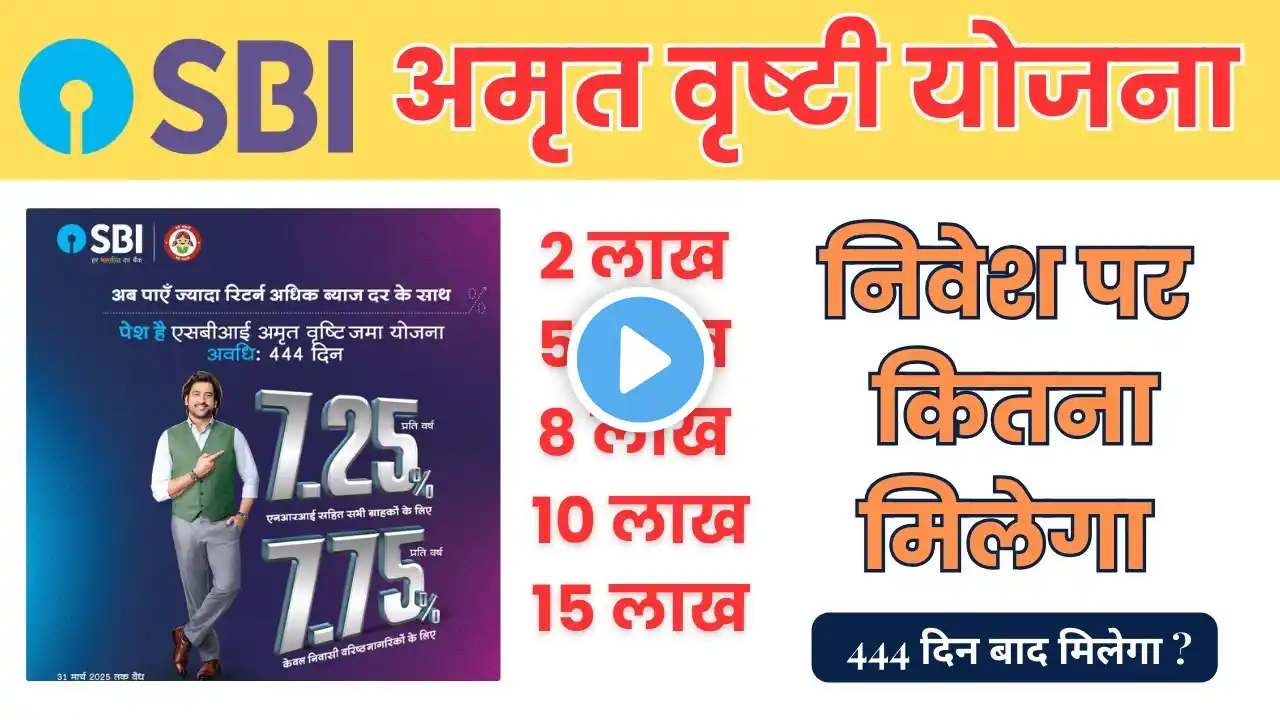

SBI Amrit Vrishti Scheme: क्या है SBI की 444 दिनों के लिए ‘अमृत वृष्टि’ FD स्कीम, कैसे मिलेगा फायदा

About video :- SBI Amrit Vrishti Scheme: क्या है SBI की 444 दिनों के लिए ‘अमृत वृष्टि’ FD स्कीम, कैसे मिलेगा फायदा Welcome to our channel! In today's video, we're diving deep into the SBI Amrit Kalash Scheme 2024, a special fixed deposit offering from the State Bank of India that has been generating a lot of buzz. If you're looking for a secure investment option with attractive returns, this scheme might be perfect for you. We'll break down everything you need to know, from eligibility criteria to the latest interest rates, and help you decide if it fits your financial goals. (Detailed Explanation of the Scheme) What is the SBI Amrit Kalash Scheme? The SBI Amrit Kalash Scheme is a special fixed deposit (FD) scheme offered by the State Bank of India. It's designed to provide higher interest rates compared to regular term deposits, making it an attractive option for those looking to grow their savings securely. This scheme is typically offered for a specific period, making it a limited-time opportunity. Key Features and Benefits: Higher Interest Rates: One of the primary attractions of the SBI Amrit Kalash Scheme is its competitive interest rates. These rates are generally higher than standard fixed deposits, allowing you to earn more on your investment. Fixed Tenure: The scheme comes with a fixed tenure, providing clarity and predictability regarding your investment period. This allows you to plan your finances effectively. Secure Investment: Being an SBI product, the Amrit Kalash Scheme offers the security and reliability associated with India's largest public sector bank. Loan Facility: You may be eligible for a loan against your FD under this scheme, providing liquidity in case of emergencies. Premature Withdrawal: While it's designed for a fixed tenure, the scheme may allow premature withdrawal, though penalties might apply. Eligibility for Senior Citizens: Senior citizens often receive higher interest rates under this scheme, making it an excellent option for retirement planning. Latest Interest Rates (Include the most recent rates and update as needed): Important Note: Interest rates are subject to change. Please refer to the official SBI website or visit your nearest branch for the most up-to-date information. Tenure of the Scheme: The SBI Amrit Kalash Scheme typically has a tenure of [Insert Current Tenure, e.g., 400 days]. This fixed period ensures that you know exactly when your investment will mature. Eligibility Criteria: Online Banking: If you have an SBI internet banking account, you can easily open an Amrit Kalash FD online. YONO App: The SBI YONO app also provides a convenient way to invest in this scheme. Branch Visit: You can visit your nearest SBI branch and open an FD in person. Bring your KYC documents for verification. Documents Required: PAN Card Aadhaar Card Passport-sized photographs Proof of address (utility bills, etc.) SBI account. (Detailed Analysis and Comparisons) Comparison with Regular SBI FDs: Highlight the difference in interest rates between the Amrit Kalash Scheme and regular SBI fixed deposits. Discuss the advantages of opting for a special scheme like Amrit Kalash over standard FDs. Explain any penalties or benefits that make this limited time offer better than standard FD's. Comparison with Other Investment Options: Who Should Invest in the SBI Amrit Kalash Scheme? Individuals seeking a secure and stable investment option. Senior citizens looking for a reliable source of income. Those planning for short-term financial goals. Investors with a low-risk appetite. Tips for Maximizing Returns: Invest a lump sum to maximize the benefits of the higher interest rate. Consider investing for the full tenure to avoid premature withdrawal penalties. For senior citizens, ensure you avail the higher interest rates offered. Reinvest the interest earned to take advantage of compounding. Potential Risks and Considerations: While the scheme is secure, remember that interest rates are subject to change. Premature withdrawal may result in penalties. Consider the impact of inflation on your returns. (Call to Action and Conclusion) Conclusion: The SBI Amrit Kalash Scheme 2024 is a valuable investment option for those seeking secure and reliable returns. Its higher interest rates, fixed tenure, and the backing of SBI make it an attractive choice. However, it's essential to understand the terms and conditions and align them with your financial goals. #SBI #AmritKalashScheme #FixedDeposit #Investment #Savings #Banking #Finance #SeniorCitizen #SBIInterestRates #FD #InvestmentTips #FinancialPlanning #SBIFD #BankFD (Links to Official Resources): Thanks fior Watching Mr Kashyap