Taxable Accounts Instead of 401(k)s?

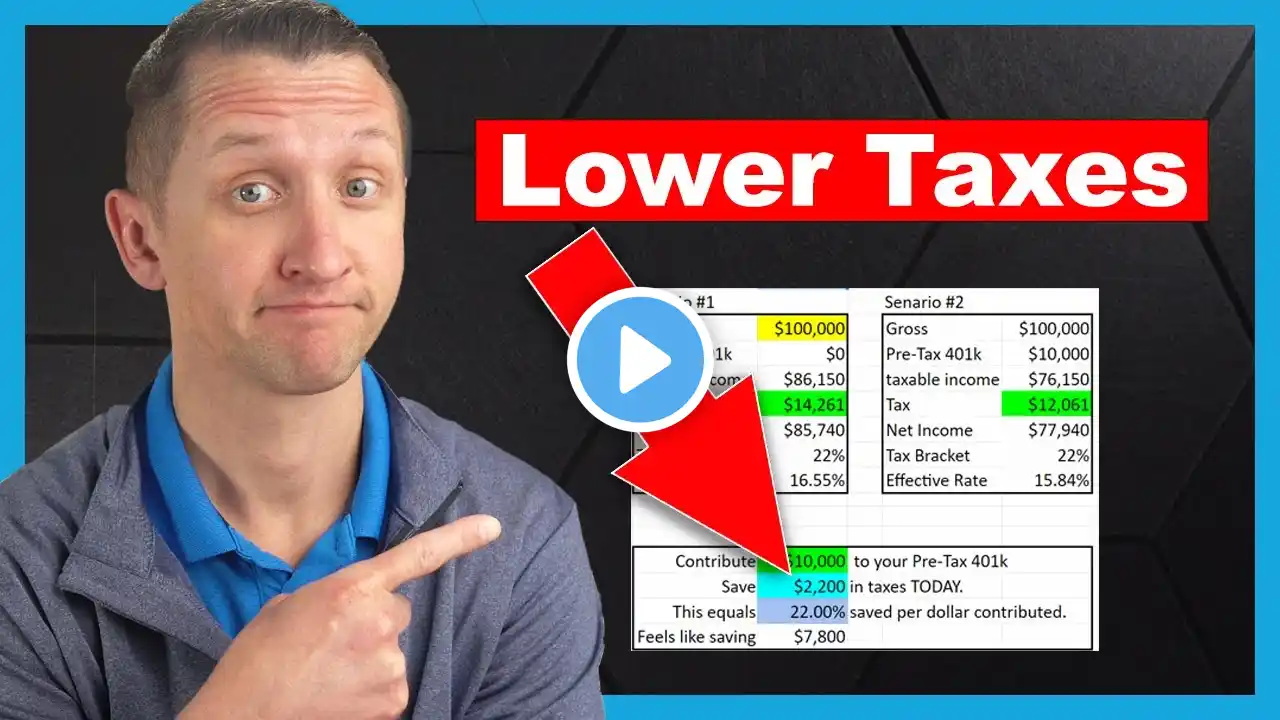

Nick Maggiulli argues against 401(k) contributions in excess of those necessary to get the employer match. https://ofdollarsanddata.com/should-i... I disagree. Traditional 401(k) contributions usually work out in favor of the taxpayer, not the IRS, as I've argued before and provided mathematical analysis to support. See https://fitaxguy.com/traditional-401k... and https://fitaxguy.com/time-to-stop-401... Mr. Maggiulli cites lack of investment choice and high fees as reasons not to invest in 401(k)s beyond the employer match. His argument ignores average employee tenure. https://www.zippia.com/advice/average... Many will invest in retirement accounts for 40 or 50 years. Who really cares about a high fee for 4 years in a 401(k) when the investment will reside in an IRA for 40 years? CNBC on fees inside a 401(k): https://www.cnbc.com/2019/07/22/how-m... 00:00 401(k) Disagreement 01:15 401(k) Assumption 02:45 Math on Taxation of 401(k) Distributions 05:05 Tax Efficient Roth Conversions 06:24 Qualified Charitable Distributions 07:31 401(k) Fees 09:01 How Long is Money in a 401(k)? 12:03 Are Taxes Going Up on Retirees? 15:03 The Tax Benefits of Roth 401(k)s 16:57 Creditor Protection 18:25 Conclusion To be abundantly clear on QCDs, QCDs are only available from traditional IRAs. They are not available from 401(k)s, though as a practical matter many 401(k)s wind up in IRAs for a whole host of reasons. This video, the show notes, and any comments are for educational purposes only. They do not constitute tax, legal, financial, and/or investment advice for any person. Consult with your own advisors regarding your own matters.