Mamata Machinery IPO Review | Details | Analysis #ipo #iporeview #newipo #upcommingipo #ipoalert

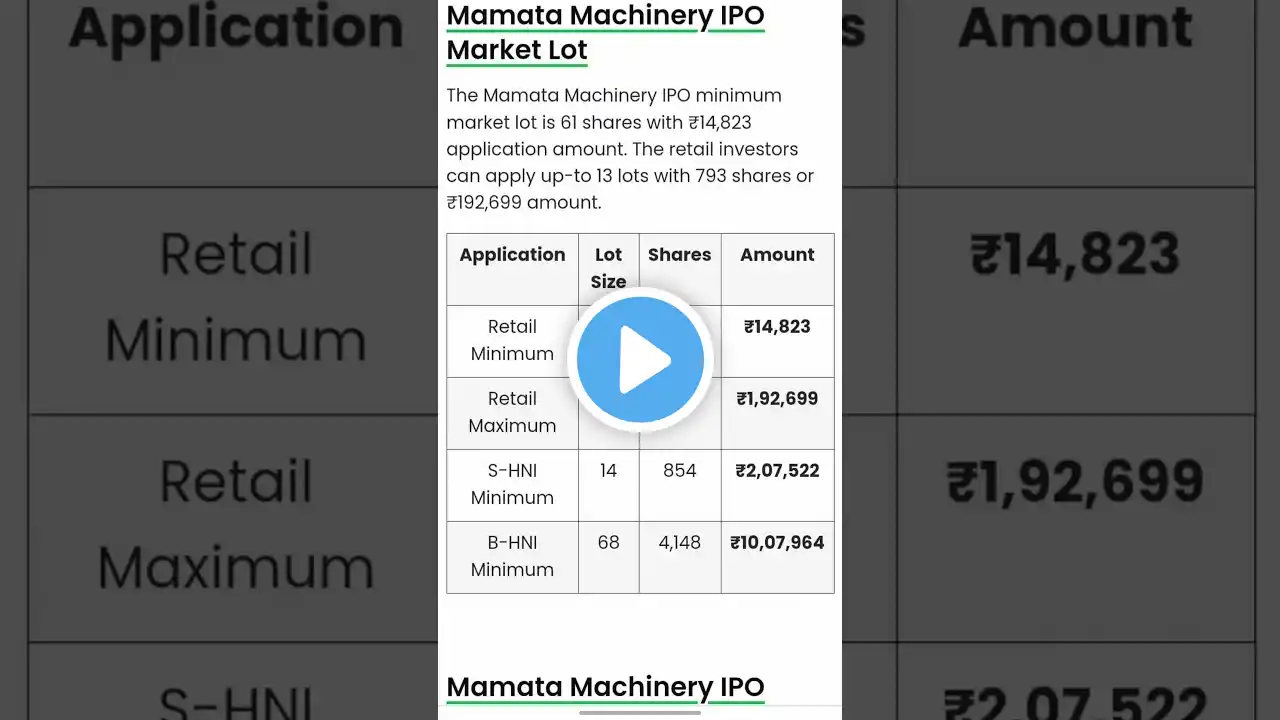

Mamata Machinery IPO Review | Details | Analysis #ipo #iporeview #newipo #upcomingipo #ipoalert #ipodetails #ipoanalysis #ipodate #ipoprice #ipolatestnews #ipoupdate #iponews #stockmarket #sharemarket #finance #ytshorts #shorts #youtubeshorts In this video we have discussed about Mamata Machinery IPO Review date Details and financial Analysis Mamata Machinery IPO is a book built issue of Rs 179.39 crores. The issue is entirely an offer for sale of 0.74 crore shares. Mamata Machinery IPO opens for subscription on December 19, 2024 and closes on December 23, 2024. The allotment for the Mamata Machinery IPO is expected to be finalized on Tuesday, December 24, 2024. Mamata Machinery IPO will list on BSE, NSE with tentative listing date fixed as Friday, December 27, 2024. Mamata Machinery IPO price band is set at ₹230 to ₹243 per share. The minimum lot size for an application is 61. The minimum amount of investment required by retail investors is ₹14,823. The minimum lot size investment for sNII is 14 lots (854 shares), amounting to ₹2,07,522, and for bNII, it is 68 lots (4,148 shares), amounting to ₹10,07,964. Mamata Machinery IPO Details IPO Date December 19, 2024 to December 23, 2024 Listing Date [.] Face Value ₹10 per share Price Band ₹230 to ₹243 per share Lot Size 61 Shares Total Issue Size 73,82,340 shares (aggregating up to ₹179.39 Cr) Offer for Sale 73,82,340 shares of ₹10 (aggregating up to ₹179.39 Cr) Employee Discount 12.00 Issue Type Book Built Issue IPO Listing At BSE, NSE Mamata Machinery IPO Reservation Investor Category Shares Offered QIB Shares Offered Not more than 50% of the Net Issue Retail Shares Offered Not less than 35% of the Net Issue NII (HNI) Shares Offered Not more than 15% of the Net Isssue Mamata Machinery IPO Timeline (Tentative Schedule) Mamata Machinery IPO IPO opens on December 19, 2024, and closes on December 23, 2024. IPO Open Date Thursday, December 19, 2024 IPO Close Date Monday, December 23, 2024 Basis of Allotment Tuesday, December 24, 2024 Initiation of Refunds Thursday, December 26, 2024 Credit of Shares to Demat Thursday, December 26, 2024 Listing Date Friday, December 27, 2024 Cut-off time for UPI mandate confirmation 5 PM on December 23, 2024 Mamata Machinery IPO Lot Size Investors can bid for a minimum of 61 