The Truth About Roth vs Traditional IRA/401(k) Math

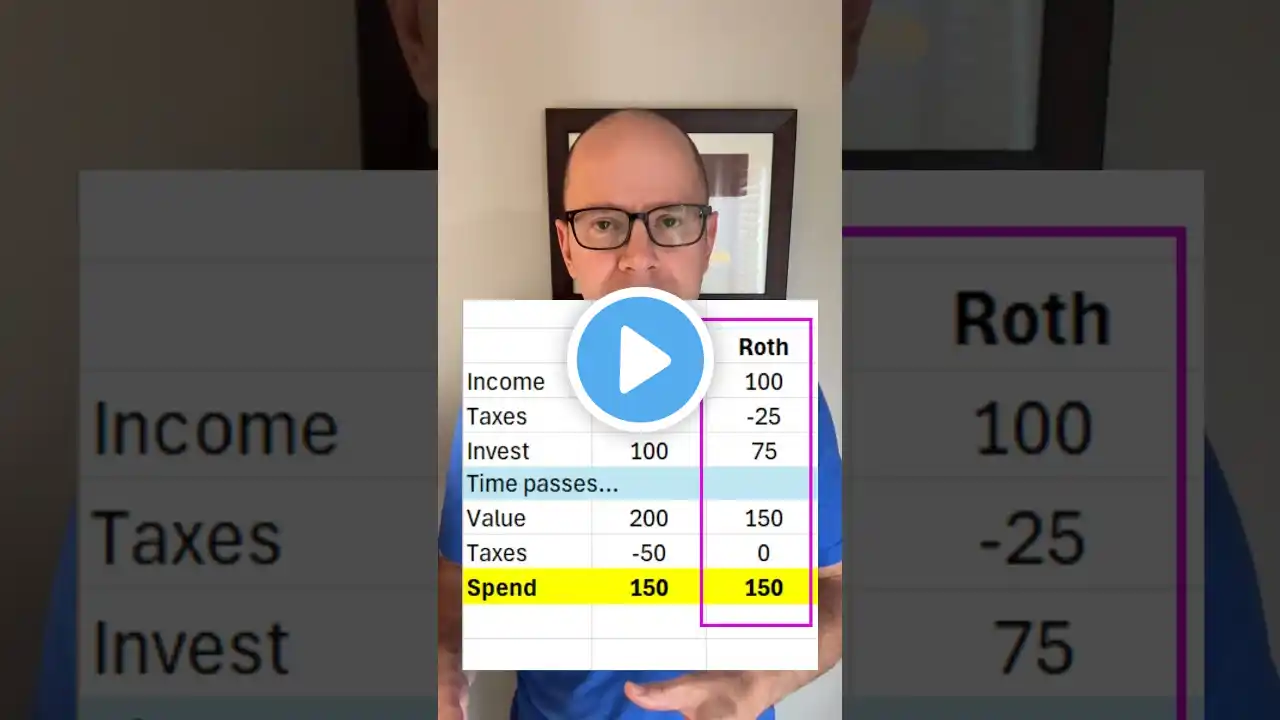

Everybody says Roth IRAs and conversions make the most sense if you have a lot of time before you use the money. But it’s important that you understand how things really work. You might hear them say “Would you rather pay taxes on the seed or the harvest?” because we assume the harvest is bigger. And there are some good reasons to convert, but the number of years involved isn’t really one of them—unless you’re using a long time to say that there’s a lot of uncertainty, which is true. When you look at the math, you’ll see that the number of years doesn’t matter. We’ve assumed your account doubles over some period of time (20 years or 200 years—it doesn’t matter). What really matters is the difference in tax rates, or strategies related to retirement income. Maybe you want to avoid Medicare IRMAA surcharges. Perhaps you want to reduce the amount of Social Security you pay taxes on, or you just want to stay in lower tax brackets when RMDs begin. The number of years has nothing to do with the math. It’s possible to lose money investing. Any returns shown are for illustrative purposes only and do not suggest the ability of Approach Financial to provide similar investment results to clients. Beware of anybody who promises to double your money. Approach Financial is a Registered Investment Adviser in the state of Colorado. Advisory services are only offered to clients or prospective clients where Approach and representatives are properly registered or exempt from registration. “Likes” should not be considered a positive reflection of the investment advisory services offered by Approach. View all comments with skepticism, as they could be scams. This information may be inaccurate or incomplete information, and you need more details. 🌞 Subscribe to this channel (it's free): / @justinonretirement Get free retirement planning resources: https://approachfp.com/2-downloads/ 🔑 9 Keys to Retirement Planning 🐢 6 Safest Investments Learn about working with me at https://approachfp.com/ ✔️ Flat-fee options ✔️ One-time projects available ✔️ Investment advice (optional) Justin Pritchard, CFP® is a fee-only fiduciary advisor who can work with clients in Colorado and most other states. IMPORTANT: It's impossible to cover everything you need to know in a video like this. The only thing that's certain is that you need more information than this. Always consult with a CPA before making decisions or filing a tax return. This is general information and entertainment, and is not created with any knowledge of your circumstances. As a result, you need to speak with your own tax, legal, and financial professional who is familiar with your details. This video is not a substitute for individualized, personal advice. Please verify with your plan administrator when employer plans are involved. This information may have errors or omissions, may be outdated, or may not be applicable to your situation. Investments are not bank guaranteed and may lose money. Opinions expressed are as of the date of the recording and are subject to change. “Likes” should not be considered a positive reflection of the investment advisory services offered by Approach Financial, Inc. The Comments section contains opinions that are not the opinions of Approach Financial, Inc., and you should view all comments with skepticism. Approach Financial, Inc. is registered as an investment adviser in the state of Colorado and is licensed to do business in any state where registered or otherwise exempt from registration.