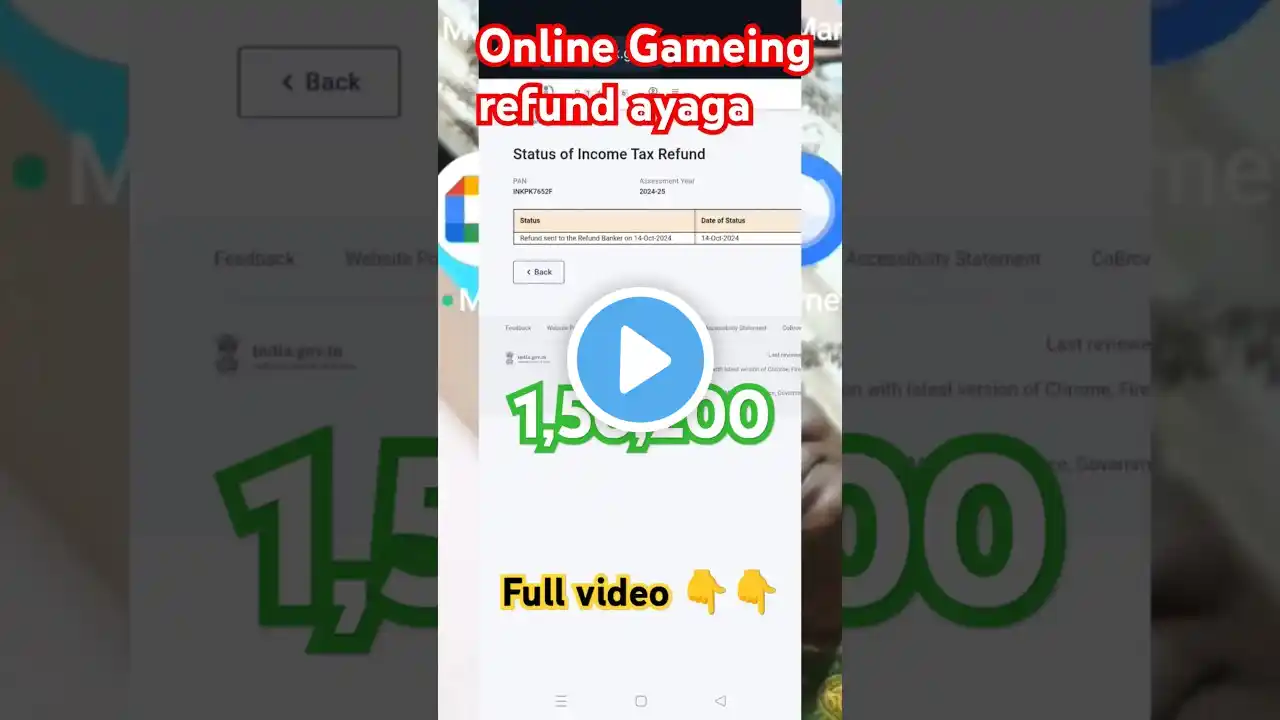

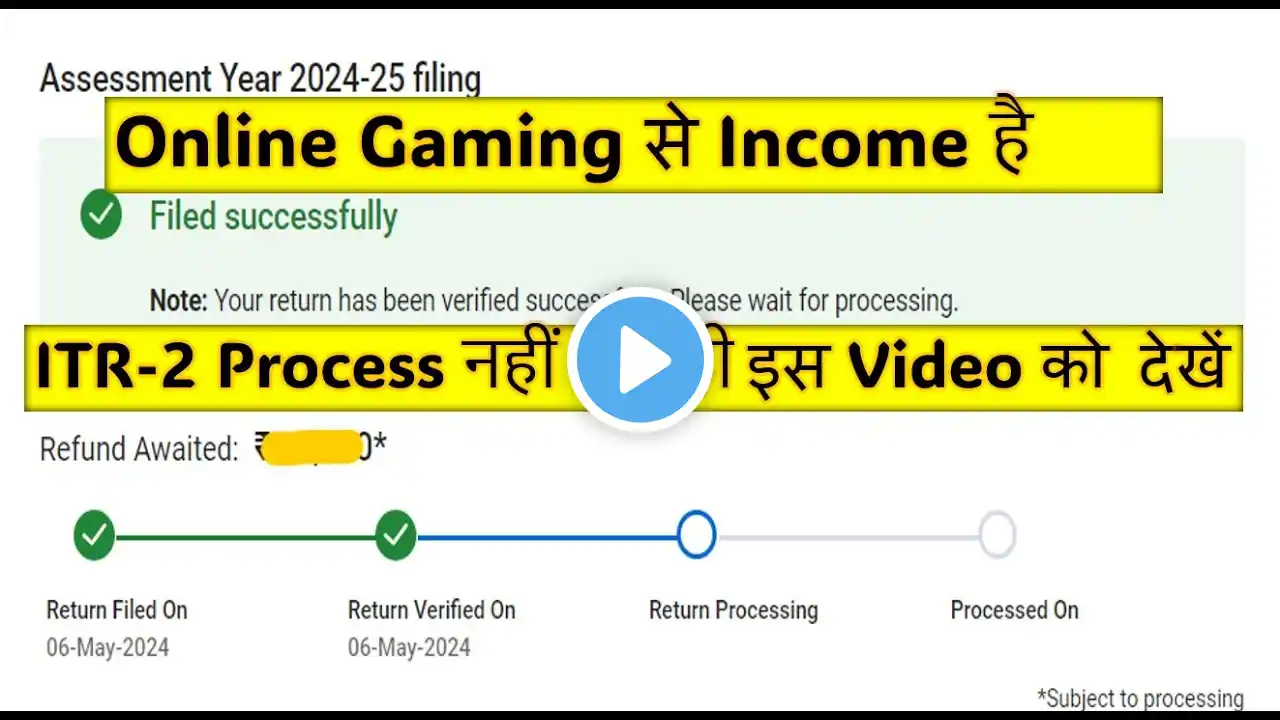

How to File Income Tax Return for Online Gaming Winnings & Get TDS Refund TDS Winning Games Refund

