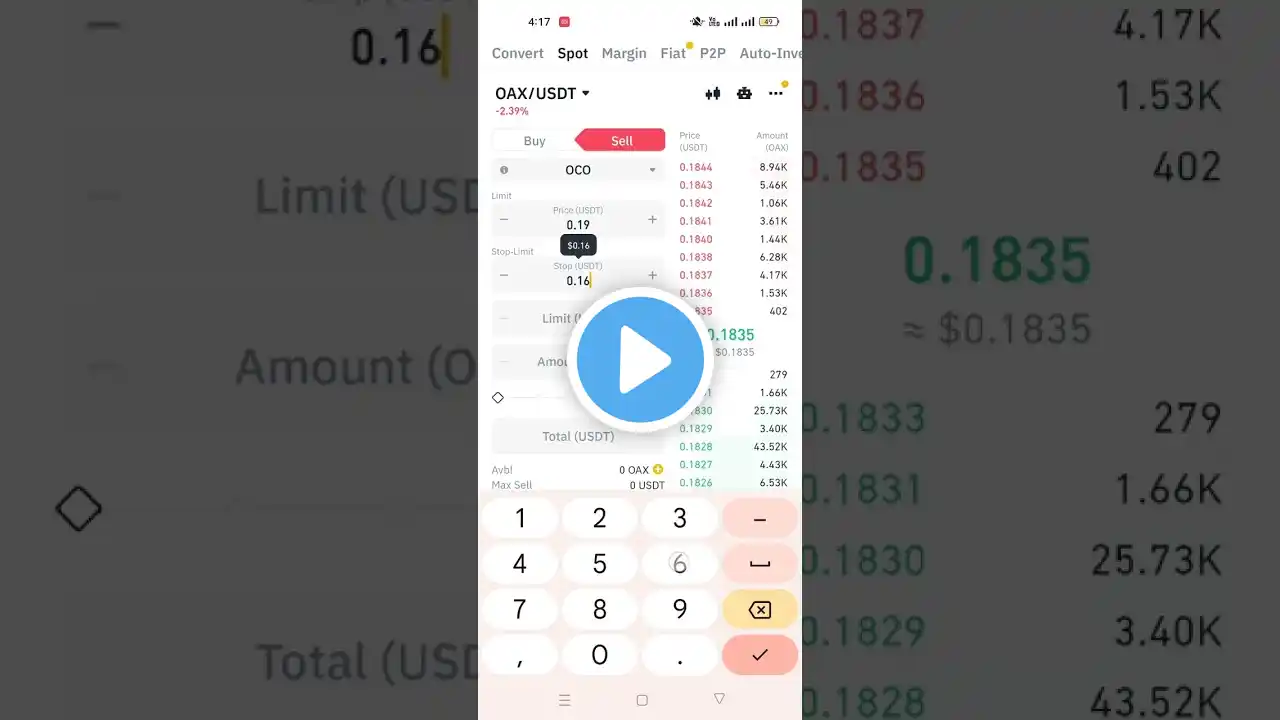

Binance oco orders kya hota hai. Kese Use Kare. binance oco order tutorial. binance oco orders hindi

Binance oco orders kya hota hai. Kese Use Kare. binance oco order tutorial. binance oco orders hindi OCO stands for One-Cancels-the-Other, and it is a type of order that allows you to place two orders at the same time. When one order is filled, the other order is automatically canceled. In the context of Pakistan and India, OCO orders can be used to: Enter and exit a trade at a specific price: For example, you could place an OCO order to buy 100 shares of a stock at $100 and sell 100 shares of the same stock at $105. If the stock price reaches $100, your buy order will be filled and your sell order will be placed. If the stock price does not reach $100, your buy order will be canceled and your sell order will not be placed. Protect profits or limit losses: For example, you could place an OCO order to buy 100 shares of a stock with a stop-loss order at $95. If the stock price falls to $95, your stop-loss order will be filled and your buy order will be canceled. This will protect your profits if the stock price falls below your target price. OCO orders can be a valuable tool for traders who want to manage their risk and take advantage of market opportunities. However, it is important to understand the benefits and drawbacks of using OCO orders before you decide to use them. Here are some of the benefits of using OCO orders: Reduces risk: OCO orders can help to reduce risk by allowing you to enter and exit a trade at a specific price. This can help you to avoid losses if the stock price moves against you. Improves execution: OCO orders can help to improve execution by allowing you to buy and sell at the best possible price. This can help you to maximize your profits or minimize your losses. Saves time: OCO orders can save you time by allowing you to place two orders at the same time. This can be especially helpful if you are trading on a busy exchange. Here are some of the drawbacks of using OCO orders: Can be more expensive: Some exchanges charge a fee for placing OCO orders. Can be less flexible: OCO orders can be less flexible than other types of orders, such as market orders. This is because you cannot specify the exact price at which you want to enter or exit a position. Can be more complex: OCO orders can be more complex to use than other types of orders. This is because you need to specify the price, size, and time of each order. Overall, OCO orders can be a valuable tool for traders who want to manage their risk and take advantage of market opportunities. However, it is important to understand the benefits and drawbacks of using OCO orders before you decide to use them. I hope this helps! Let me know if you have any other questions.