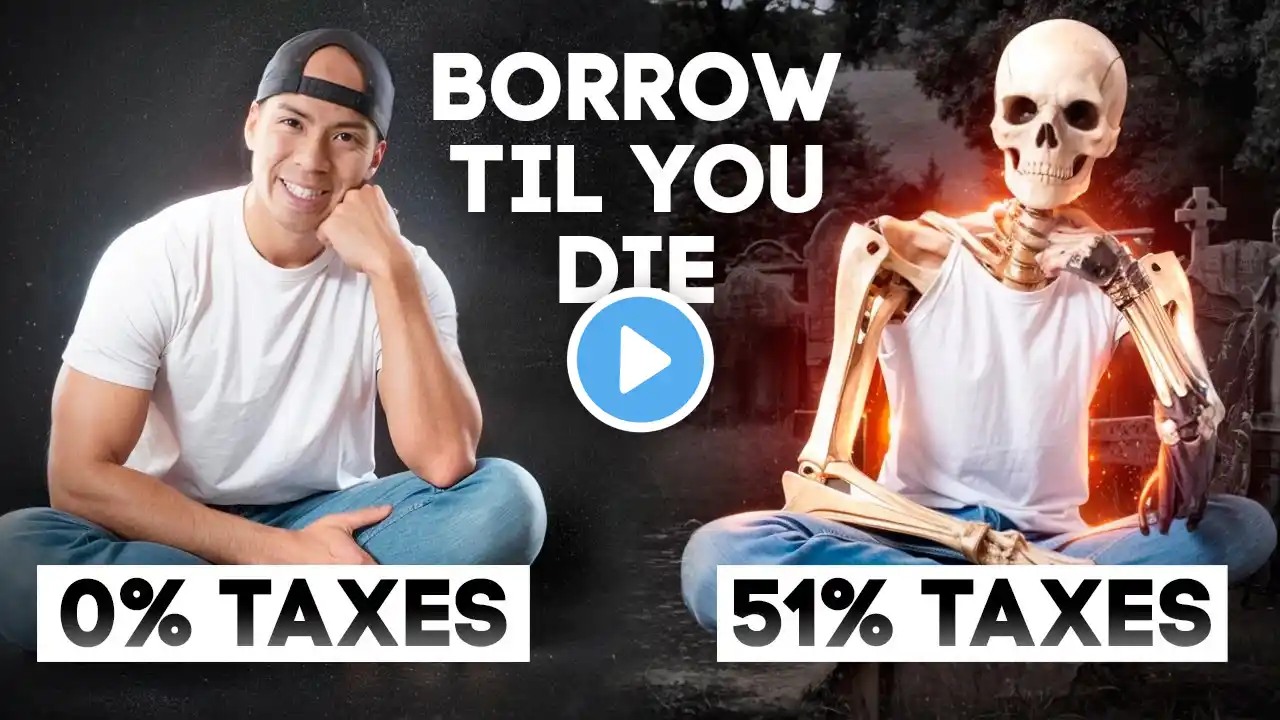

Buy, Borrow, Die Tax Strategy: How To Never Pay Taxes Again

The Buy, Borrow, Die Tax Strategy Is How The Wealthiest Americans Avoid Paying Taxes. Some of the wealthiest individuals are able to pay almost 0% of their income towards taxes, while everyone else pays up to 37% of their income towards taxes. So how is this possible? It all starts with understanding how your wealth is taxed. When you buy assets that grow in value, it is not income. When you borrow money against your assets, it is not income. When you die, the transfer of your assets is not income. On other hand, when you SELL assets, it is considered income. OR when you earn wages, it is considered income. The Buy, Borrow, Die Tax Strategy allows you to build wealth, get cash when you need it, avoid paying taxes, and pass generational wealth down to your heirs tax-free. And as a licensed CPA that helps people save on taxes everyday at mycpacoach.com, I am going to walk you through this entire process for you in 3 easy steps. What is Buy, Borrow, Die Strategy: (0:00) Step 1: (1:32) How The Rich Avoid Tax: (2:13) Step 2: (3:30) Borrowing Methods: (7:30) Step 3: (8:43) Subscribe: / @mycpacoach Apply to Become a Tax Client: https://mycpacoach.com/contact/ Enroll in Tax Savers Course: https://mycpacoach.com/tax-saver/