Dividend & Option Income For February 2025

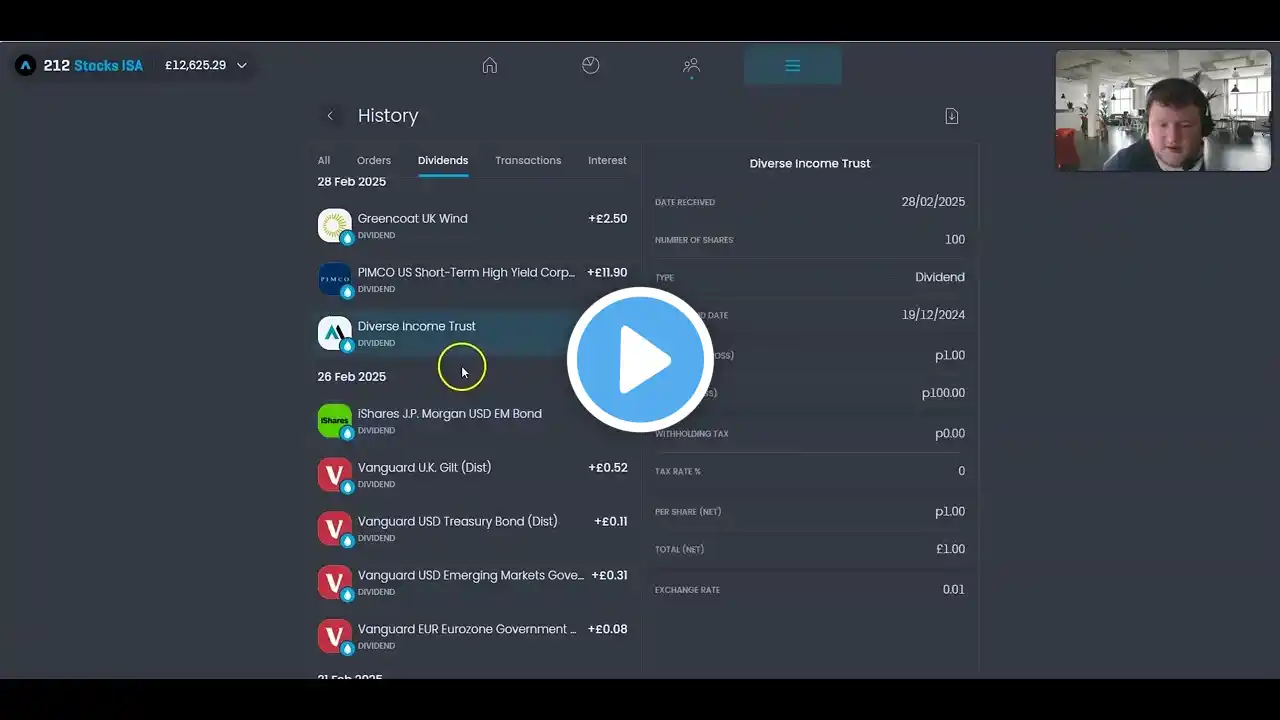

Welcome to my February income update! In this video, I break down the total dividend and options income earned for February, highlighting how my diversified portfolio continued to grow even in a stagnant, down-trending market. 💸 Dividend Income Overview: I earned dividends from a mix of high-yield ETFs, including YieldMax favorites like YMAX, TSLY, AMZY, and more, plus income from Roundhill’s QDTE. New additions to my portfolio—JP Morgan’s JEPQ ETF and NEOS Investments SPYI—also contributed to a robust dividend yield, collectively boosting my income by ~8% from last month, reaching $1,459.00 in dividends. These consistent payouts underline the growth in the dividend side of my account, reinforcing the benefits of a diversified income strategy. 📈 Options Trading Highlights: On the options front, my strategies continued to deliver solid returns: TNA maintained its performance, bringing in over $1,200 in monthly returns using the Poor Man’s Covered Call strategy. SPY set a new record by yielding over $500 this month with the same strategy. Additionally, I earned an extra $120 from a fun put credit spread on the SPX index, which is now available for trading on Robinhood. Overall, the options side of the portfolio contributed significantly to a ~6% increase from last month. 🔍 Total Income & Portfolio Growth: Combined, the dividends and options income brought my total earnings for February to $3,346.00. This robust performance was achieved despite market stagnation and downturns, showcasing the resilience of a well-balanced, income-focused strategy. 📊 March Outlook: Looking ahead to March, there are some concerns that monthly income might drop unless the high-yield ETFs can capture the necessary volatility to generate higher premiums and dividends. Additionally, the options side—especially positions in TNA—may experience reduced earnings if TNA faces significant downtrends. I’ll share my thoughts on potential adjustments and strategies to navigate these challenges in the coming month. Join me as I break down every aspect of this month’s income performance, explain my strategy adjustments, and outline my plans for maximizing returns in March. ⚠️ Disclaimer: This video is for informational and educational purposes only. It is not financial advice. Always perform your own research and consult with a financial advisor before making any investment decisions. If you found this update helpful, please like, subscribe, and hit the notification bell to stay updated on all things finance and dividend investing. Share your thoughts and questions in the comments below – let’s grow our financial knowledge together!