Smart Money Concept: Liquidity and How It Influences Price Movement

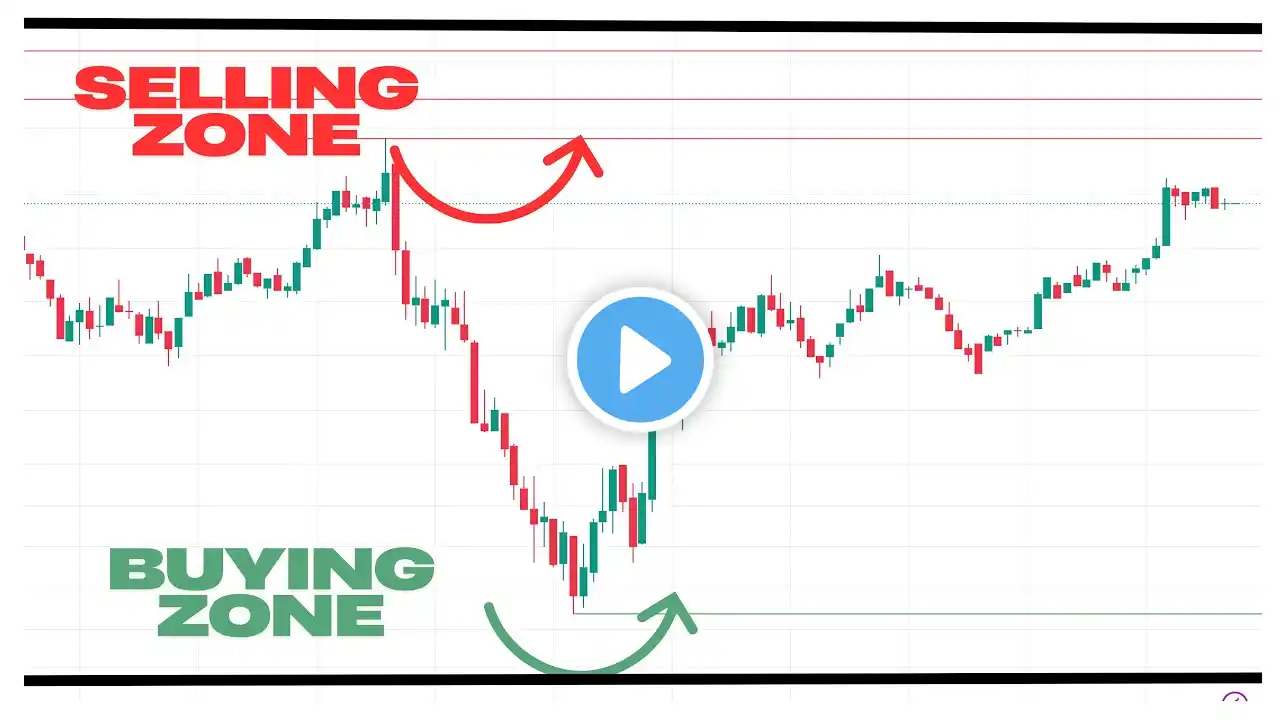

When the market moves against you the second you place a trade, it’s usually liquidity at play. Institutional traders, or Smart Money, know exactly where the liquidity pools are, and they use them to execute massive orders without causing a stir. In this webinar, we’ll break down: 📌 The difference between internal & external liquidity 📌 Where institutions look for entry & exit points 📌 How to spot manipulation before it happens Unlock pro trading secrets and learn how liquidity shapes the market. Smart Money Episodes https://www.altrady.com/crypto-tradin... Discord https://app.altrady.com/discord/start [00:00:00] - Welcome & Introduction Ben and Roman introduce the session and recap previous lessons. [00:04:42] - What is Liquidity & Why It Matters Understanding liquidity and its role in market movements. [00:06:05] - How Big Players Use Liquidity Explaining how institutional traders manipulate liquidity zones. [00:10:30] - External vs. Internal Liquidity Breaking down key liquidity concepts with real examples. [00:17:50] - Spotting Liquidity Pools on the Chart How to identify liquidity zones and price magnets. [00:26:15] - Compression & Liquidity Traps Recognizing market compression and liquidity sweeps. [00:39:57] - Using Liquidity for Trade Entries & Exits Practical strategies to improve trade execution. [00:55:45] - Live Market Analysis: Liquidity in Action Applying liquidity concepts to real-time price movements. [01:02:00] - Altrady’s New Smart Money Indicator How to use the tool to simplify liquidity-based trading. [01:06:59] - Final Thoughts & Next Steps Key takeaways, upcoming topics, and community engagement. Notion Trading Journal https://altrady.notion.site/1a77168a5...