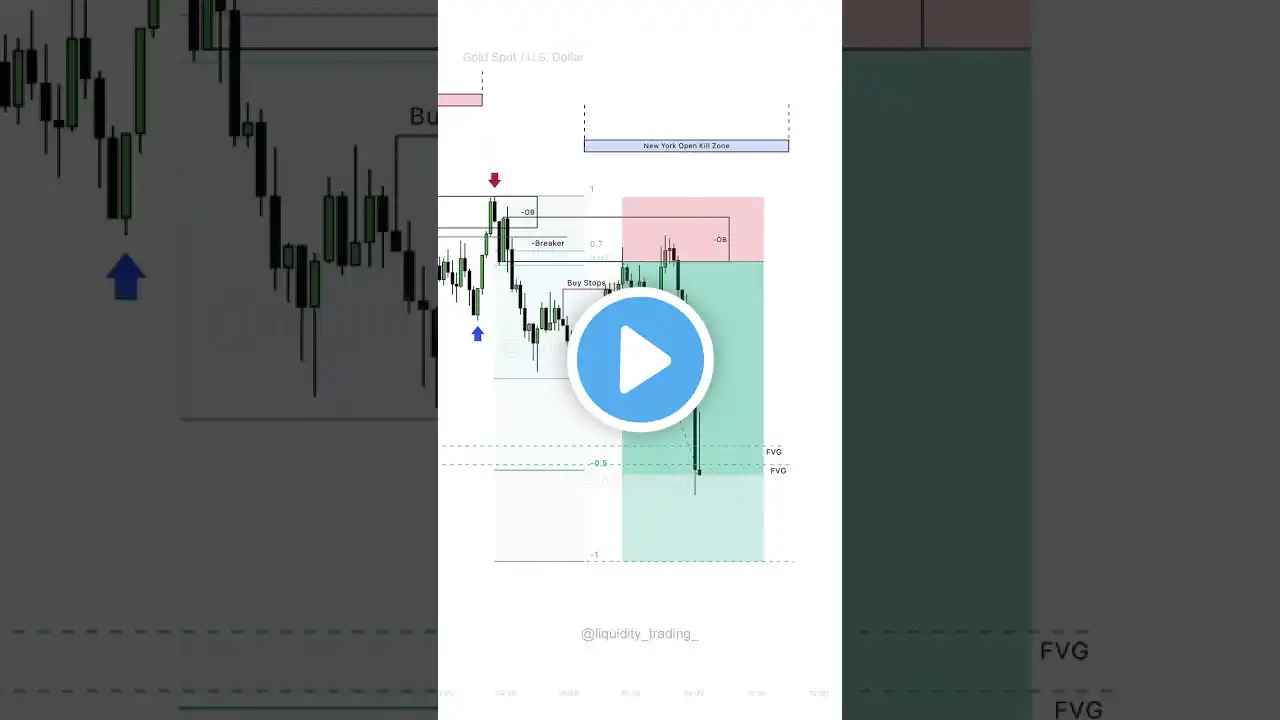

How ICT is Transforming the Gold Trade & hit target make money #gold #trading #forex #crypto #money

In the Forex (foreign exchange) market, Crypto and Stockmarket. SMC (Smart Money Concepts) and ICT (Inner Circle Trader) are trading methodologies used by professional traders to analyze price action, liquidity, and institutional order flow. 1. Smart Money Concepts (SMC) SMC focuses on how institutional traders (big banks, hedge funds) manipulate the market. Key elements include: Market Structure: Understanding higher highs (HH), higher lows (HL), lower highs (LH), and lower lows (LL) to identify trends. Liquidity: Spotting areas where retail traders place stop-loss orders (above highs or below lows), which smart money often targets. Order Blocks (OB): Zones where institutions place large buy/sell orders. Price often returns to these zones before continuing in the same direction. Fair Value Gaps (FVG): Areas of inefficient price action (imbalances) that price may return to for correction. Breaker Blocks: Former support/resistance zones that institutions use for price manipulation. Mitigation Blocks: Areas where smart money absorbs liquidity before a major move. 2. Inner Circle Trader (ICT) Concepts ICT, developed by Michael J. Huddleston, expands on SMC with: Daily Bias: Identifying bullish/bearish sentiment based on previous price action. Kill Zones: Specific time periods when smart money operates (e.g., London Open, New York Open, Asia Session). Power of Three (P3): Price manipulation phases: Accumulation, Manipulation, and Distribution. Equilibrium & Discount/Premium Zones: Using Fibonacci retracements to find optimal entry points. Judas Swing: A false breakout designed to trap retail traders. How to Perform SMC & ICT in Forex Trading 1. Identify Market Structure – Determine the trend (Bullish/Bearish/Consolidation). 2. Mark Liquidity Areas – Find stop-hunt zones (highs/lows where traders have stop-loss orders). 3. Use Order Blocks & Fair Value Gaps – Look for price imbalances and institutional order zones. 4. Trade During Kill Zones – Enter trades when smart money is most active (e.g., London Open, NY Open). 5. Wait for Confirmation – Look for price action signals like break of structure (BOS), change of character (CHOCH), or candlestick patterns. 6. Enter at Discount/Premium Levels – Use Fibonacci to measure retracements and enter at favorable prices. 7. Set Stop-Loss & Take-Profit – Place SL below order blocks and TP at liquidity zones. Would you like a step-by-step example of an SMC/ICT trade? #trading #icttrading #forex #scalpingtradingstrategybanknifty #tradingplatform #stockmarket #tradesetup #tradingsoftware #tradingbasedonpatterns #bitcoin #crypto #smc #trading #trading #gold #bentrader