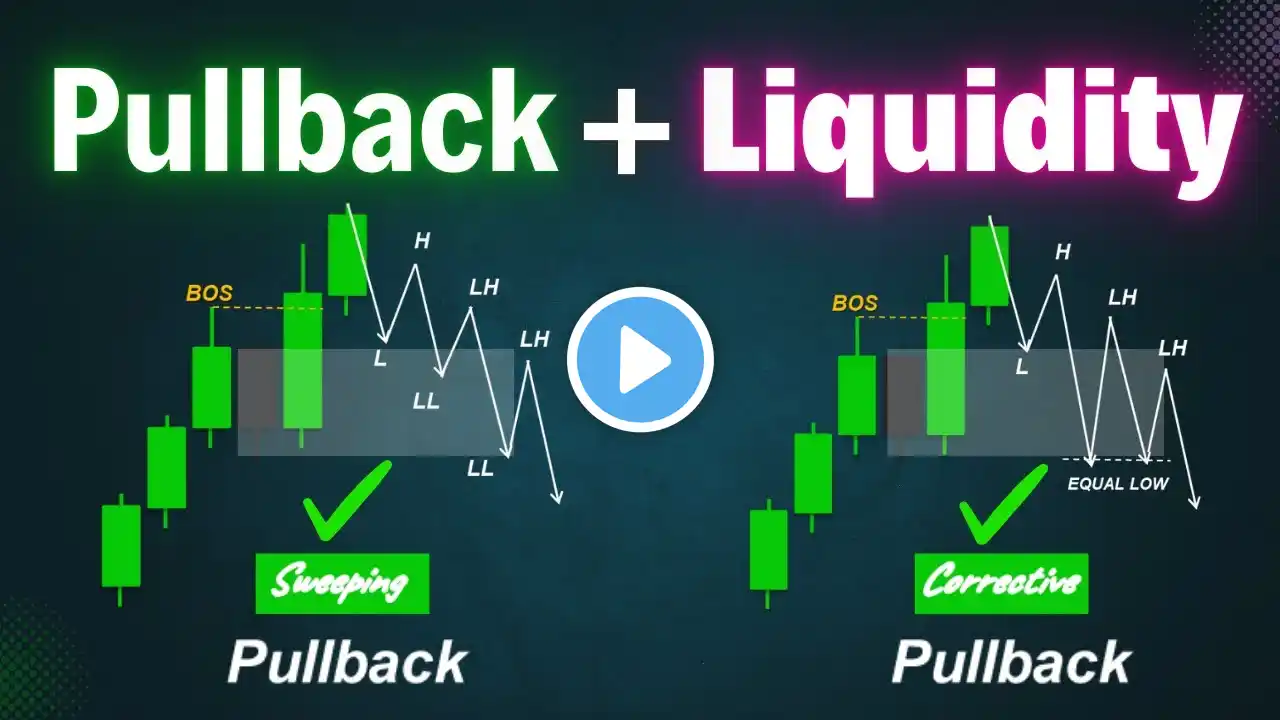

How to Trade Pullbacks + Liquidity Strategy | Works (Even for Beginners!)

How to Trade Pullbacks How to Trade Liquidity In this video, we explore the advanced concepts of market structure analysis with a focus on identifying valid pullbacks—a crucial skill for improving trade accuracy and avoiding common pitfalls in the market. What You’ll Learn: What pullbacks are and their role in predicting trend continuations, reversals, or structural breaks. Key criteria for recognizing valid pullbacks in bullish and bearish setups. The three main types of pullbacks: Aggressive, Corrective, and Sweeping. Practical trading strategies for leveraging pullbacks, including entry techniques using smart money concepts like order blocks and liquidity zones. Highlights: How to identify valid pullbacks by analyzing price action, liquidity sweeps, and structural levels. Insights into different price movement phases: impulse, corrective, and continuation. Real examples of how pullbacks break liquidity zones and align with directional trends. Step-by-step strategies for conservative and aggressive entries, validated through backtesting. Takeaways: By mastering the art of identifying and trading pullbacks, you’ll enhance your ability to: Avoid invalid setups that lead to stop-loss hits. Recognize liquidity sweeps for high-probability trade confirmations. Tailor your approach based on the type of pullback and your risk tolerance. Whether you’re a beginner or a seasoned trader, this guide is packed with actionable techniques to refine your strategy and boost your trading confidence. How to Trade Pullbacks + Liquidity Strategy | Works (Even for Beginners!) • How to Trade Pullbacks + Liquidity St...