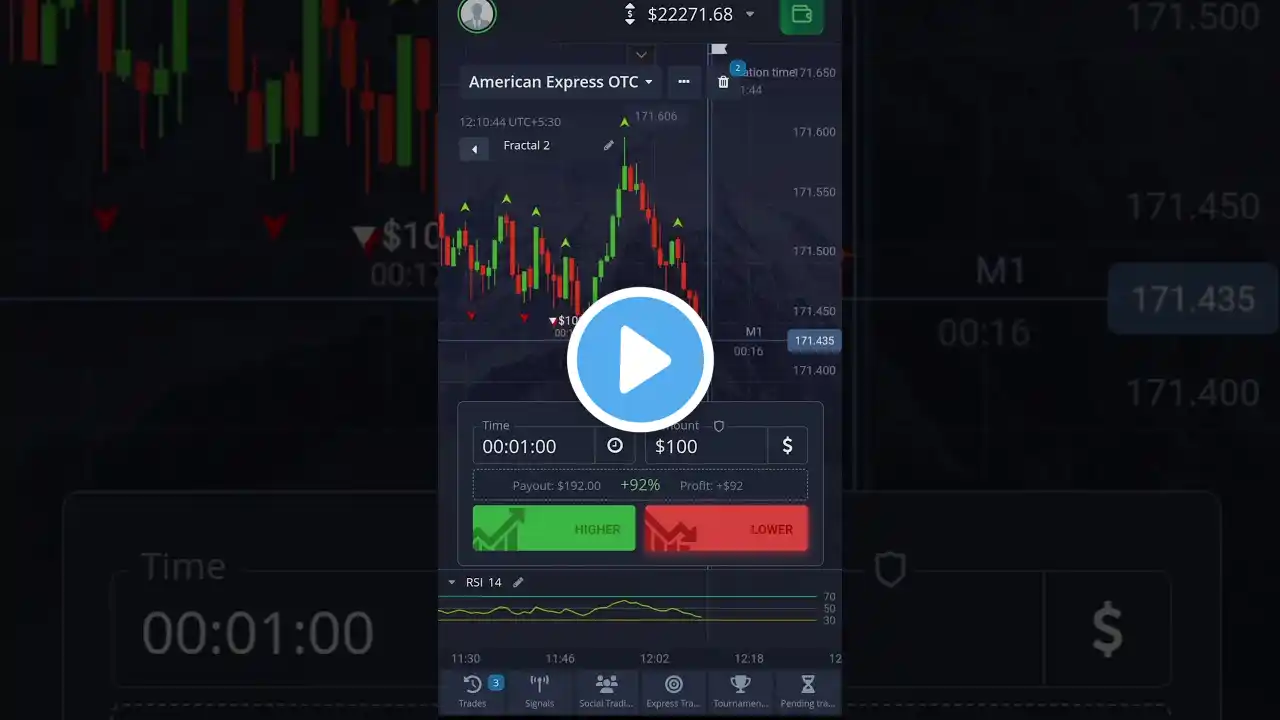

RSI Reversal Strategy #pocketoptionsignals #pockeoptionstrategy #binaryoptions #trading #pockeoption

The *Relative Strength Index (RSI)* is a popular momentum oscillator used in technical analysis to measure the speed and change of price movements of a financial asset. It is a valuable tool for traders to identify potential buy and sell signals, overbought and oversold conditions, and trend reversals. *Understanding RSI* The RSI is calculated using the formula: \[ \text{RSI} = 100 - \left( \frac{100}{1 + \frac{\text{Average Gain}}{\text{Average Loss}}} \right) \] **Average Gain**: The average of the gains over a certain period. **Average Loss**: The average of the losses over a certain period. Typically, the RSI is calculated over a 14-day period, but this can be adjusted depending on the trader's strategy and the asset's characteristics. The RSI values range from 0 to 100: **Above 70**: The asset is considered **overbought**, suggesting that it might be overvalued and a pullback or corrective move could occur. **Below 30**: The asset is considered **oversold**, indicating it might be undervalued and could experience a rebound or upward move. *How to Trade Using RSI* 1. **Identify Overbought and Oversold Conditions**: When the RSI exceeds 70, the asset might be overbought. Traders often look for selling or shorting opportunities when the RSI crosses back below 70. When the RSI drops below 30, the asset might be oversold. Traders might look for buying opportunities when the RSI moves back above 30. 2. **Look for Divergences**: **Bullish Divergence**: Occurs when the asset price makes a new low, but the RSI makes a higher low. This indicates weakening momentum on the downside and can be a signal to buy. **Bearish Divergence**: Occurs when the asset price makes a new high, but the RSI makes a lower high. This indicates weakening momentum on the upside and can be a signal to sell. 3. **Use RSI in Conjunction with Trend Indicators**: During a strong uptrend, the RSI can remain in the overbought region for a long time. In such cases, traders often look for RSI pullbacks to around the 50 level to enter long positions. During a strong downtrend, the RSI can stay in the oversold region for extended periods. Traders may wait for the RSI to rise to around 50 to consider shorting opportunities. 