How Institutions Control the Market: Smart Money Explained!

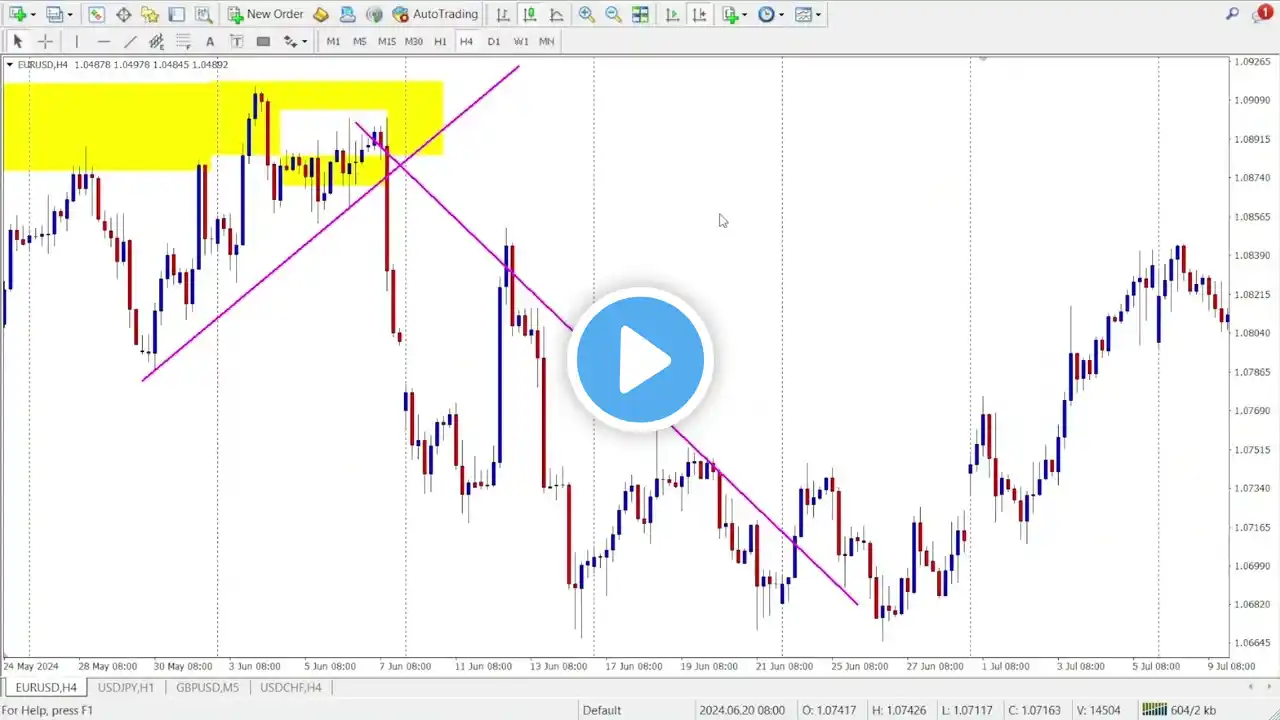

How Institutions Control the Market: Smart Money Explained! In this video, I’ll reveal a vital trading concept: Smart Money. Understanding this helps us see how big institutions like banks manipulate markets. Have you ever set a buy order near support, only to see your stop loss hit before the price reverses? This happens because smart money, or institutional investors, control large amounts of capital and move markets to take advantage of retail traders. By identifying supply and demand zones—key levels where price reacts—we can align with smart money. Additionally, understanding market structure, trends, and signals like change of character will help you make profitable trades and avoid traps. Best Forex Trading App: https://one.exnesstrack.net/a/ghux6gaye7 Trading View Link : https://in.tradingview.com/pricing/?s... [00:00] Introduction [01:44] Supply & Demand [04:55] Market Structure [06:28] Change Of Character [08:04] Examples Your Quarries: What is Smart Money Concept in trading? How do big banks manipulate the forex market? Difference between support/resistance and supply/demand zones How to identify supply and demand zones on a chart What is a liquidity sweep in trading? How to spot market structure changes (CHoCH) Best timeframes for trading smart money concepts How to avoid stop-loss hunting by institutions Smart Money vs. retail traders: Key differences Why do retail traders lose to institutions? How to trade like institutions using SMC What are higher highs and lower lows in market structure? How to use break of structure (BOS) in trading Is smart money concept applicable to stocks and crypto? What are liquidity zones and why are they important? Best candlestick patterns for supply and demand trading How do institutions use stop-loss orders? How to implement risk management with smart money concepts Best indicators to use with SMC Real-life examples of smart money manipulation in trading #smartmoneyconcepts #supplyanddemandzone #marketmanipulation #institutionaltradingconcept #liquidity #changeofcharacter #forextraders #tradingpsychology #marketstructure #breakofstructure