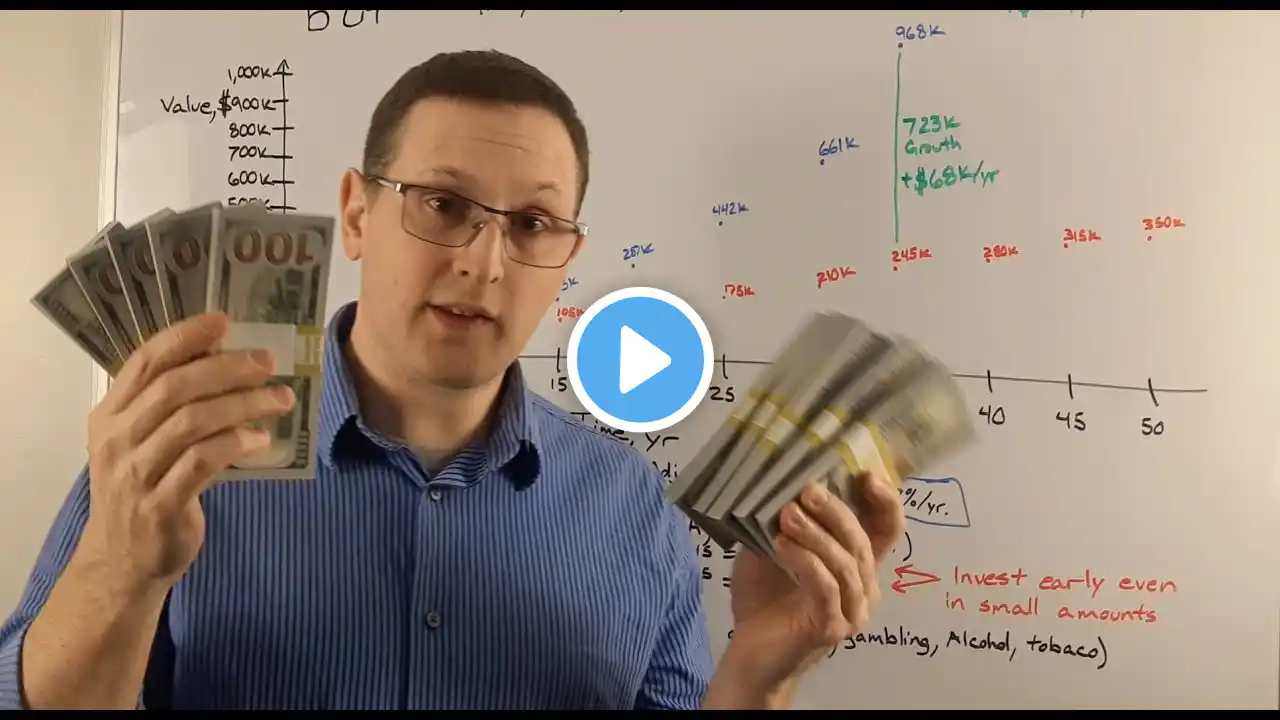

Why the First $100,000 is Hard but $1 Million is Easy

In this video, I explain why it's hard to make the first $100k but then it's significantly easier to get to $1M after. Watch this next: • Unlock Financial Freedom Without a Bu... -- Building wealth follows a challenging but predictable trajectory. In the early days, accumulating your first $100,000 feels incredibly difficult. This initial phase requires significant discipline and strategic financial planning. You're essentially learning critical saving habits, overcoming psychological barriers, and developing the skills necessary to make money work for you. Every dollar saved requires deliberate effort, and progress seems frustratingly slow. The breakthrough happens when you cross that $100,000 threshold. Suddenly, compound interest becomes your friend. Your money starts generating meaningful returns, creating a snowball effect that accelerates your wealth accumulation. Each subsequent $100,000 becomes progressively easier to achieve because you've established a solid financial foundation and understand the mechanics of investing. What makes this journey transformative is the shift in mindset and strategy: early on, you're primarily saving through direct income, but after reaching critical mass, your investments begin doing the heavy lifting, generating returns that compound and grow exponentially. -- Timestamps 0:00 - Intro 0:52 - The Savings Struggle 2:34 - Why is it Easier to Get to $1 Million? 5:20 - Psychological & Practical Milestones