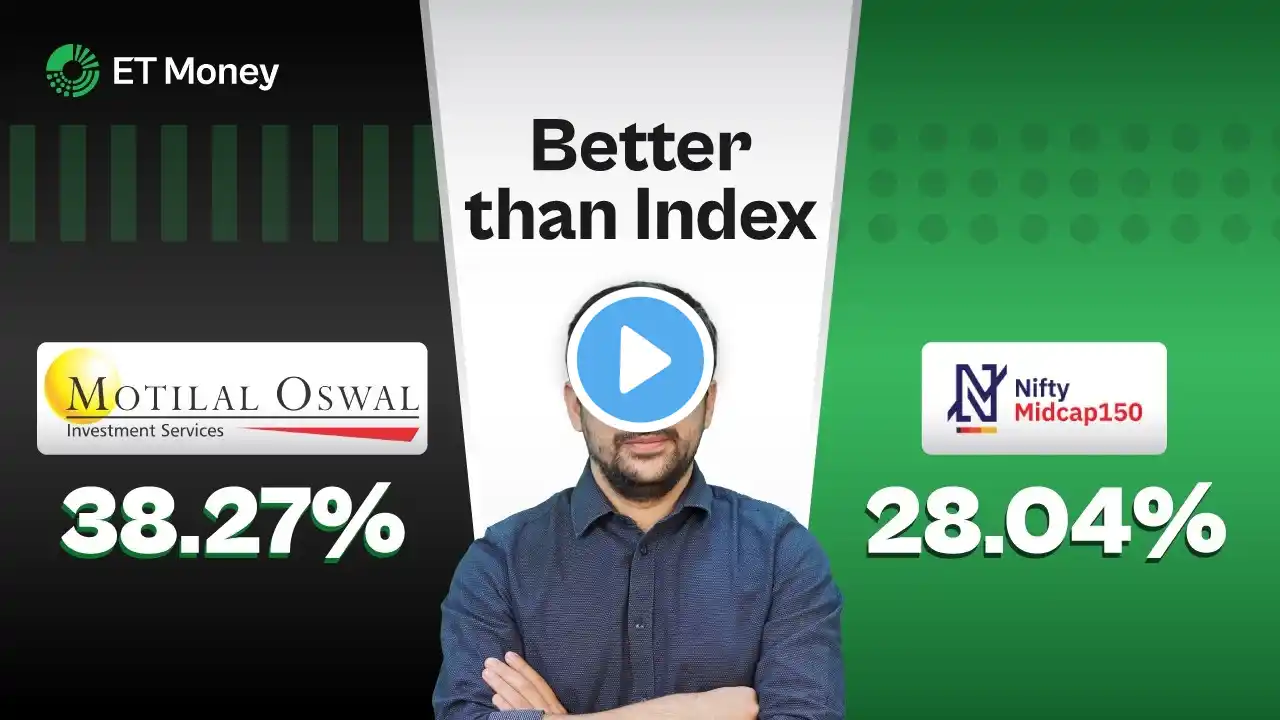

Motilal Oswal Midcap Fund Review: Performance, Returns, and Fund Manager Impact.

1️⃣Subscribe to Our Model Portfolios -https://www.investt.in/pricing 2️⃣ Book Appointment - https://blog.investt.in/appointments/ 3️⃣ Mutual funds Book Free- https://pages.investt.in/stop-paying-... --- The Motilal Oswal Midcap Fund has garnered attention among investors looking to tap into the growth potential of mid-sized companies. This fund focuses on midcap stocks, which are companies ranked between 101 and 250 in terms of market capitalization. These stocks offer a blend of high growth potential and relative stability compared to small-cap stocks, making midcap funds an attractive option for investors aiming to generate long-term wealth. In this video, we’ll provide an in-depth review of the Motilal Oswal Midcap Fund, covering key aspects such as returns, fund performance, and an important change in fund management that significantly impacted its trajectory. Fund Manager Change in 2021 One of the key highlights of the Motilal Oswal Midcap Fund is the change in the fund manager in 2021. This change has played a crucial role in shaping the fund’s recent performance. Prior to 2021, the fund was managed by a different manager with a more conservative investment approach. However, in 2021, Nirav Sheth took over as the new fund manager. Under his leadership, the fund has seen a significant shift in strategy, focusing on high-conviction midcap stocks with strong growth potential. The result? Superior returns. Since Nirav Sheth assumed the role of fund manager, the fund has outperformed many of its peers in the midcap category. The new approach focuses on businesses with solid fundamentals, growth potential, and competitive advantages. This has helped the fund to navigate market volatility and deliver higher returns to its investors. Rolling Returns and Performance When assessing mutual funds, rolling returns provide a clear picture of how the fund has performed over various time periods, smoothing out market fluctuations. The Motilal Oswal Midcap Fund has consistently delivered competitive rolling returns over the past few years, especially after the management change. The three-year rolling return of the fund has averaged around 15-18%, while the five-year rolling return has been equally impressive, hovering in the range of 12-15%. During periods of market volatility, such as the COVID-19 pandemic, the fund demonstrated resilience. Post-pandemic, the fund saw a sharp recovery, thanks to its focus on growth-oriented midcap companies that benefited from the market rebound. Quarterly Performance Examining the fund’s quarterly performance reveals its strong growth trajectory. The fund delivered strong double-digit returns in multiple quarters, particularly after 2021. In the first quarter of 2022, the fund outperformed the midcap index by a significant margin, showcasing the effectiveness of its revamped investment strategy. Consistently, the fund has managed to stay ahead of its benchmark, making it a top contender for those looking for midcap exposure. Why Choose Motilal Oswal Midcap Fund? Investors seeking high-growth potential in midcap stocks can consider the Motilal Oswal Midcap Fund as a viable option. With a renewed focus on high-quality midcap companies, the fund offers exposure to a diversified portfolio of midcap stocks with robust growth potential. Additionally, the fund manager’s active management approach ensures that the portfolio is well-positioned to take advantage of market opportunities. Conclusion and Verdict The change in fund management in 2021 marked a turning point for the Motilal Oswal Midcap Fund. With a more aggressive and growth-focused investment strategy, the fund has delivered impressive returns, outperforming its benchmark and many of its peers in the midcap category. If you’re looking to invest in midcap stocks for long-term wealth creation, this fund could be an excellent option. Connect with Mutual Funds Telugu on Social Media: ►https://www.blog.investt.in/ ►https://t.me/joinchat/G-GqlmXWXxsiSc9M ► / investtofficial For any queries related to Mutual Funds and Insurance mail to [email protected] #mutualfundstelugu #bestmutualfunds #investt.in Thank You for Watching.