4. **RSI Crossovers**: Some traders look for crossovers as potential entry or exit points. For example, a cross above 50 could signal a buy, while a cross below 50 might signal a sell. 5. **Combine RSI with Other Indicators**: RSI is often used in combination with other indicators like Moving Averages, MACD, or Bollinger Bands to confirm signals and improve trade accuracy. *Tips for Trading with RSI* **Use Multiple Time Frames**: Analyze RSI on multiple time frames (e.g., daily, hourly, and weekly charts) to get a better picture of the asset's overall trend and momentum. **Adjust RSI Settings**: The default RSI period is 14, but traders can adjust this to suit different market conditions and trading styles. Shorter periods (e.g., 7 or 9) make the RSI more sensitive, while longer periods (e.g., 21 or 30) smooth out the indicator. **Avoid Over-Reliance**: The RSI is a helpful tool, but it should not be used in isolation. Combining it with other technical analysis tools and fundamental analysis can enhance its effectiveness. *Conclusion* The RSI is a versatile indicator that helps traders identify potential market entry and exit points by analyzing momentum and price strength. By understanding and applying the RSI correctly, traders can improve their decision-making and enhance their trading strategies. #pocketoption #pocketoptionbot #pocketoptionlive #pocketoptionsignals #pocketoptionbonus #pocketoption #pocketoptionstrategy, #pocketoptiontrading #стратегиянаpocketoption #pocketoptionwithdrawal #pocketoption5secondstrategy #pocketoptionsignals #pocketoptiontradingstrategy #pocketoptionاستراتيجية #pocketoptionbot #api pocket option #pocketoptionmt4 strategyindicator #pocketoptionlivetrading #pocketoptionпроверка #pocketoptionbeststrategy #livepocketoptiontrading #pocketoptionaffiliateprogram #howtodepositmoneyinpocketoptionwithcashapp #pocketoptiontrader #pocketoptionforbeginners #pocketoption5secondsstrategy100 win #pocketoptionsentimenttrading #strategypocketoption #2minutepocketoptionstrategy #pocketoptionlive #pocketoptionpromocode #pocketoptioncopytrade #трейдингpocketoption #pocketoptiondigitaltradingvsquick trading #best1minute tradingstrategypocket option #pocketoption1minutestrategy #macdиндикаторpocketoption #livetradingonpocketoption #التداول على منصةpocket option #tradingpocketoption #pocketoptiontradingcroossignal #pocketoption2minutes strategy #pocketoptionbonus #pocketoptionrobotcrosssignal #bestpocketoptionstrategy #pocketoptionsecretstrategy5secound #copytradingpocketoption #forextradingforbeginnerspocket option #pocketoptionweekendtrading #البورصةpocketoption