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount. Application Lots Shares Amount Retail (Min) 1 61 ₹14,823 Retail (Max) 13 793 ₹1,92,699 S-HNI (Min) 14 854 ₹2,07,522 S-HNI (Max) 67 4,087 ₹9,93,141 B-HNI (Min) 68 4,148 ₹10,07,964 Mamata Machinery IPO Promoter Holding The promoters of the Company are Mahendra Patel, Chandrakant Patel, Nayana Patel, Bhagvati Patel, Mamata Group Corporate Services LLP and Mamata Management Services LLP. Share Holding Pre Issue 92.45% Share Holding Post Issue About Mamata Machinery Limited Incorporated in April 1979, Mamata Machinery Limited manufactures and exports machines for making plastic bags, pouches, packaging, and extrusion equipment. The company provides manufacturing solutions for the packaging industry. The company caters to FMCG, Food, & Beverage industries. The company's customers include Balaji Wafers Private Limited, Dass Polymers Private Limited, Jflexy Packaging Private Limited, Euphoria Packaging Private Limited, Sunrise Packaging, Om Flex India, Chitale Foods, V3 Polyplast Private Limited, Dhalumal Packaging Industries LLC, Laxmi Snacks Private Limited, Ganges Jute Private Limited, Western India Cashew Company Private Limited and N. N. Print & Pack Private Limited and Gits Food Products Private Limited and Emirates National Factory for Plastic Ind LLC. As of May 31, 2024, the company has exported machines to over 75 countries. The company has international offices in Bradenton, Florida, and Montgomery, Illinois, as well as sales agents in over five countries across Europe, South Africa, and Asia.. The company has two machine manufacturing facilities, one in India and one in the USA. As of May 31, 2024, the company employs 87 skilled engineers and application experts in electronics, mechanics, software, and design. Disclaimer Information provided in this video is for educational purpose only. It may not necessarily be correct and not intended to be taken as financial legal or other type of advice. It has not been prepared with regard to the individual needs objectives or financial situation of any particular person. Please consult your financial advisor before any type of investment. Invest at your own risk. We are not SEBI registered. Information provided in this video is for educational purpose only. It is personal view on particular share and IPO . Do you thorough research before buying or selling any IPO. Buy and Sell at your own risk