Traditional vs. Roth 401(k): Which One is Right for You?

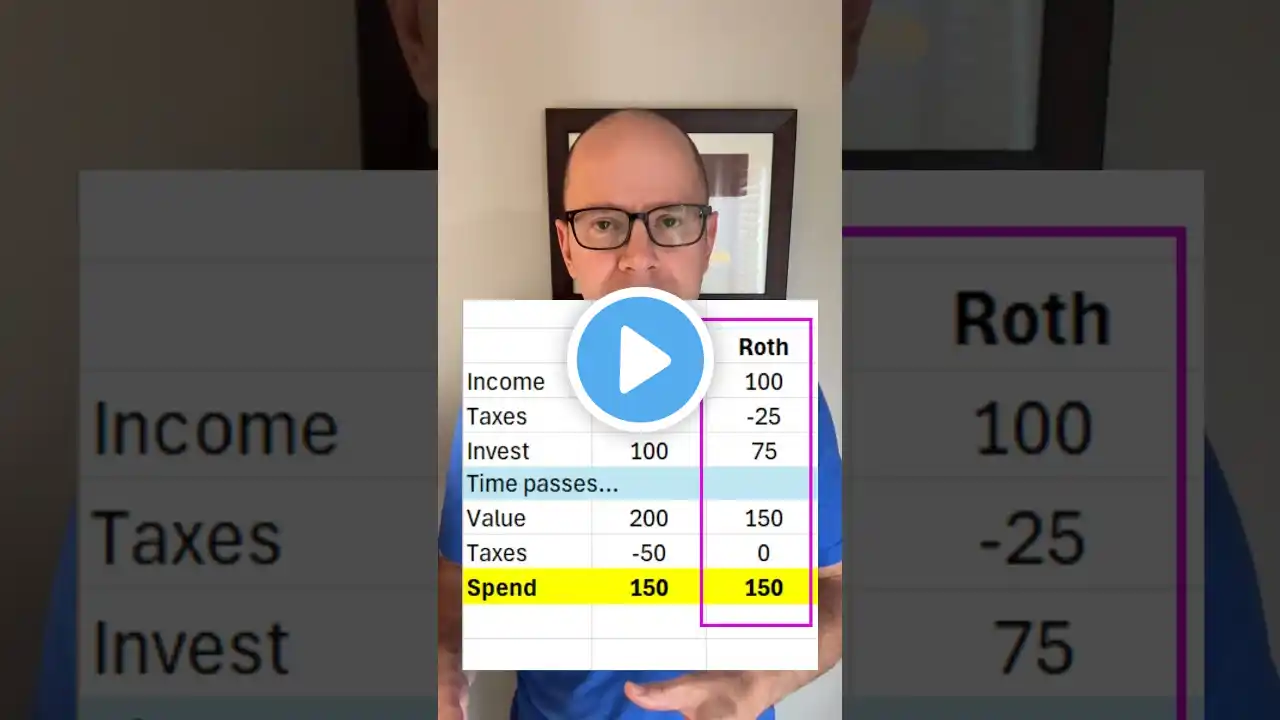

Both retirement accounts offer tax advantages, but they work very differently: ✔️ Traditional 401(k): Contributions are pre-tax, lowering your taxable income today. Your money grows tax-deferred, but withdrawals are taxed as income in retirement. ✔️ Roth 401(k): Contributions are after-tax (you pay taxes upfront). Money grows tax-free, and withdrawals in retirement are also tax-free. The best choice depends on your tax situation now vs. in the future. Lower tax bracket today? Roth might be better. Expecting lower taxes in retirement? Traditional may be the way to go. Which one do you prefer? Let’s discuss. #RetirementPlanning #401k #FinanceTips #SmartInvesting