Should You Do a Traditional-to-Roth 401(k) Conversion?

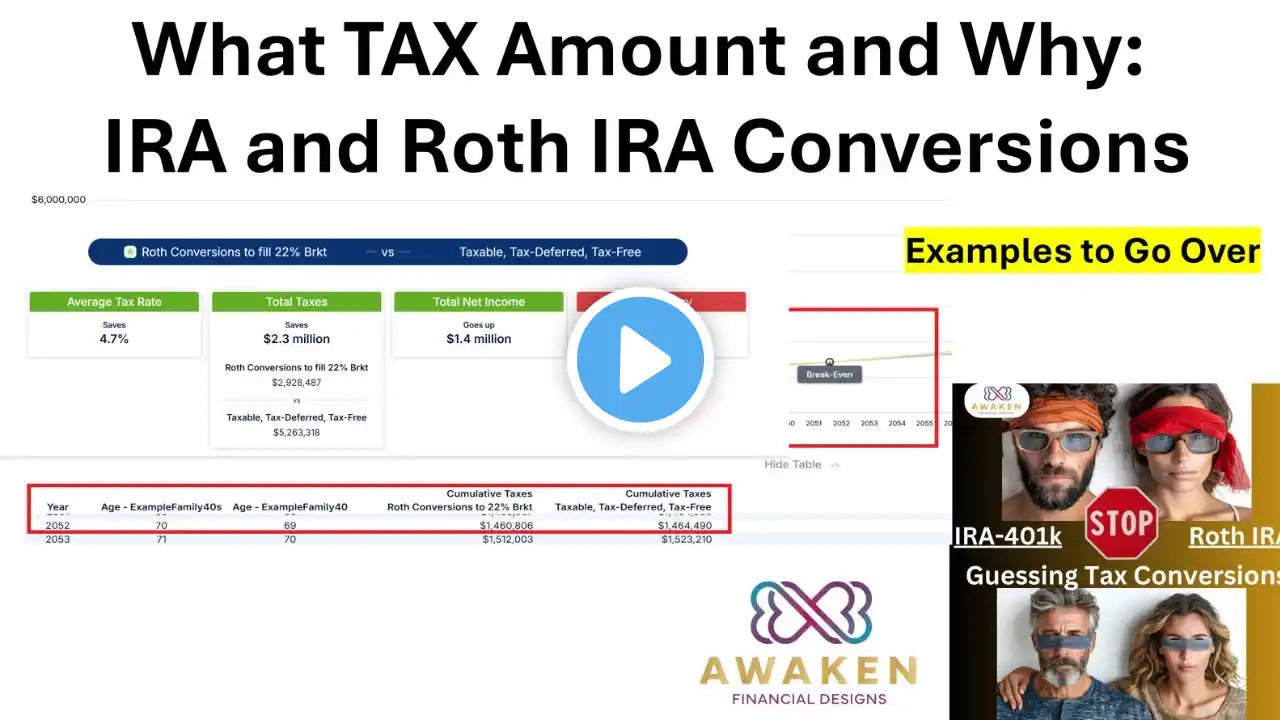

Should You Do a Traditional-to-Roth 401(k) Conversion? 🤔 A Traditional-to-Roth conversion can be a powerful tax strategy—but only if done strategically. Timing and circumstances matter. ✅ Why consider it? Pay taxes now at a lower rate, avoid higher taxes in retirement Enjoy tax-free withdrawals later Reduce required minimum distributions (RMDs) 🚨 But not everyone should convert. Factors like current tax bracket, expected future income, and available cash to cover taxes play a big role. Have you considered a Roth conversion? Let’s discuss. #TaxPlanning #401k #RetirementStrategy #SmartInvesting