The specifics of Section 115BBJ and its impact on your online gaming winnings How TDS (Tax Deducted at Source) provision 194BA affects your winnings Step-by-step guide to filing your income tax return in cases of online gaming income How to claim a refund of TDS deducted on your winnings Download Link for Documents: Store Link- https://capuneet-in.myinstamojo.com (Download option will be available after successful payment) Connect with us on Social Media@ WhatsApp channel: https://whatsapp.com/channel/0029Va9n... Instagram- https: //www.instagram.com/capuneetjain.in/ Telegram channel: https://t.me/CAPuneetJain_in YouTube: / @capuneetjain Stay informed and ensure you're compliant with the latest tax laws surrounding online gaming winnings. Don't miss out on your chance to get your TDS refund back! Tags: Online Gaming Tax, Section 115BBJ, TDS Provision 194BA, Dream11 Tax, Pokerbazzi Tax, My11 Circle Tax, Income Tax Return, Online Gaming Income, Tax Refund, Online Fantasy Gaming Tax Hashtags: #OnlineGamingTax #Section115BBJ #TDSProvision194BA #IncomeTaxReturn #TaxRefund #FantasyGamingTax How to file ITR for Online Gaming Income for AY 2024-25 & FY 2023-24 | File ITR for Online Gaming How to file ITR for Online Gaming Income for AY 2024-25 & FY 2023-24 | File ITR for Online Gaming Are you earning income through online gaming and wondering how to file your Income Tax Return (ITR)? In this comprehensive guide, we'll walk you through the process step-by-step for the Assessment Year 2024-25 and Financial Year 2023-24 Understanding Online Gaming Income: Learn about the types of income generated from online gaming, including prize money, sponsorships, streaming revenue, and more. Tax Implications: Discover the tax implications of earning income from online gaming, including whether it is considered business income or professional income. Documentation Required: Find out what documents you need to gather for filing your ITR, such as bank statements, payment receipts, and any other relevant financial records. Choosing the Right ITR Form: Determine which Income Tax Return (ITR) form is appropriate for reporting your online gaming income based on your sources of revenue and other financial activities. Filing Process: Follow a step-by-step walkthrough of the online filing process, including registering on the Income Tax Department's portal, filling out the ITR form, and submitting it electronically. Deductions and Exemptions: Explore potential deductions and exemptions available to reduce your taxable online gaming income, such as expenses related to equipment, internet bills, and professional fees. Compliance and Reporting: Understand your obligations for reporting online gaming income accurately and transparently to avoid any penalties or legal issues Tags:- #onlinegaming #gaming #itrfiling #incometax #incometaxreturn #rtsprofessionalstudy #business #incometaxreturnfiling2024 #itrfiling #itr2 #itr2filing #itr3 How To File ITR For Winning From Lottery | ITR Filing For TDS Winning Games Refund | ITR 2 How to file Income tax return, How to file Income Tax Return 2024 How to file Income tax return for winning from games, lottery & gambling TDS refund ke liye ITR kaise bharen 2024-25 How to use form for winning from games, lottery & gambling New income tax return filing 2024 Assessment Year 2023-24 Financial Year 2024-25 How to file Income tax return for winning from games, lottery & gambling ? How to file Income tax return online in India for swinning from games, lottery & gambling for AY 2024-25 Can I file ITR 2 AY 2024-25 online, How to file ITR-1, How can I file my income tax return online for AY 2024-25? ITR 2 for FY 2022-23 is for salaried individuals? ITR for salary income, ITR for pension income, ITR for FD TDS, FD pe TDS kata hai How to file ITR, FD interest wapis lene ke liye ITR, Bank ne tax kaat diya wapis kaise lena hai, ITR for Other Income, ITR-2, ITR 2023, TDS वापिस कैसे लें ? file itr with form-16, Please ♥Like ♥ Share ♥Subscribe #howtofileincometaxreturn2024 #newincometaxreturnfiling2024 #itr2 #ITR2024 #taxin2024 #itrkaisebharen #tdsrefundkeliyeitr #incometaxreturn #howtofileincometaxreturnhindi #howtofileincometaxreturnenglish #itrhelp #itrforotherincome #itronline #itr #incometaxreturn #incometax #gst #savings #howtoearnmoney #tds #savetax #taxrefund #refundoftds #tds #tdsreturn #returnfortdsrefund #howtofileitrforrefund #NEWCHANGESINCOMETAX2024 #taxationcoaching #INCOMETAXUPDATES2024 #INCOMETax #TRENDINGININCOMETAX #newinincometax #2024tax #savetax #taxplanning #capuneetjain #cagurujipuneetjain #ITR #TDS