What is the Liquidity Coverage Ratio (LCR)? | Finance Strategists | Your Online Finance Dictionary

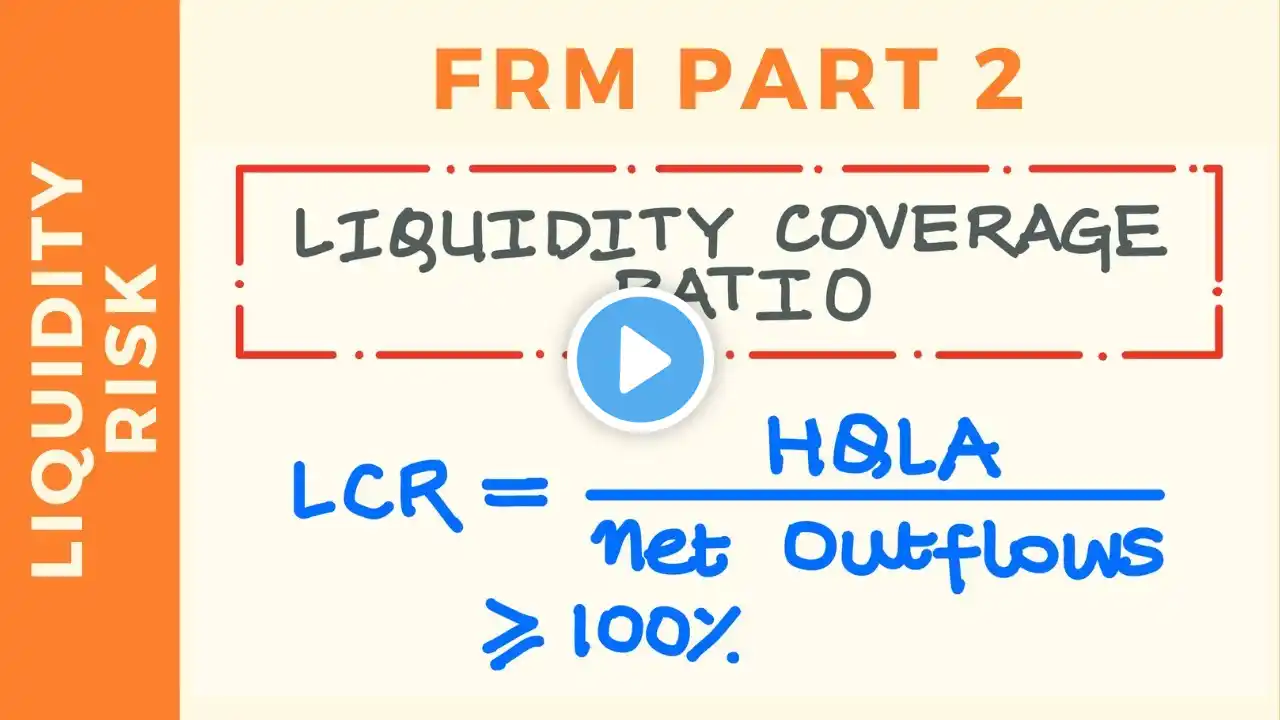

Liquidity coverage ratio or LCR refers to the percentage amount of cash, cash equivalents, or short-term securities that large banks are required to hold as reserves to meet their short-term financial obligations during a crisis event. The LCR is calculated by dividing a bank's most liquid assets by its cash outflows over a 30-day period. _______________________ 0:00 Liquidity Coverage Ratio (LCR) Definition 0:23 LCR Calculation 0:55 Liquidity Coverage Ratio Requirements 1:25 LCR Formula 2:19 LCR Question & Application _______________________ Talk with an advisor by emailing [email protected] Learn more by visiting the page: https://www.financestrategists.com/te... Check out the main Finance Strategists YouTube Page here: / @financestrategists4468 _______________________ Message from the founder: Here at Finance Strategists, we believe one of the best ways you can help someone is with their finances. We create helpful informational videos and content to help people take control of their finances. Finance Strategists plans to launch "Finance Strategists for Kids" where we teach fundamental financial concepts to kids in a clear manner allowing them to generate margin in their lives to bless other people. We believe raising up a generation of leaders with financial freedom can change individual lives, neighborhoods, countries, and the world. _________________________ 🔔 Hit the bell next to Subscribe so you don't miss a video! 📧 Fill out this form to receive the "Finance Word of the Day" in your inbox! 👨🏻💻 Watch our newest vids! - https://bit.ly/FS-Recently-Added 💃 To book Ranie for voiceover or spokeswoman, email [email protected] _________________________ Follow us on Socials: Website: FinanceStrategists.com Instagram: @financetrategists Twitter: @FinStrategists LinkedIn: https://bit.ly/FS-linkedin Facebook: https://bit.ly/Facebook-FS