How salaried class employees can save tax on their cars? l Car Lease Policy | Finance ke Nuskhe

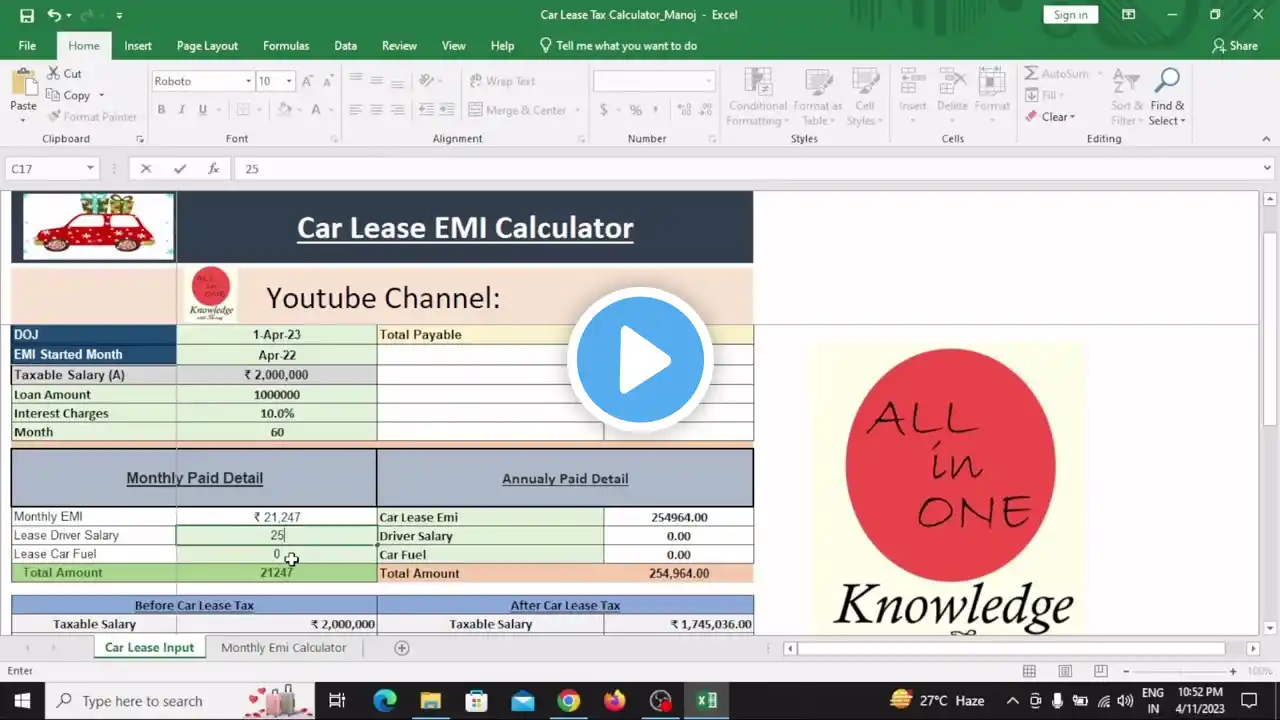

As you climb up the ladder in your profession, it is commonly seen that the employer provides a car to ensure easy commute for such employees. Few companies also have a car lease policy. In this video, we will discuss how an employee can make use of these policies or purchase a car and plan their taxes efficiently. We have discussed all possible scenarios and their tax impact. Download Black App https://black-cleartax.app.link/itr_e... To file your ITR, click https://bit.ly/FileITROnClearTax. For a LIVE chat with our experts on any queries, click here - https://bit.ly/3rZ6G3S You can also read these articles below: Car provided by the employer- https://cleartax.in/s/tax-benefit-sal... ClearTax PF calculator - https://cleartax.in/s/pf-calculator Timestamps 00:00 Introduction 00:27 Detailed Explanation 02:15 Tax Impact on fuel and car allowance 04:03 Bonus Nuskha 04:28 Conclusion Relevant links: 💰 Subscribe to up your personal finance game: / @blackbycleartax → Watch next -Tax planning: • Guidelines to Upload ROC Forms l Gene... Let’s connect: IG – / clearfromcleartax Twitter – / clearfromct FB – / clearfromcleartax LinkedIn - / mycompany Clear offers tax compliance and other financial solutions to 400k+ growing businesses, 2000+ large enterprises, 80k+ tax experts and more than 6 million tax filers. #PFWITHDRAWAL #ITRFiling #IncomeTax #Clear