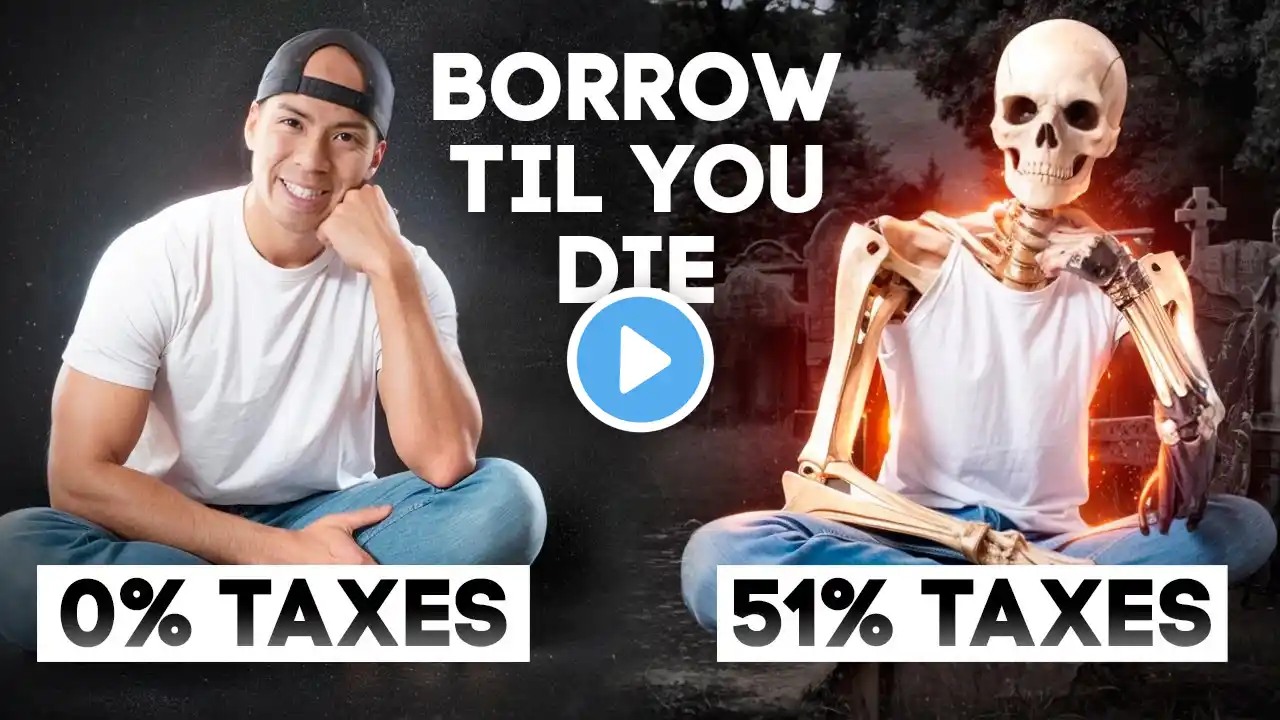

Real Estate Tax Advantages, How to Pay ZERO Capital Gains Tax When Selling Your Property

💰 Want to keep more of your hard-earned real estate profits? Whether you're selling your primary residence or investment property, you could legally pay ZERO capital gains tax by using the $250K/$500K personal exemption OR a 1031 Exchange... 🚀 In this video, Scott Fong explains: ✅ How single homeowners can claim $250,000 tax-free profits when selling ✅ How married couples can exempt up to $500,000 in capital gains ✅ The #1 strategy to defer ALL capital gains taxes using a 1031 Exchange ✅ Why savvy real estate investors roll their gains into new properties tax-free ✅ Key rules & timelines you MUST follow to qualify (next video). 💡 Don’t leave money on the table! With the right strategy, you can sell smarter, keep more, and reinvest tax-free. 📅 Schedule your free consultation today! Visit: https://www.siffinvestment.com Direct: (415) 601-1051 Email: [email protected] 📢 LIKE & SHARE this video with anyone thinking about selling a property! 🔔 SUBSCRIBE for more real estate tax strategies, investing tips, and wealth-building advice.