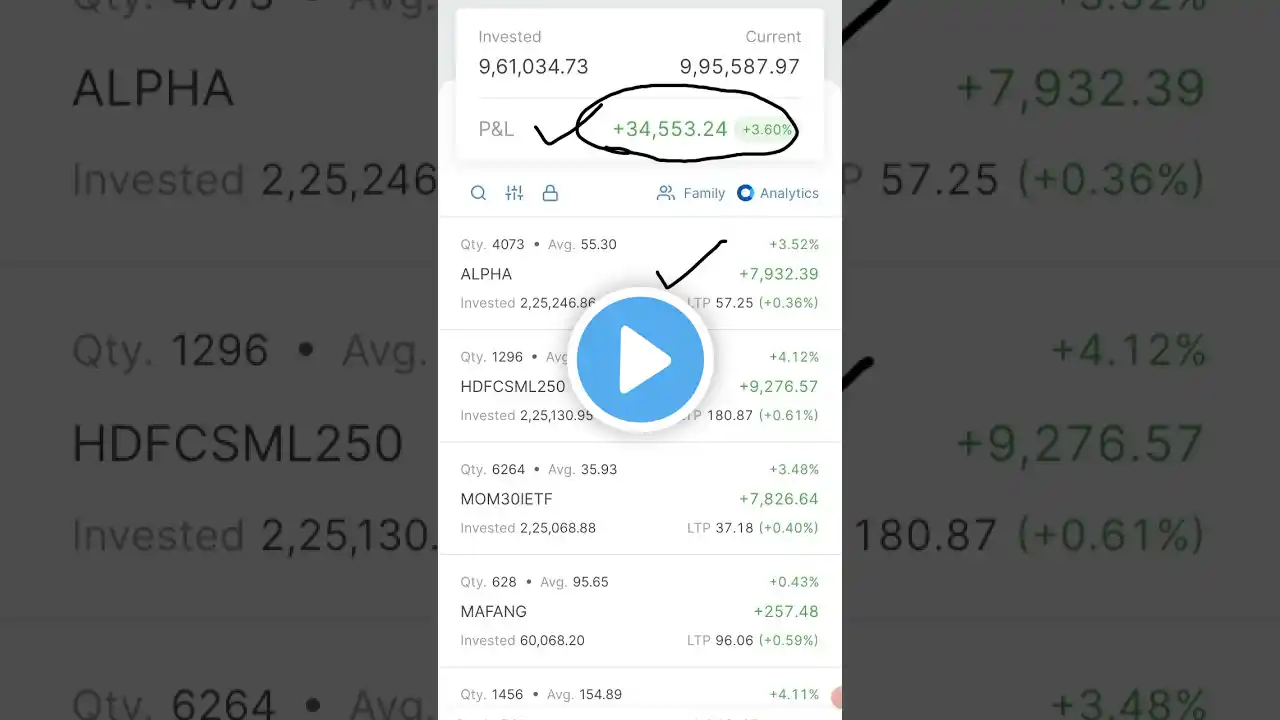

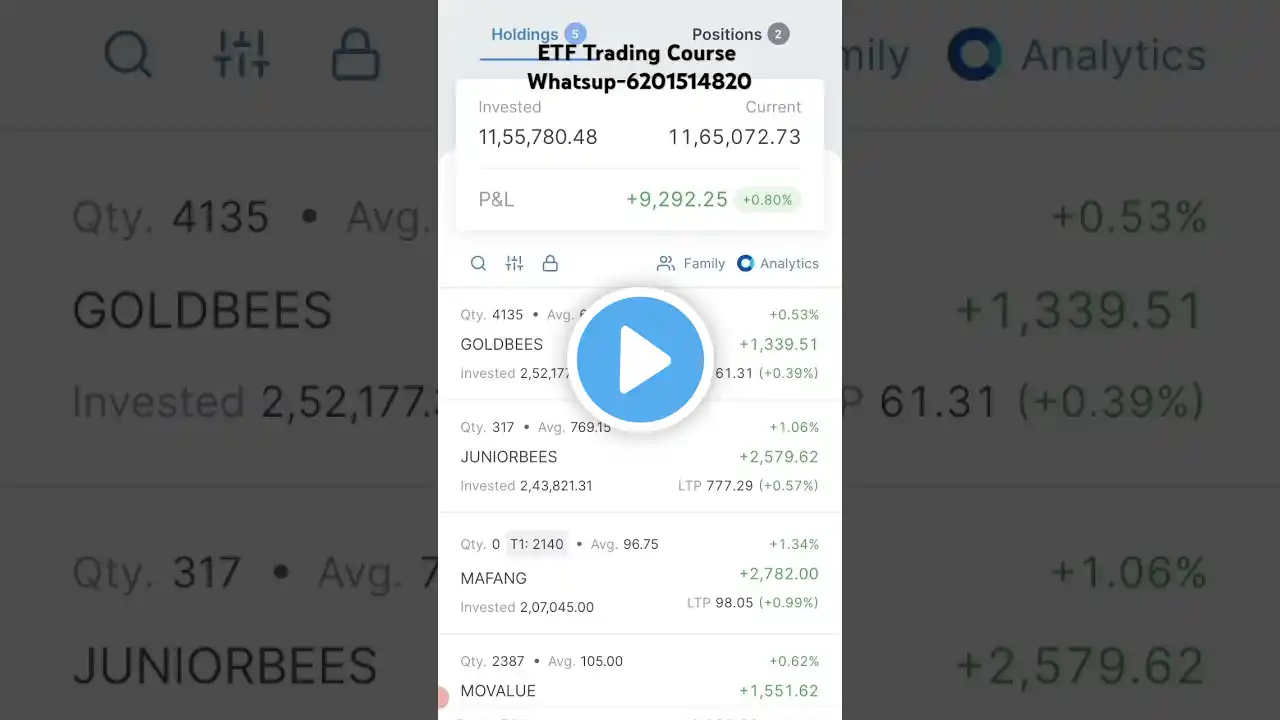

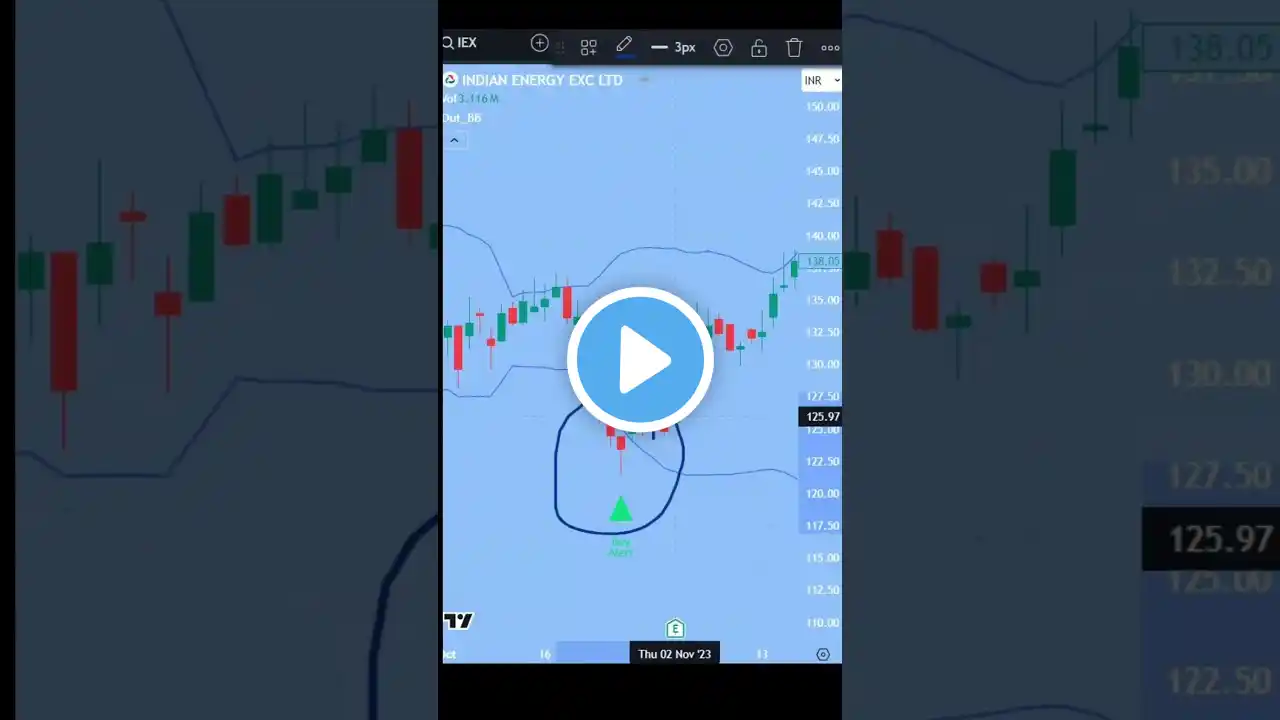

#marketview #stockmarket #swingtrading #shorts #financeshorts #bollingerbands #tradingstrategy #investing #beginners #beginnerstrading Here in this short video we have discussed a swing trading strategy for beginners, using Bollinger Band. Detail description of the strategy Trade Setup For all trades using single indicator To be used in- Intraday, Positional, or BTST/SWING trades Time Frame to Use- For Intraday Trade- 1 Minute/3 Minute/5 Minute For Positional Trade- 15 Minute / 25 Minute For BTST/SWING Trade- 75 Minute/ 1 Day Can be used in- Index F&O, Stock (cash and F&O)/( with the time frame mentioned above) Indicator to use- Bollinger Band- 20, 2 Setup a. Will plot the chart with mentioned time frame- according to our trading type. b. Wait for a candle to form which is completely out of Bollinger band, that is, no part of the candle is in contact with the Bollinger Band plotted, and this candle will be our signal candle. c. After formation of signal candle, will have to wait for the next candle to form which will be our trigger candle. In case signal candle forming above the upper Bollinger band, we will have to wait for trigger candle to break the bottom of the signal candle to enter into a bearish trade, and in this case top of the signal candle will be the stop loss and for any signal candle forming below the lower Bollinger band, will have to wait for the trigger candle to break the top of the signal candle, to enter into bullish trade. In this case, bottom of the signal candle will be the stop loss. d. For trades in both the sides, we may expect to get minimum risk to reward of 1:4 Advantage of this trading strategy- 1. Need no in-depth knowledge of technical analysis 2. It is a reversal strategy, so we will be able to capture a trend very early. 3. Same strategy can be utilized with different time frames for other types of trades. Disadvantage of this strategy- as it is a reversal trade, so accuracy is low, particularly in scalping trades- So we have to catch the targets with RR 1:4. And for winning trades we must trail the stop losses aggressively. Important points 1. To get proper idea, and belief in the strategy one must do self-back test 2. For swing trade- price of a stock may fall due to some particular events, and a signal can be generated, but before entering a into a trade in that instrument, we first need to be clear about the reason of falling. Hopefully this video may help you to understand the market trend better, and will be beneficial to make your trade plan better if you enjoyed the video then please don't forget to Like, Share, and Subscribe to MarketView for more insights, analysis, and strategies on the stock market. Hit the notification bell so you never miss out on the latest updates and trade plans. Let’s grow together in our trading journey!