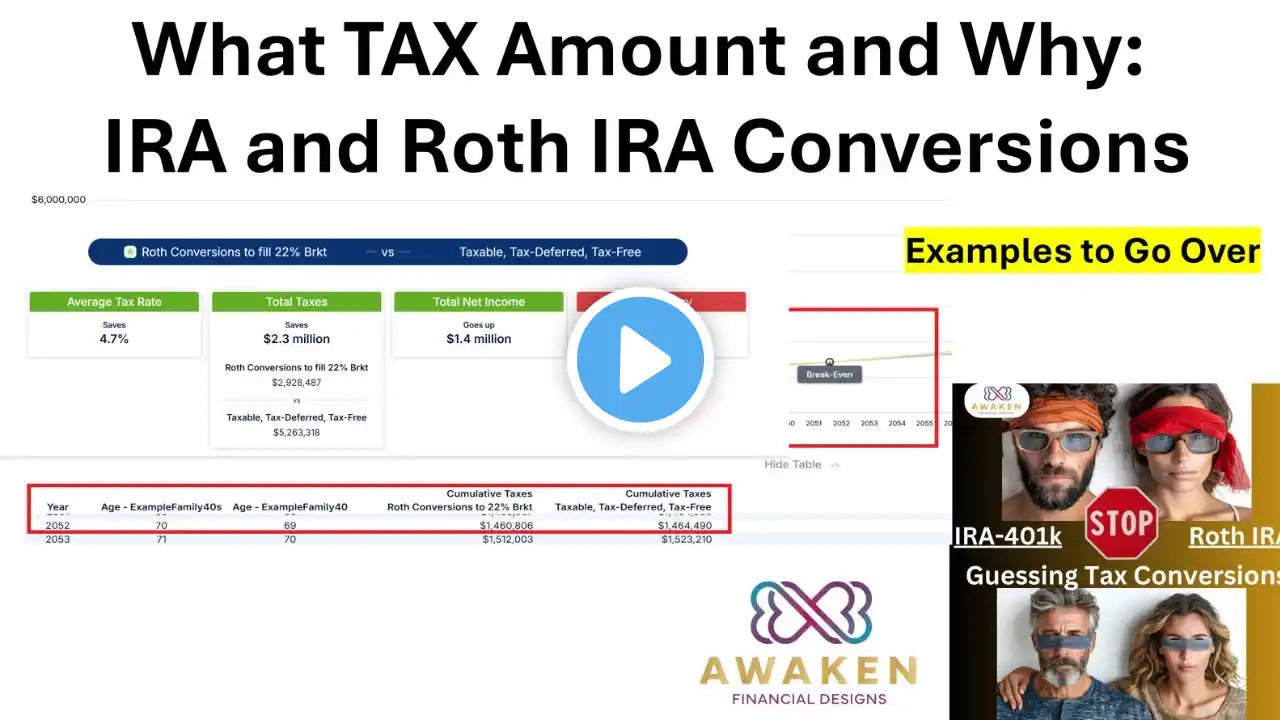

Should You Convert Your IRA to Roth IRA: Tax Strategies, Break-Even Points & Savings Analysis

Thinking about converting your IRA (Traditional IRA, 401(k), or TSP) to a Roth IRA? This video breaks down the tax implications, potential savings, and break-even points of Roth conversions for two different married couples—one in their 40s and another in their 60s. Using a mathematical and visual approach, we analyze when a Roth conversion makes financial sense, how to minimize taxes, and how to maximize long-term tax-free growth. If you're planning for retirement, this tax strategy breakdown is essential. Watch now to make an informed decision on your Roth IRA conversion! Schedule a Free Discovery Call with Ashley to talk more about your financial situation: https://app.greminders.com/c/awakenfi... Our Upcoming Events: https://awakenfinancialdesigns.com/ Check out our website for more information: https://awakenfinancialdesigns.com/ Our Facebook Page: / awakenfinancialdesigns Instagram Page: / awaken_financial_designs Tik Tok: / ucxx4ro8y6pui3fmso2f-kfq Linkedin: / davidlundbergadvisor