2025 IRS TAX REFUND UPDATE - NEW Refunds Approved, Path Act, Processing Delays, Transcripts

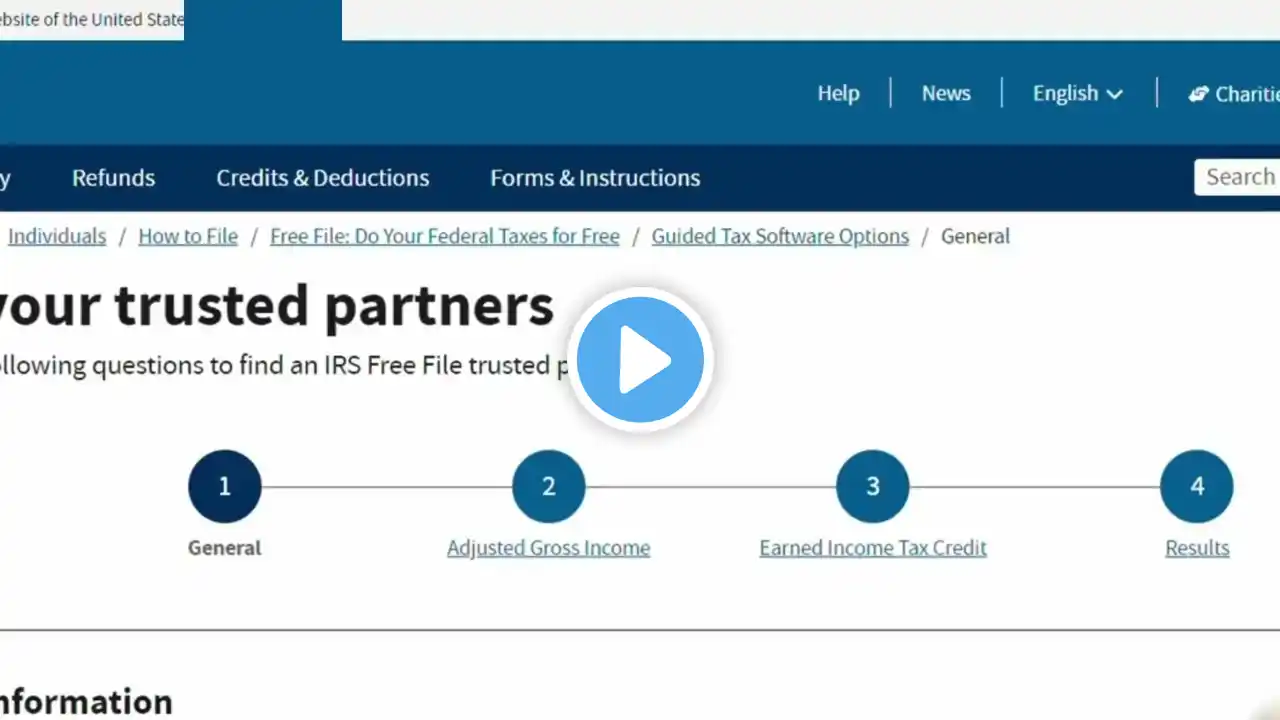

On today’s IRS tax refund update we will take a look at the latest developments including the next round of tax refunds scheduled for release and when the first possible refunds that have been put on hold due to the path act should be set for release and from there we will take a look at the top issues impacting our viewers including those who are encountering tax topic 152 as well as the 570 and 971 codes on their tax transcripts, or no updates to their tax transcripts as well as refund delays due to the need to complete ID verification. Starting out with the latest as we are now in one of the busiest weeks of the tax season as those tax refunds on hold due to the path act will finally be set for release, now those of you impacted by path act refund holds you will start to see updates on your tax transcripts and refund status results over the next several days with those impacted refunds finally set to be transmitted and released by the IRS. Now the next 2 batches of tax refunds are scheduled for release on February 18th and 19th as confirmed by the tax transcript and refund status results seen here and these refund batches will not contain refunds containing either the earned income tax credit or additional child tax credit with the next refund release date set for February 20th and also unlikely to contain any refunds consisting of path act holds followed by February 21st which is very likely based on last years tax refund schedule to contain the first round of refunds previously held due to the path act however it will be starting the week of February 24th in which we will see a significant amount of refunds containing the Earned Income Tax Credit and Additional child tax credits going out to those impact tax filers so it is important to check your tax transcripts and locate the 846 refund issue code. Meanwhile a number of viewers are continuing to report encountering tax topic code one hundred fifty two like seen here when checking the status of their refund status results and that is a normal code and one you are likely to see indicating your tax return is currently being processed and it is also common for many who have this code to eventually see it disappear with no code being shown in the refund status results as seen on the far left and again that does not indicate any issue with your tax return however if you are seeing tax topic one hundred fifty one that does indicate a potential issue and most likely a refund adjustment as a result while tax topic code two hundred three indicates your return has been processed but your tax refund has been reduced due to an outstanding obligation such as past due child support or state income tax debt. 0:00 Introduction 0:32 New Tax Refunds 1:48 Tax Topic 152 2:40 Tax Transcript Codes 4:04 ID Verification 4:55 Closing This video is under Fair Use: Copyright Disclaimer under Section 107 of the Copyright Act in 1976, Allowance is made for "Fair Use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright status that might otherwise be infringing. Disclaimer: This is for informational purposes only and is subject to change. Material provided should not be considered tax, accounting, or legal advice. Please consult a certified tax consultant for tax advice. #TaxRefund #IRS #News #Taxes #TaxReturn #Tax #Refund #TaxSeason #youtube #video #new #newvideo #breaking news