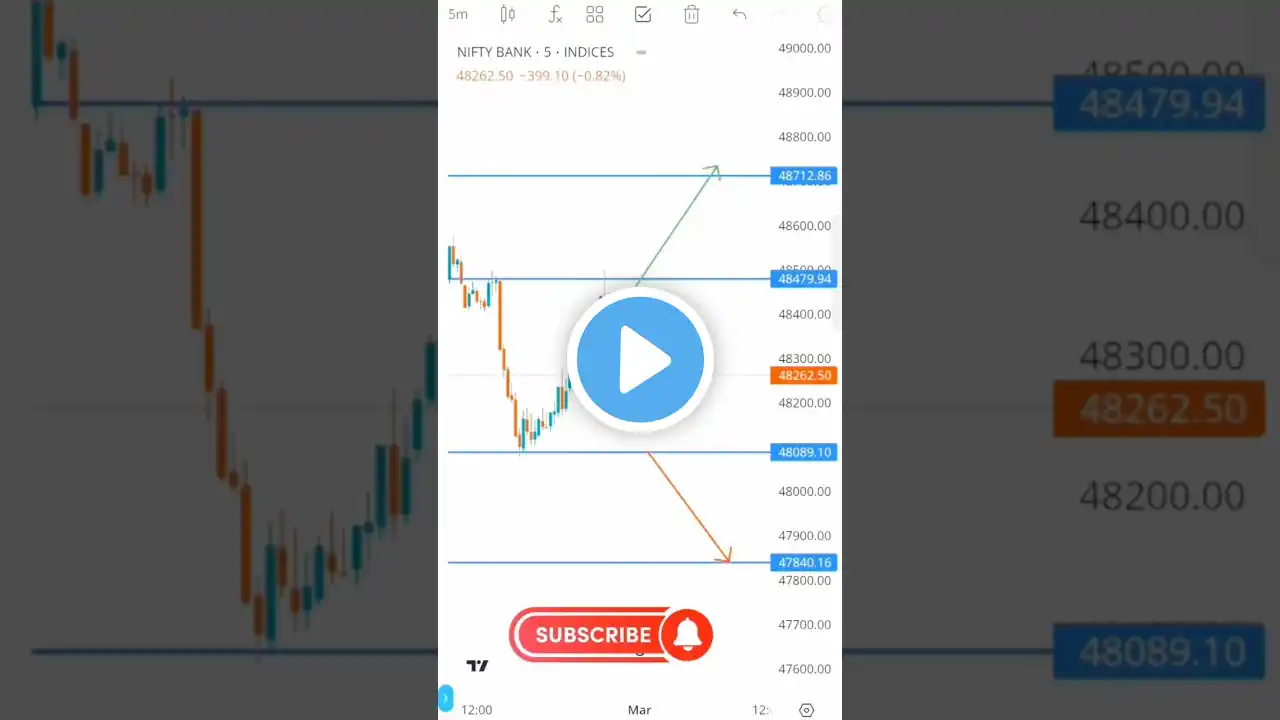

Best Advice For Every 🔥🚀💖Banknifty Chart 💖🚀🔥#trending #repost 📈 #reels #viralvideo #reproom

As of February 28, 2025, the Nifty Bank Index (BANKNIFTY) closed at 48,344.70, marking a decrease of 399.10 points (-0.82%) from the previous close. Technical analysis indicates a prevailing bearish sentiment: Relative Strength Index (RSI): The 14-day RSI stands at 37.842, suggesting the index is approaching oversold conditions. Moving Averages: Both simple and exponential moving averages across various periods signal a 'Strong Sell.' For instance, the 50-day simple moving average is at 48,872.84, while the exponential is at 48,801.21, both higher than the current index level. MACD: The Moving Average Convergence Divergence (MACD) is at -168.31, reinforcing the bearish outlook. Additionally, the Average Directional Index (ADX) is at 36.922, indicating a strong trend, and the Commodity Channel Index (CCI) is at -79.2054, which may suggest the index is nearing oversold territory. Given these indicators, traders should exercise caution and consider the bearish signals when making trading decisions.